China Mobile Payment Market Share

China has emerged as one of the world’s leaders in mobile payments, transforming the way people conduct financial transactions. With a projected market value exceeding USD 60 billion in 2024, the country has become the largest mobile payment market globally, fueled by the rapid adoption of smartphones, internet connectivity, and digital financial services. The widespread use of mobile payment platforms is largely due to China’s strong push towards a cashless society, alongside a robust e-commerce ecosystem, government support, and advancements in mobile technology.

The market is marked by the dominance of a few major players who have shaped the landscape and significantly influenced the development of mobile payment systems across China. The emergence of mobile payment technologies has disrupted traditional banking services and revolutionized the way consumers pay for goods and services, from online shopping and restaurant bills to in-person transactions and peer-to-peer transfers. The integration of mobile payments with other services such as transportation, utility payments, and even government services has further accelerated adoption, making mobile payment solutions an integral part of everyday life in China.

Major Players in the China Mobile Payment Market

Alipay

Market Share and Position

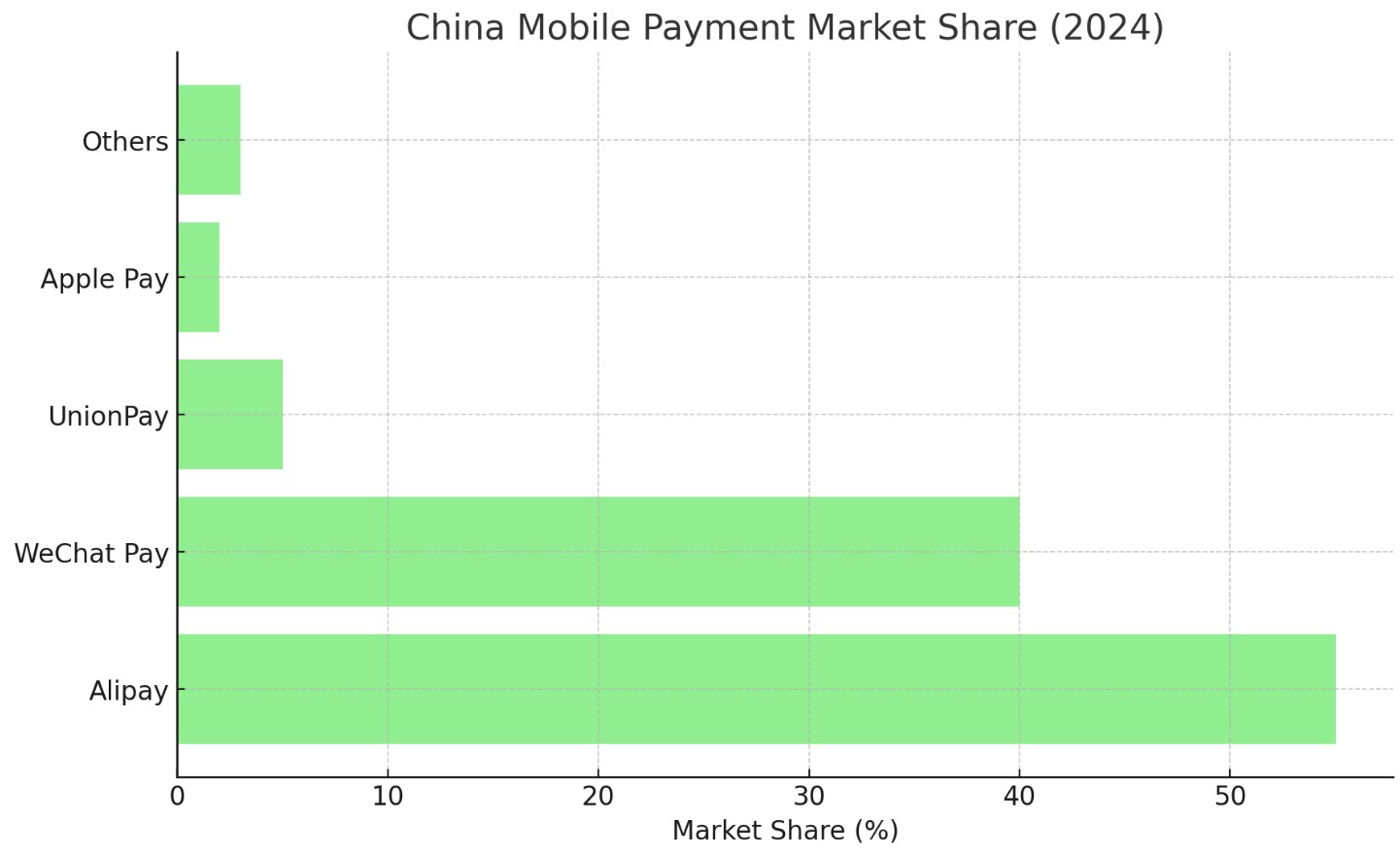

Alipay, owned by Ant Group (an affiliate of Alibaba Group), is the undisputed leader in China’s mobile payment market. As of 2024, Alipay commands a market share of approximately 55%, with annual transaction volumes exceeding USD 40 billion. Alipay has become synonymous with mobile payments in China, with over one billion active users globally and widespread usage in both urban and rural areas. Alipay’s dominance in the market is primarily due to its early entry, its vast range of services, and its extensive ecosystem that integrates mobile payments with online shopping, utility bill payments, transportation, and even social features.

Alipay has evolved beyond being just a mobile payment platform to a comprehensive financial ecosystem that includes wealth management, insurance, credit scoring, and microloans. This wide range of services has made Alipay a critical part of China’s digital economy. The platform’s ability to seamlessly integrate with Alibaba’s e-commerce ecosystem, such as Taobao and Tmall, has played a significant role in its market dominance.

Key Strategies and Innovations

- Ecosystem Integration: Alipay’s integration with Alibaba’s vast e-commerce platform allows it to capture a large portion of the transaction volume within the Alibaba ecosystem, which includes shopping, ticketing, and various other services.

- Comprehensive Financial Services: Alipay has expanded its offerings to include wealth management, lending, and insurance, which further enhance user engagement and allow the platform to cater to a broader audience beyond just payments.

