China Mobile Phone Market Share

China is home to one of the largest and most dynamic mobile phone markets in the world, driven by its vast population, rapid urbanization, and the country’s growing middle class. With an estimated market size exceeding USD 50 billion in 2024, China remains a key player in the global smartphone industry, both as the largest producer and consumer of mobile devices. The mobile phone market in China is not only characterized by high demand for smartphones, but also by intense competition among domestic and international brands.

The rise of China’s mobile market can be attributed to several factors, including the increasing demand for high-performance smartphones, technological advancements in mobile networks such as 5G, and the country’s significant e-commerce growth. China’s mobile phone market is diverse, spanning affordable budget smartphones to high-end flagship models, with several key players dominating different segments of the market. Consumers in China have become more discerning, increasingly seeking devices that offer better cameras, faster processors, longer battery life, and cutting-edge features like 5G connectivity, AI capabilities, and foldable displays.

Major Players in the China Mobile Phone Market

Huawei

Market Share and Competitive Position

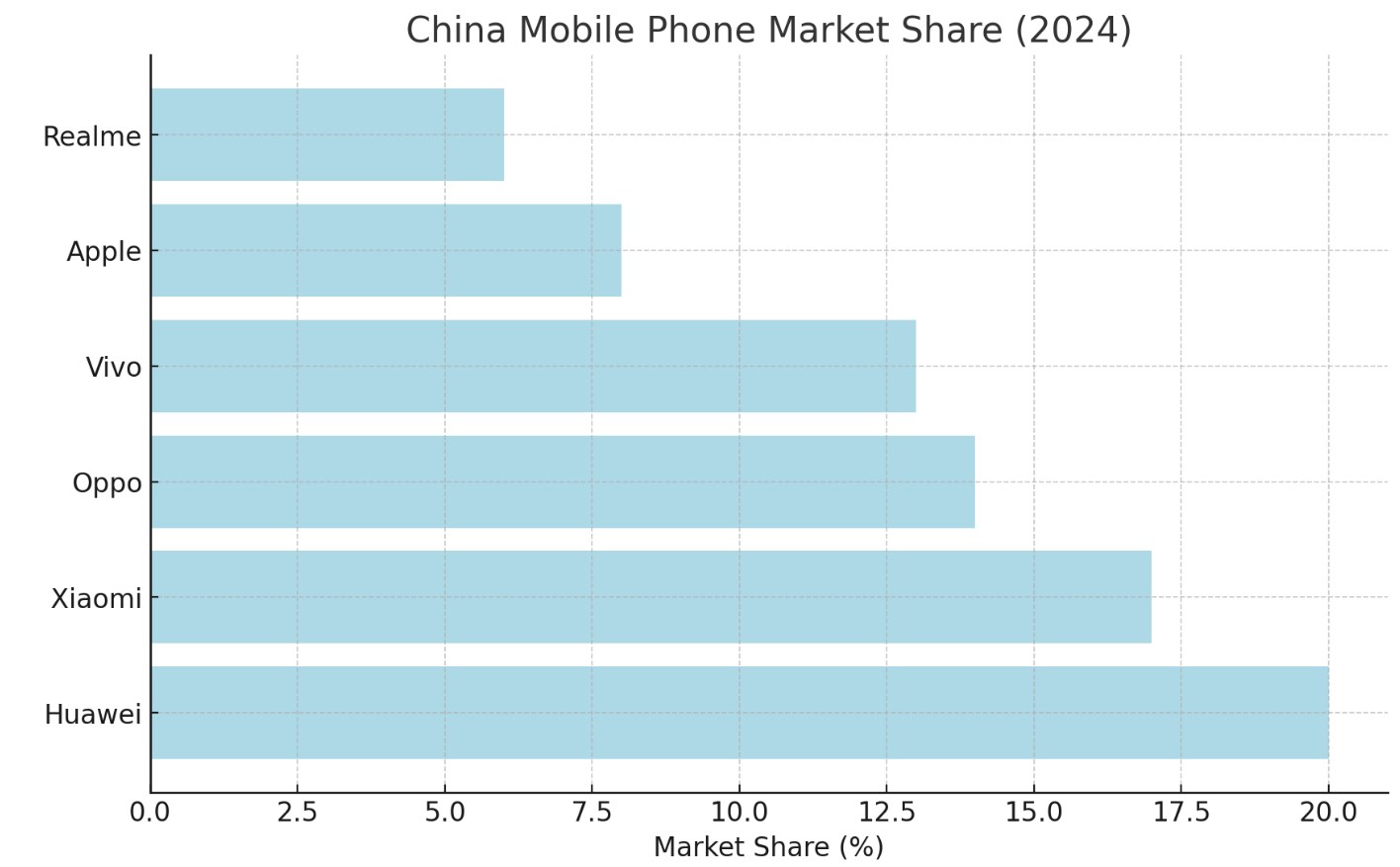

Huawei, the Chinese technology giant, is one of the leading players in the mobile phone market in China. As of 2024, Huawei holds a market share of approximately 20%, with annual revenues from its mobile division expected to exceed USD 18 billion. Huawei’s strong presence in China’s mobile phone market is a result of its ability to produce high-quality smartphones that offer a combination of innovation, design, and performance.

