China Lithium Battery Market Share

The lithium battery market in China is an essential part of the global energy transition, playing a significant role in powering a wide range of technologies, from consumer electronics to electric vehicles (EVs) and renewable energy storage. As one of the largest producers and consumers of lithium batteries, China dominates the global lithium battery market. This dominance is driven by the country’s massive manufacturing capacity, the growth of the electric vehicle market, and its role in the global push toward sustainability.

In 2023, the Chinese lithium battery market is valued at approximately ¥450 billion (about $65 billion), with a growth rate of 20-25% annually. The increasing demand for EVs, renewable energy storage systems, and portable consumer electronics is propelling the market. China’s government has also played a significant role in supporting the development of the lithium battery industry through subsidies, incentives, and policies aimed at encouraging the adoption of green technologies. This has not only accelerated the production and consumption of lithium batteries but also solidified China’s position as a global leader in this sector.

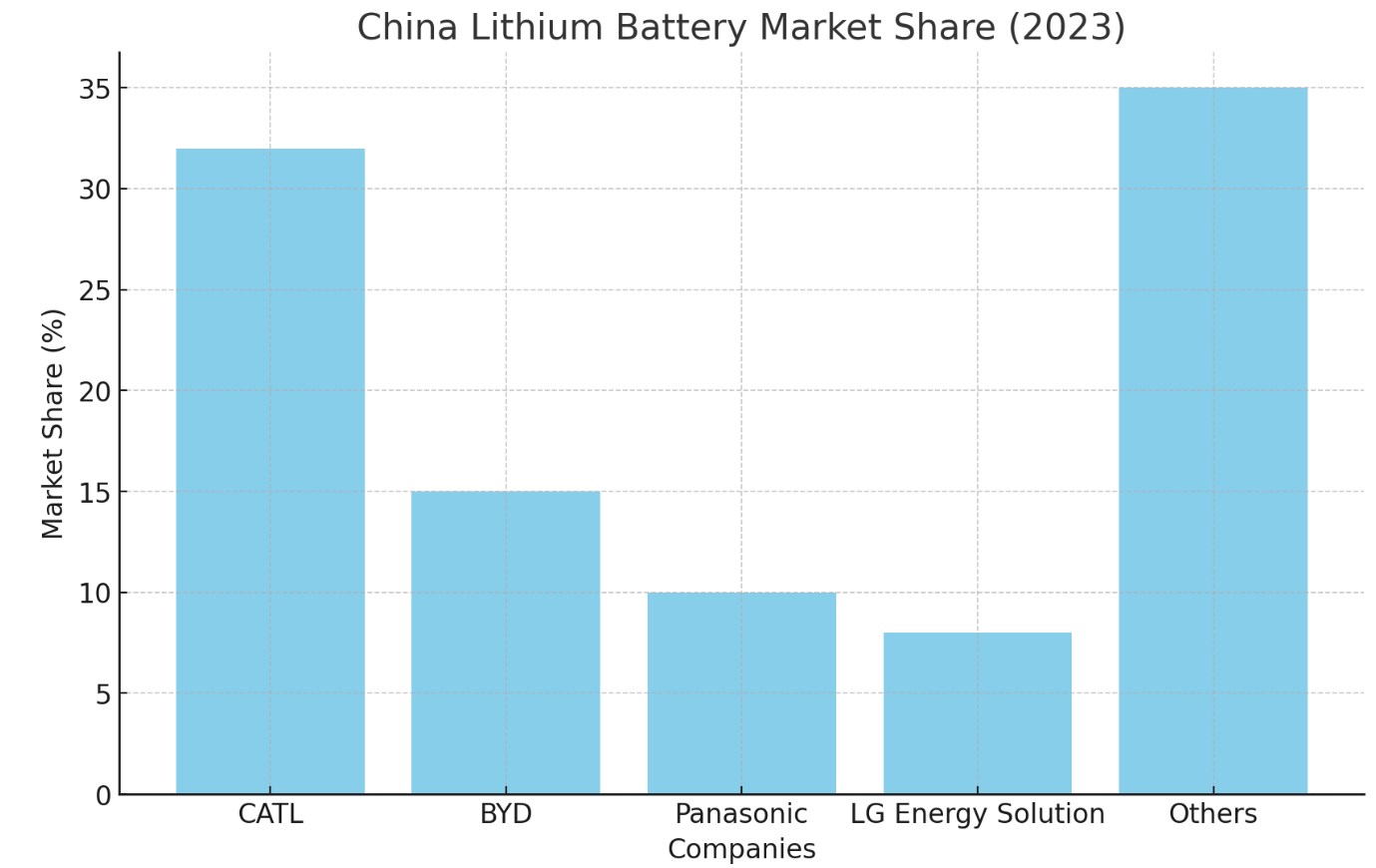

China’s lithium battery market is diverse, encompassing several product categories, including batteries for electric vehicles, consumer electronics, and energy storage systems. The key players in the market are both domestic giants, such as CATL and BYD, and international companies, like Panasonic and LG Chem, that have established significant manufacturing footprints in China. These players compete on factors such as battery capacity, energy efficiency, and production scale, all of which are vital to meet the growing demand for sustainable and high-performance batteries.