Alipay’s success can be attributed to its ability to innovate continuously, providing not only mobile payments but also a comprehensive financial ecosystem that has helped it maintain a dominant position in China’s mobile payment market.

WeChat Pay

Market Share and Competitive Position

WeChat Pay, developed by Tencent and integrated into the WeChat messaging platform, is the second-largest mobile payment platform in China, with an estimated market share of around 40% in 2024. With more than 1.2 billion monthly active users, WeChat has evolved from a simple messaging app to a central hub for communication, entertainment, and commerce. WeChat Pay leverages this massive user base, providing an easy and convenient method for users to make payments, transfer money, and pay for services within the app.

WeChat Pay’s market share is a result of its seamless integration with the broader WeChat ecosystem, which encompasses a wide range of services such as messaging, social media, gaming, and content sharing. The platform allows users to easily make payments without leaving the app, whether for peer-to-peer transfers, utility bill payments, or in-store transactions. In addition, the integration of WeChat Pay with Tencent’s other services, such as online gaming and e-commerce, has created an interconnected ecosystem that keeps users within the Tencent platform.

Key Strategies and Innovations

- Seamless Integration with Social Media: WeChat Pay’s integration with WeChat, the most popular social media app in China, allows users to perform transactions directly within the app without the need for third-party tools or external websites.

- Comprehensive Service Ecosystem: WeChat Pay’s ability to provide a range of services, from peer-to-peer transfers to payments for in-store purchases, combined with social networking features, has made it an indispensable part of everyday life in China.

WeChat Pay’s competitive position is driven by its seamless integration with the social media platform and its ability to create an ecosystem that encompasses a wide range of services for its users.

UnionPay

Market Share and Position

UnionPay, a state-owned payment services company in China, is the country’s largest card payment provider and also plays a significant role in the mobile payment market. UnionPay’s market share in mobile payments is estimated to be around 5% in 2024, though the company is a dominant player in traditional payment cards. While UnionPay’s mobile payment services, UnionPay QuickPass, have gained traction, particularly in the acceptance of payments at retail outlets, its position in the mobile payment market is not as strong as Alipay and WeChat Pay.

UnionPay’s market share has been primarily supported by its deep integration with Chinese banks and its influence over the national payment infrastructure. The company has increasingly focused on expanding its mobile payment services to compete with Alipay and WeChat Pay. The company has forged partnerships with international financial institutions to expand its presence globally, but its domestic focus remains strong, where it is used primarily for offline payments and traditional banking services.