Huawei’s smartphones, particularly the P series and Mate series, have earned a reputation for their advanced camera systems, cutting-edge design, and high-performance processors. The company has also been at the forefront of 5G technology, with its devices being some of the first to support 5G connectivity in the global market. Despite facing challenges in global markets due to geopolitical tensions, Huawei has maintained its strong position in China, benefiting from the government’s support and its loyal domestic customer base.

Key Strategies and Innovations

- Emphasis on 5G and AI: Huawei has been a leader in the development of 5G smartphones, ensuring that its devices are equipped with the latest network technology. The integration of artificial intelligence in its cameras and processors has further strengthened its appeal to Chinese consumers.

- Local Production and Supply Chain Strength: Huawei’s robust local supply chain and manufacturing capacity allow it to keep production costs low and meet domestic demand efficiently.

Huawei’s focus on technological innovation, 5G connectivity, and AI integration has helped it maintain a dominant position in China’s highly competitive mobile phone market.

Xiaomi

Market Share and Competitive Position

Xiaomi, a major Chinese smartphone manufacturer, is one of the most successful and innovative brands in China’s mobile phone market. As of 2024, Xiaomi holds an estimated market share of around 17%, with projected revenues from mobile phone sales exceeding USD 10 billion. Xiaomi’s success can be attributed to its combination of high-quality smartphones, affordable pricing, and innovative features that appeal to a wide range of consumers.

Xiaomi has positioned itself as the leader in the affordable smartphone segment, offering devices that deliver flagship features at a fraction of the price of premium brands. The company has a strong presence in both the online and offline retail spaces, utilizing e-commerce platforms and a vast network of physical stores to reach consumers. Additionally, Xiaomi has successfully expanded into other product categories, such as smart home devices, wearables, and IoT products, creating an integrated ecosystem of connected devices that enhance the overall user experience.

Key Strategies and Innovations

- Affordable Premium Smartphones: Xiaomi’s strategy of offering high-quality smartphones at competitive prices has made it a popular choice among price-sensitive consumers.

- Expansion into IoT and Smart Devices: Xiaomi has developed an ecosystem of connected devices, such as smart speakers, wearables, and home appliances, further increasing its brand loyalty among consumers.

Xiaomi’s approach to providing affordable yet feature-rich smartphones, combined with its diversification into other smart devices, has allowed it to grow its market share significantly in China.

Oppo

Market Share and Competitive Position

Oppo, a subsidiary of BBK Electronics, is one of the top smartphone manufacturers in China, holding an estimated market share of around 14% in 2024. Oppo has been particularly successful in catering to mid-range consumers by offering smartphones that balance performance, design, and affordability. The company’s annual revenue from mobile phone sales in China is projected to exceed USD 8 billion in 2024.

Oppo’s smartphones are popular for their sleek designs, innovative camera technology, and high-quality displays. The company has focused on developing devices with exceptional photography capabilities, such as the Oppo Find and Reno series, which feature advanced camera systems with AI-driven enhancements. Oppo is also investing heavily in 5G technology, positioning itself as a key player in the upcoming 5G smartphone wave in China.

Key Strategies and Innovations

- Focus on Camera Innovation: Oppo has become well-known for its focus on camera innovation, particularly in terms of AI-powered photography and fast charging technology.

- Mid-Range Market Focus: Oppo’s strategy of targeting the mid-range market with feature-rich smartphones at competitive prices has helped it capture a significant share of the consumer market in China.

Oppo’s commitment to innovation, particularly in mobile photography and 5G, has made it one of the leading smartphone brands in China.

Vivo

Market Share and Position

Vivo, another subsidiary of BBK Electronics, is a prominent player in China’s mobile phone market, holding an estimated market share of approximately 13% in 2024. Vivo’s revenue from mobile phone sales in China is projected to exceed USD 7 billion in 2024. The company has established itself as a strong competitor by focusing on delivering smartphones with excellent performance, cutting-edge features, and stylish designs.

Vivo’s success has been driven by its focus on high-quality audio, camera, and display technologies, making its smartphones particularly appealing to young, tech-savvy consumers. The company has also made significant investments in 5G technology and AI integration, with the launch of its flagship Vivo X series of smartphones featuring advanced 5G capabilities and AI-powered features.

