China Search Engine Market Share

China’s search engine market is one of the most critical segments of the country’s rapidly expanding digital economy. With a market size exceeding USD 25 billion in 2024, China is home to one of the world’s largest and most dynamic search engine ecosystems. As the country’s internet penetration continues to grow, along with the increasing number of online businesses and services, the demand for efficient search engines and digital advertising platforms has soared. In the Chinese market, search engines play a crucial role not only in information retrieval but also in driving the digital marketing industry, shaping consumer behavior, and supporting e-commerce.

Unlike other regions of the world, China’s search engine landscape is highly unique, mainly due to the country’s censorship laws, the presence of the Great Firewall, and the absence of many Western players such as Google. As a result, the market is dominated by domestic players, with Baidu, Qihoo 360, and Sogou standing out as the leading search engines in the country. Each player has carved out its niche in the search engine market through tailored services, digital advertising solutions, and specialized technology platforms that cater to local consumers’ needs and comply with regulatory frameworks.

As of 2024, the Chinese search engine market is experiencing rapid growth in both traditional search services and the burgeoning areas of AI-powered search, voice search, and vertical search engines. The market is also witnessing a shift in user behavior, as consumers increasingly seek personalized content, on-demand services, and integration with e-commerce platforms, making search engines a central component of the digital ecosystem.