Key Drivers of the Market

Surge in Electric Vehicle Adoption

One of the most significant drivers of China’s lithium battery market is the rapid growth of the electric vehicle (EV) industry. China is the world’s largest market for electric vehicles, accounting for over half of global EV sales. The country’s commitment to reducing carbon emissions and promoting green technologies has fueled this growth. Government policies, such as subsidies for EV buyers and manufacturers, as well as mandates for a higher percentage of electric vehicles in the fleet, have made EVs more affordable and accessible to consumers.

Lithium-ion batteries are the key enabler of electric vehicles, providing the energy storage capacity needed to power these vehicles efficiently. As the EV market continues to grow in China, the demand for high-performance lithium batteries is expected to increase significantly. This growth in EV adoption has driven innovation in battery technology, leading to improvements in energy density, charging speed, and overall efficiency, which in turn has expanded the market for lithium batteries.

Renewable Energy Storage

The shift toward renewable energy sources, such as solar and wind, is another critical driver of the lithium battery market in China. The intermittency of renewable energy generation has highlighted the need for efficient energy storage solutions, and lithium-ion batteries have emerged as the preferred technology for storing energy from renewable sources.

China’s government has heavily invested in renewable energy infrastructure, with ambitious goals to increase the share of renewables in the energy mix. Lithium batteries are being used to store surplus energy produced during the day for use at night or during periods of low renewable generation. As the demand for renewable energy storage systems continues to rise, so too will the demand for high-capacity lithium batteries.

Consumer Electronics

In addition to EVs and energy storage, consumer electronics remain a significant segment of the lithium battery market in China. China is the world’s largest market for smartphones, laptops, and other portable electronic devices, all of which rely on lithium-ion batteries for power. As these devices become more sophisticated and feature-rich, the demand for batteries with higher energy densities and longer life cycles has increased.

The development of new consumer electronics, such as wearables, IoT devices, and smart home products, has further contributed to the growth of the lithium battery market. These devices require small, lightweight, and high-performance batteries, driving demand for advanced lithium-ion battery technologies.

Major Segments in the Lithium Battery Market

Electric Vehicle Batteries

Electric vehicle batteries are the largest and fastest-growing segment in China’s lithium battery market. The demand for EVs has surged due to government incentives, advancements in battery technology, and a growing awareness of environmental issues. Electric vehicles, including passenger cars, buses, and commercial vehicles, rely on lithium-ion batteries to provide the power necessary for operation.

In 2023, the electric vehicle battery segment in China is valued at approximately ¥220 billion ($32 billion), and it is projected to continue growing rapidly as China’s EV market expands. The increasing range of electric vehicles and improvements in battery life have driven consumer interest in EVs, making this segment the most important driver of China’s lithium battery market.

Energy Storage Batteries

Energy storage systems, which use lithium-ion batteries to store electricity for later use, are another critical segment of China’s lithium battery market. These systems are particularly important in integrating renewable energy sources into the grid, where energy is produced in an intermittent fashion. Lithium-ion batteries are preferred for energy storage applications due to their high energy density, long lifespan, and fast response times.

The energy storage segment is growing rapidly, with China’s government investing heavily in grid modernization and renewable energy integration. By 2023, the energy storage battery market in China is valued at around ¥85 billion ($12 billion), with significant growth expected as more renewable energy systems come online and require storage solutions.

Consumer Electronics Batteries

Lithium batteries used in consumer electronics are another major segment in China’s market. China is the world’s largest producer of smartphones, tablets, laptops, and wearables, all of which rely on lithium-ion batteries to function. As the global demand for consumer electronics continues to rise, so too does the demand for advanced, high-capacity lithium batteries.

The consumer electronics battery segment is valued at approximately ¥80 billion ($11.5 billion) in 2023, with continued growth expected as new devices and innovations in mobile technology, smart wearables, and the Internet of Things (IoT) continue to fuel the need for more efficient and powerful batteries.

Major Players in the Chinese Lithium Battery Market

CATL (Contemporary Amperex Technology Co. Ltd.)

CATL is the undisputed leader in China’s lithium battery market, holding a market share of around 32% in 2023. The company is one of the world’s largest producers of lithium-ion batteries, primarily supplying batteries for electric vehicles, energy storage systems, and consumer electronics. CATL’s success is attributed to its cutting-edge technology, large-scale production capabilities, and strong relationships with major automotive manufacturers.