Key Strategies and Innovations

- Sound and Display Technologies: Vivo has differentiated itself with its high-quality audio and display technologies, providing immersive experiences for consumers.

- 5G and AI Integration: Vivo has prioritized the development of 5G smartphones and AI-powered features to enhance user experience and stay competitive in the market.

Vivo’s emphasis on innovation, combined with its high-quality audio and display technologies, has helped the brand maintain a strong position in China’s competitive mobile phone market.

Apple

Market Share and Position

Apple, the American multinational technology company, holds a strong position in China’s mobile phone market, with an estimated market share of 8% in 2024. Despite facing stiff competition from domestic brands, Apple’s iPhone continues to enjoy popularity among China’s affluent consumers, particularly in the premium segment. In 2024, Apple’s annual revenue from iPhone sales in China is expected to exceed USD 20 billion.

Apple’s success in China can be attributed to its strong brand loyalty, premium product offerings, and seamless integration with the broader Apple ecosystem. While Apple’s iPhones are priced higher than many of its competitors, the company’s focus on delivering high-performance smartphones with cutting-edge features has helped it maintain a loyal customer base. Additionally, Apple’s ecosystem, which includes devices like the iPad, MacBook, and Apple Watch, has encouraged consumers to remain within the Apple family of products.

Key Strategies and Innovations

- Premium Brand Positioning: Apple’s strategy of offering premium smartphones with cutting-edge features, such as the A-series chips, OLED displays, and Face ID technology, has positioned the brand as the leader in the high-end mobile phone segment in China.

- Ecosystem Integration: Apple’s seamless integration between its hardware, software, and services has created a loyal customer base that continues to expand within the Apple ecosystem.

Apple’s strong brand, premium product positioning, and seamless ecosystem integration have allowed it to maintain its competitive edge in China’s mobile phone market.

Realme

Market Share and Position

Realme, a subsidiary of Oppo, is a relatively new entrant in the Chinese mobile phone market but has quickly established itself as a significant player. As of 2024, Realme holds an estimated market share of around 6%, with projected revenues from mobile phone sales reaching USD 4 billion. The company’s success can be attributed to its strategy of offering high-performance smartphones at affordable prices, making it particularly appealing to younger, price-conscious consumers.

Realme’s smartphones are known for their advanced features, such as high-quality cameras, fast processors, and long battery life, all while maintaining a competitive price point. The company has also made a name for itself by offering devices that cater to the growing demand for 5G connectivity, positioning itself as a key player in the budget-to-mid-range segment of China’s smartphone market.

Key Strategies and Innovations

- Affordable Premium Smartphones: Realme’s strategy of offering smartphones with high-end features at affordable prices has made it a popular choice among young Chinese consumers.

- 5G Accessibility: Realme has focused on making 5G smartphones accessible to a broader audience by offering devices that support 5G connectivity at competitive prices.

Realme’s focus on affordable smartphones with strong performance and 5G capabilities has allowed it to gain significant traction in China’s competitive mobile phone market.

Key Trends Shaping the Market

5G Adoption and Expansion

The rollout of 5G technology is one of the most significant trends shaping China’s mobile phone market. With the government’s push to deploy 5G nationwide, there is a growing demand for smartphones that support 5G connectivity. Major players like Huawei, Xiaomi, Oppo, and Vivo have embraced 5G, launching a wide range of devices to meet the demand for faster data speeds and improved connectivity. As 5G becomes more widely available, it is expected to drive further growth in China’s mobile phone market, enabling new applications in areas such as gaming, virtual reality, and the Internet of Things (IoT).

Rise of Foldable and Flexible Displays

Foldable smartphones, featuring flexible OLED displays, are another major trend in China’s mobile phone market. Companies like Huawei and Samsung have already introduced foldable models, which are attracting consumer attention for their innovative designs and added functionality. As the technology matures and becomes more affordable, foldable smartphones are expected to become a key part of the premium segment in China, further differentiating brands and driving innovation in the industry.

E-commerce and Online Sales Growth

E-commerce has become an increasingly important sales channel for mobile phones in China. Online platforms like JD.com, Tmall, and Pinduoduo have become essential channels for smartphone sales, particularly for budget-conscious consumers. Manufacturers like Xiaomi and Realme have embraced the online-first approach, while more established brands like Apple and Huawei are also leveraging digital platforms to expand their reach. The convenience of online shopping, combined with aggressive online marketing campaigns and flash sales, has made e-commerce an integral part of China’s mobile phone market.

China’s mobile phone market continues to evolve, driven by advancements in technology, shifting consumer preferences, and increasing competition among domestic and international brands. The growth of 5G, foldable devices, and online sales are expected to shape the future of the market, creating new opportunities for both established and emerging players.