Key Strategies and Innovations

- Collaboration with Banks: UnionPay has leveraged its partnerships with Chinese banks to expand its mobile payment offerings and create a seamless integration of services for consumers.

- Global Expansion and Acceptance: UnionPay has focused on increasing its global presence by partnering with international financial institutions and offering mobile payment services that enable global acceptance of UnionPay cards.

UnionPay’s position in the mobile payment market is based on its ability to integrate with the existing financial infrastructure and the growing acceptance of its mobile payment services in China.

Apple Pay

Market Share and Position

Apple Pay, the mobile payment service developed by Apple, has found success in China, particularly among affluent consumers who prefer using their iPhones and Apple Watches for payments. In 2024, Apple Pay holds a market share of approximately 2% in China’s mobile payment market. While Apple Pay faces significant competition from Alipay and WeChat Pay, it has carved out a niche by offering a secure and convenient method for making payments both in-store and online.

The key advantage of Apple Pay lies in its integration with Apple’s ecosystem of devices, which allows users to easily make payments using their iPhones, iPads, or Apple Watches. Apple Pay has also integrated with major Chinese banks and retailers, increasing its acceptance among merchants and consumers. As mobile payments continue to grow, Apple Pay remains a key player, particularly among users who are already entrenched in the Apple ecosystem.

Key Strategies and Innovations

- Integration with Apple Devices: Apple Pay’s seamless integration with iPhones, iPads, and Apple Watches allows users to make payments quickly and securely without needing to carry physical cards.

- Focus on Security: Apple Pay emphasizes security through tokenization and biometric authentication methods such as Face ID and Touch ID, making it a trusted mobile payment solution for consumers concerned with privacy.

Apple Pay’s ability to integrate within the Apple ecosystem and offer enhanced security has made it an appealing mobile payment solution for tech-savvy Chinese consumers.

Other Key Players

Baidu Wallet

Baidu Wallet, developed by the Chinese internet search giant Baidu, has also ventured into the mobile payment market. While its market share remains relatively small compared to Alipay and WeChat Pay, Baidu Wallet is gaining traction among consumers, particularly in the areas of online payments and bill settlements. Baidu Wallet integrates with Baidu’s ecosystem, which includes a wide array of digital services such as search, advertising, cloud services, and navigation.

Meituan Pay

Meituan Pay is part of Meituan Dianping, a leading Chinese e-commerce platform focused on food delivery and local services. Meituan Pay allows users to make payments for a variety of services within the Meituan ecosystem, including restaurant bills, food delivery, hotel bookings, and travel services. Although its market share in mobile payments is limited, Meituan Pay is significant within its specific domain, particularly among consumers who use Meituan’s services frequently.

Key Trends Shaping the Market

Rise of QR Code Payments

In China, QR code-based payments have become ubiquitous, with consumers using mobile phones to scan codes for in-store purchases, peer-to-peer transfers, and online payments. QR code-based payment solutions are simple, secure, and cost-effective, making them widely adopted by both merchants and consumers. Alipay and WeChat Pay have both extensively integrated QR code payments into their platforms, making them the dominant methods of payment for small-scale transactions.

5G and Mobile Payment Integration

The rollout of 5G technology in China is expected to further accelerate the adoption of mobile payments, providing faster data speeds and more reliable connections for consumers and merchants. Mobile payment services are integrating more deeply with other advanced technologies, including AI and IoT, to offer better user experiences, personalized recommendations, and improved security features.

Government Regulations and Digital Currency

China’s government has introduced a range of regulations designed to promote digital payments and control financial transactions, with the goal of reducing cash usage and increasing the efficiency of financial systems. Additionally, the introduction of the Digital Yuan, a central bank digital currency (CBDC), has the potential to reshape the mobile payment landscape by offering a state-backed, secure digital currency that can be used alongside existing platforms like Alipay and WeChat Pay.

The mobile payment market in China is evolving rapidly, driven by technological advancements, government support, and a highly competitive landscape. The continued dominance of Alipay and WeChat Pay, coupled with the rise of 5G and digital currencies, suggests that China’s mobile payment industry will continue to lead the global shift towards a cashless society.