China Social Media Market Share

China’s social media market is one of the largest and most rapidly growing markets in the world. With more than a billion internet users and a highly engaged online population, China represents a significant portion of the global social media landscape. Social media platforms in China have become deeply integrated into everyday life, shaping everything from communication and entertainment to shopping and professional networking. The landscape is unique, with several Chinese social media giants dominating the market, each offering a variety of services that go far beyond simple social networking.

In 2023, China’s social media market is valued at approximately ¥600 billion ($85 billion), growing at a compound annual growth rate (CAGR) of around 8-10%. This growth is driven by the rapid adoption of mobile internet, the increasing use of social media for e-commerce and advertising, and the growing popularity of short-form video content. With the rise of live streaming, e-commerce integration, and the expansion of social media into professional networking, Chinese social media platforms are constantly evolving to meet the needs of their vast and diverse user base.

The Chinese social media market is dominated by a few large players, including WeChat, Douyin, Weibo, and Kuaishou, as well as some emerging platforms that cater to niche demographics. These companies are fiercely competitive, constantly innovating with new features and services to retain user engagement and drive monetization. At the same time, social media in China is subject to strict government regulation, which can impact both the platforms and the types of content that are shared. Despite these challenges, China remains a world leader in social media, with platforms often setting trends that influence the global market.

Key Drivers of the Market

Rising Smartphone Penetration

Smartphone penetration in China has been one of the key drivers behind the rapid growth of social media usage. With more than 1.6 billion mobile phone subscriptions and the widespread availability of affordable smartphones, mobile internet has become the primary way that Chinese consumers access social media. The continued improvement in smartphone technology, including faster processors, better cameras, and larger screens, has also fueled the growing demand for mobile-first social media platforms.

China’s mobile-first culture is characterized by a high degree of social media integration with mobile apps. Many of China’s most popular platforms, such as WeChat, Douyin, and Weibo, are accessed primarily through smartphones, and mobile apps are often the preferred method for users to interact with social media. The rise of 4G and 5G networks has further enabled the seamless streaming of content, making social media platforms even more accessible and engaging for Chinese users.

Integration of E-commerce and Social Media

The integration of e-commerce into social media platforms is another major driver of growth in China’s social media market. Platforms like WeChat, Douyin, and Weibo have evolved beyond traditional social networking services to become all-in-one hubs that combine social interaction with online shopping, gaming, live streaming, and digital payments.

For example, WeChat’s “Mini Programs” allow users to shop, book tickets, make reservations, and even complete banking transactions without leaving the app. Similarly, Douyin (the Chinese version of TikTok) has successfully integrated e-commerce into its short-form video content, allowing creators and businesses to sell products directly to users via live streaming and video posts. As a result, social media has become an essential platform for brands and businesses to reach and engage with consumers, contributing to the growth of both the social media and e-commerce markets in China.

Major Segments in the Social Media Market

Short-Form Video Platforms

Short-form video content has become the dominant format on Chinese social media platforms. Platforms like Douyin and Kuaishou have revolutionized how people consume content by focusing on short, engaging videos that can be easily shared and liked. These platforms leverage algorithms to recommend personalized content to users based on their preferences, creating an addictive user experience that keeps people coming back.

In 2023, the short-form video segment in China is valued at approximately ¥300 billion ($43 billion), representing the largest and fastest-growing segment of the social media market. The popularity of short-form video has also given rise to influencer marketing, with creators using platforms like Douyin and Kuaishou to build large followings and generate revenue through brand partnerships, live streaming, and product promotion.

The success of short-form video platforms in China has also had a significant influence on other social media services globally. As short-form videos continue to capture more of the audience’s attention, they have reshaped the social media landscape and given rise to a new generation of content creators.

Messaging and Social Networking Platforms

Messaging and social networking platforms continue to dominate China’s social media market. These platforms allow users to communicate with friends, family, and colleagues while also offering a range of additional services, such as news, gaming, entertainment, and e-commerce. The most prominent of these platforms is WeChat, which offers everything from instant messaging and voice calls to mobile payments, gaming, news, and much more.

WeChat’s influence extends far beyond traditional social networking. With over 1.2 billion active users in China, the app has become a central part of daily life, acting as a super app that integrates nearly every aspect of Chinese internet use. WeChat’s “Mini Programs,” which are lightweight apps within the app, allow users to shop, access services, and make payments, further blurring the line between social networking and e-commerce.