CATL’s focus on research and development has allowed it to stay at the forefront of battery technology, particularly in the areas of energy density, battery life, and safety. As the demand for electric vehicles continues to rise, CATL is poised to maintain its leadership in the Chinese lithium battery market. The company’s market value is estimated at ¥160 billion ($23 billion) in 2023, and it continues to expand its global footprint by supplying batteries to companies such as Tesla, BMW, and Volkswagen.

CATL’s Key Strengths

- Large-scale production capacity: CATL’s extensive manufacturing facilities give it the ability to meet the growing demand for EV and energy storage batteries.

- Strategic partnerships: The company’s collaboration with major automotive manufacturers has helped it become a leading supplier of batteries for electric vehicles.

BYD (Build Your Dreams)

BYD is another major player in the Chinese lithium battery market, holding a market share of around 15% in 2023. While BYD is well known for its electric vehicles, the company is also a major producer of lithium-ion batteries used in automotive applications and energy storage systems. BYD has integrated its battery manufacturing with its vehicle production, creating synergies that enable it to produce high-quality, affordable batteries for electric vehicles.

BYD’s success can be attributed to its ability to develop and manufacture its own lithium-ion batteries, allowing it to control costs and enhance product performance. The company is actively expanding its presence in the global electric vehicle market and is focusing on the development of solid-state batteries, which are expected to offer higher energy densities and improve safety.

BYD’s Key Strengths

- Vertical integration: BYD’s ability to control both the production of electric vehicles and batteries gives it a competitive advantage in the EV market.

- Focus on sustainability: The company is committed to reducing emissions and promoting sustainable transportation through its battery-powered vehicles and energy storage solutions.

Panasonic

Panasonic is one of the largest international players in China’s lithium battery market, with a market share of around 10% in 2023. The company is a key supplier of lithium-ion batteries for electric vehicles and energy storage systems. Panasonic’s collaboration with Tesla, providing batteries for the electric carmaker’s Model 3 and Model Y vehicles, has made it one of the most prominent players in the global EV battery market.

Panasonic has also expanded its production capabilities in China to meet the increasing demand for lithium batteries. The company’s focus on developing high-energy-density batteries and improving the efficiency of its manufacturing processes has helped it stay competitive in the fast-growing market.

Panasonic’s Key Strengths

- Partnership with Tesla: Panasonic’s longstanding partnership with Tesla has helped it secure a significant position in the EV battery market.

- Focus on innovation: The company is investing heavily in next-generation battery technologies, such as solid-state batteries, to improve performance and safety.

LG Energy Solution

LG Energy Solution, a subsidiary of LG Chem, is another significant player in China’s lithium battery market, holding an estimated market share of around 8% in 2023. LG Energy Solution is a global leader in the production of lithium-ion batteries for electric vehicles, consumer electronics, and energy storage systems. The company supplies batteries to major automotive manufacturers, including General Motors, Hyundai, and Volkswagen.

LG Energy Solution’s focus on research and development has led to significant advancements in battery technology, including improved energy efficiency, safety features, and longer battery life. The company continues to expand its production capabilities in China to meet the growing demand for high-quality lithium batteries.

LG Energy Solution’s Key Strengths

- Global presence: LG Energy Solution’s global footprint and partnerships with major automakers give it a strong position in the lithium battery market.

- Innovation in battery technology: The company’s focus on developing advanced battery technologies positions it as a leader in the EV and energy storage sectors.

Other Competitors

In addition to the major players, several smaller companies are making their mark in China’s lithium battery market. These include companies such as CALB (China Aviation Lithium Battery) and Guoxuan, which are focusing on specific segments of the market, such as energy storage systems and commercial vehicle batteries. These companies are growing their market share by offering competitive products and targeting niche applications in China’s rapidly expanding lithium battery industry.

Future Trends and Projections

Solid-State Batteries

One of the most exciting trends in the lithium battery market is the development of solid-state batteries, which promise higher energy densities, faster charging times, and improved safety compared to traditional lithium-ion batteries. Companies such as BYD and CATL are investing in solid-state battery research, and it is expected that this technology will be a significant factor in the future of electric vehicles and energy storage systems.

Expansion of Electric Vehicle Adoption

The Chinese government’s commitment to reducing carbon emissions and promoting the adoption of electric vehicles is expected to continue driving growth in the lithium battery market. As more consumers and businesses switch to electric vehicles, the demand for lithium-ion batteries will rise, pushing manufacturers to innovate and improve their products.

Energy Storage Systems

As the global shift to renewable energy continues, the demand for energy storage systems will increase. Lithium batteries are the preferred technology for energy storage due to their high energy density and long life cycles. The expansion of renewable energy projects in China, along with the growth of residential and commercial energy storage, will further accelerate the demand for lithium-ion batteries.

The lithium battery market in China is poised for continued growth, driven by the increasing demand for electric vehicles, energy storage systems, and consumer electronics. With companies like CATL, BYD, Panasonic, and LG Energy Solution leading the way, China remains a key player in the global lithium battery industry, shaping the future of energy storage and electric transportation.