Weibo, often referred to as China’s version of Twitter, remains one of the most popular social networking platforms in the country. Weibo has been successful in maintaining its user base by combining microblogging with social networking features, and it continues to be a key platform for news, celebrity content, and public discussions.

In 2023, messaging and social networking platforms account for approximately ¥250 billion ($36 billion) of China’s social media market, with WeChat and Weibo capturing the majority of this share.

Live Streaming and Interactive Entertainment

Live streaming has become an integral part of China’s social media ecosystem, with platforms like Douyin, Kuaishou, and Taobao Live dominating this space. Live streaming allows users to interact with content creators in real-time, watch live events, and even make purchases via live broadcasts. This form of interactive entertainment has exploded in popularity, with millions of Chinese users engaging in live-streamed content every day.

In 2023, the live streaming segment of China’s social media market is valued at around ¥150 billion ($21.5 billion), and its growth continues to be driven by the rise of e-commerce live streaming, where influencers and brands promote products in real-time to their audiences. Live streaming has also become a primary source of income for many influencers and celebrities, further increasing its importance in China’s social media landscape.

Professional Networking Platforms

Professional networking platforms have gained traction in China, as they provide a space for business professionals to connect, share ideas, and search for job opportunities. While LinkedIn is the most widely used global platform, domestic services like Maimai have carved out their own niche in China by offering features tailored to local business practices and needs.

Maimai, for example, focuses on offering a more professional social networking experience with features such as career development tools, job postings, and company-specific networking. As the demand for professional development and networking grows in China, platforms like Maimai are gaining ground among business professionals.

Major Players in the Chinese Social Media Market

Tencent (WeChat, QQ)

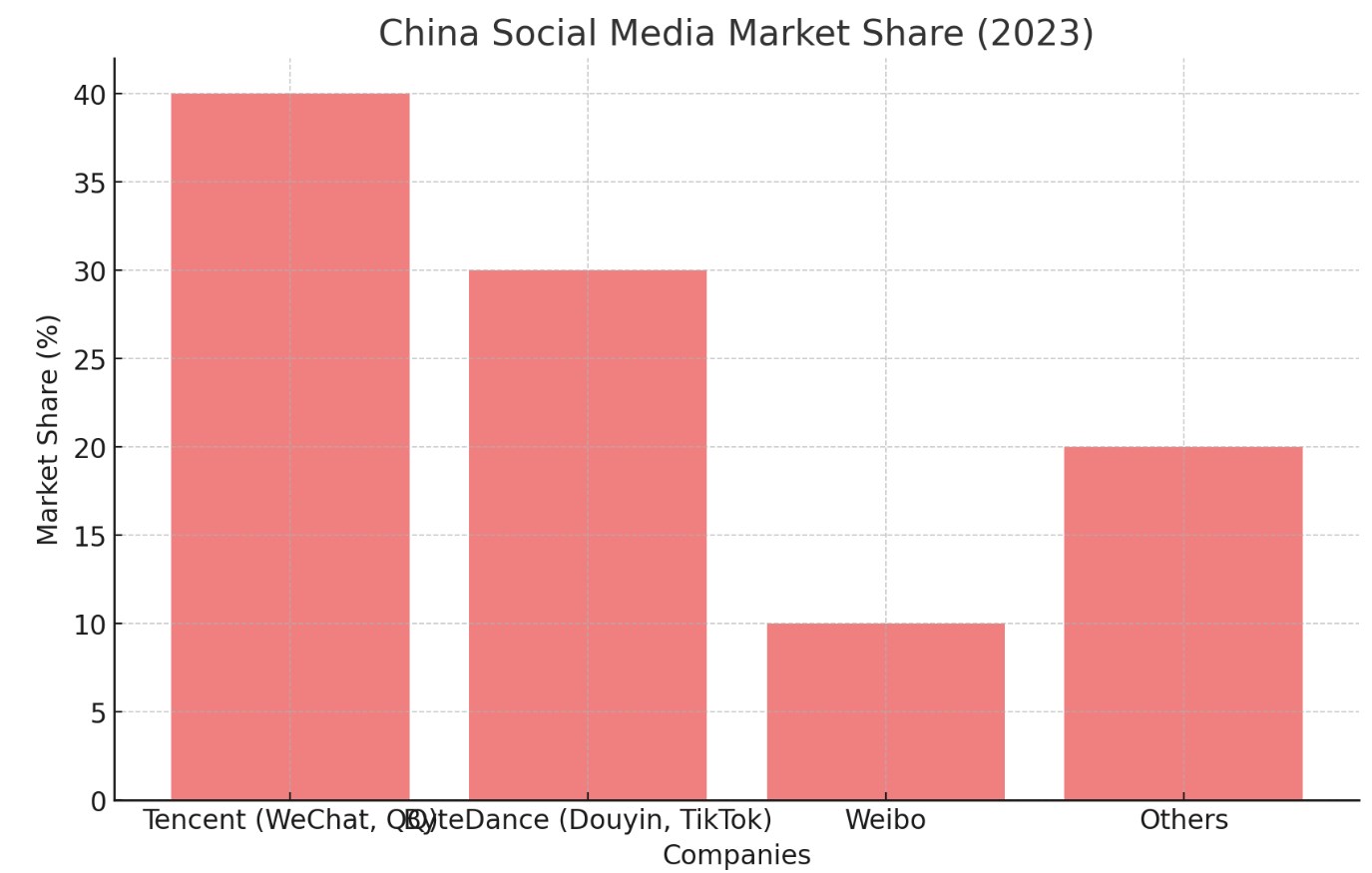

Tencent is the dominant player in China’s social media market, holding a market share of approximately 40% in 2023. The company’s flagship platform, WeChat, is the most popular messaging and social networking app in China, with over 1.2 billion monthly active users. WeChat has become an all-in-one super app that offers messaging, social networking, e-commerce, mobile payments, gaming, and more, making it a central part of Chinese digital life.

In addition to WeChat, Tencent also operates QQ, a popular messaging and social networking platform with a large user base, particularly among younger audiences. QQ has been a staple in China’s internet landscape for over two decades and continues to maintain relevance in the social media space.

Tencent’s market value in China’s social media industry is estimated at ¥250 billion ($36 billion) in 2023. The company continues to innovate by expanding WeChat’s functionalities and integrating social media with other services like e-commerce and mobile payments, reinforcing its dominance in the market.

Tencent’s Key Strengths

- All-in-one super app: WeChat’s versatility and integration with multiple services make it a key player in the Chinese social media landscape.

- Large user base: Tencent has access to a massive number of users, ensuring its market leadership and dominance across multiple segments.

ByteDance (Douyin, TikTok)

ByteDance is the parent company of Douyin (the Chinese version of TikTok), one of the fastest-growing social media platforms in China. Douyin has rapidly gained popularity with its short-form video content, which appeals to a young, mobile-first audience. The platform’s algorithm-driven content discovery system has contributed to its explosive growth and its ability to create viral content that attracts millions of users.

Douyin’s user base has surpassed 700 million monthly active users in China in 2023, making it one of the most popular social media platforms in the country. ByteDance’s overall market share in China’s social media market is approximately 30%, with Douyin and its live streaming platform Kuaishou contributing significantly to the company’s market value of around ¥180 billion ($26 billion).

ByteDance’s Key Strengths

- Powerful content algorithm: Douyin’s algorithm ensures highly personalized content, making it highly engaging for users.

- Innovation in short-form video: ByteDance has transformed social media with its focus on short-form video and live streaming, creating a new standard for content consumption.

Weibo is one of China’s leading social networking platforms, with a strong presence in news, entertainment, and celebrity content. Often described as a hybrid of Twitter and Facebook, Weibo offers microblogging features that allow users to post updates, share multimedia, and engage in discussions. Weibo has been a go-to platform for real-time updates on news, trends, and celebrity culture in China.

In 2023, Weibo holds a market share of approximately 10%, with a user base of over 500 million monthly active users. The platform’s market value is estimated at ¥60 billion ($8.7 billion). Weibo’s focus on real-time content and public discussions makes it an important player in the Chinese social media landscape.

Weibo’s Key Strengths

- Real-time content: Weibo excels at providing live updates and breaking news, making it a go-to platform for users looking to stay informed.

- Celebrity culture: Weibo has a unique niche in celebrity culture and entertainment, helping it maintain a strong and engaged user base.

Market Trends and Future Outlook

The integration of e-commerce with social media is expected to continue growing in China. Platforms like Douyin and WeChat have pioneered the trend of e-commerce integration, allowing users to shop directly from their social feeds. As this trend expands, more platforms are likely to integrate similar features, turning social media into a primary channel for online shopping.