Major Players in the China Search Engine Market

Baidu

Market Share and Position

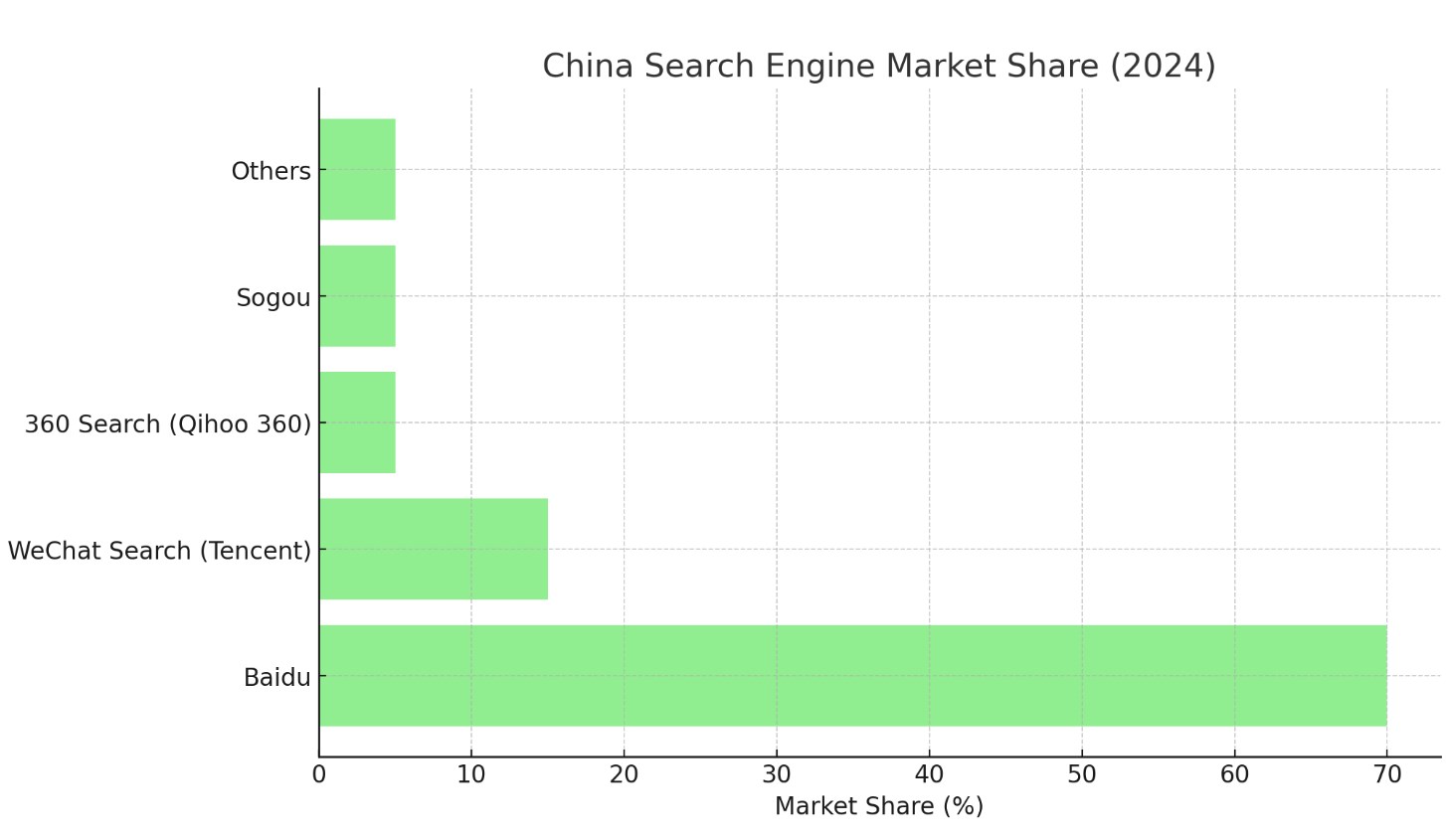

Baidu, often referred to as the “Google of China,” is the dominant player in the country’s search engine market. As of 2024, Baidu holds an estimated 70% market share, with its annual revenue from search advertising and related services exceeding USD 12 billion. Founded in 2000 by Robin Li and Eric Xu, Baidu has grown to become the largest search engine in China, offering a wide range of services beyond traditional search, including cloud computing, artificial intelligence (AI), autonomous driving, and online marketing.

Baidu’s search engine is deeply integrated into China’s internet ecosystem, offering not only search functionality but also a suite of products and services designed to enhance the user experience. Baidu’s advanced AI algorithms, combined with its massive data resources, allow the company to provide highly personalized search results, making it a crucial tool for Chinese consumers. The company’s search platform also integrates various verticals such as news, video, music, maps, and shopping, allowing Baidu to capture a larger share of users’ attention and ad spending.

Key Strategies and Innovations

- Artificial Intelligence and Machine Learning: Baidu is at the forefront of AI research and development in China. The company uses AI and deep learning technologies to improve search results, enhance voice search, and personalize content for users.

- E-commerce Integration: Baidu has leveraged its search engine to drive e-commerce transactions by partnering with various online retail platforms, offering users a seamless shopping experience through its search interface.

Baidu’s leadership in the Chinese search engine market can be attributed to its investment in AI, the expansion of its services beyond search, and its dominant position in the digital advertising space.

Qihoo 360

Market Share and Competitive Position

Qihoo 360, best known for its antivirus software and internet security products, has also established a strong presence in China’s search engine market. As of 2024, Qihoo 360 holds an estimated market share of 15%, with revenues from its search services exceeding USD 3 billion. While Qihoo 360 is not as dominant as Baidu in search, it has positioned itself as a key competitor by focusing on delivering secure and efficient search services tailored to Chinese consumers’ needs.

Qihoo 360’s search engine, known as 360 Search, offers users a safe and fast search experience with a strong emphasis on internet security. The company’s products are highly trusted by users who prioritize privacy and protection against online threats. Qihoo 360 has been able to leverage its strong brand in cybersecurity to attract users to its search engine platform, making it the second-largest search engine player in China.

Key Strategies and Innovations

- Security Integration: Qihoo 360 integrates its search engine with its popular antivirus software, providing users with a sense of security while browsing the web and conducting online searches.

- Vertical Search Solutions: In addition to general search services, Qihoo 360 has developed specialized search engines for specific verticals such as shopping, finance, and news, further enhancing its user base and offering more targeted solutions.

Qihoo 360’s focus on security, privacy, and specialized vertical search services has helped it secure a significant share of China’s search engine market.

Sogou

Market Share and Position

Sogou, a subsidiary of Tencent, is another major player in China’s search engine market, holding an estimated market share of around 10% in 2024. Founded in 2004, Sogou initially focused on providing a Chinese language input method but later expanded into search services. The company is now one of the top search engines in China, offering a range of services including web search, mobile search, and vertical search engines for specific categories such as news, videos, and music.

Sogou’s strong integration with Tencent’s vast social media and gaming ecosystem has helped it grow its user base. The company’s search engine benefits from Tencent’s massive user network, including WeChat and QQ, making it an essential tool for users who frequently engage with Tencent’s digital ecosystem. In addition, Sogou has invested heavily in voice search and AI technology, ensuring that its search engine remains competitive with Baidu and Qihoo 360.

Key Strategies and Innovations

- Integration with Tencent’s Ecosystem: Sogou’s search engine benefits from its integration with Tencent’s social media platforms, particularly WeChat, which allows the search engine to reach a large number of users.

- Voice Search and AI: Sogou has placed a strong emphasis on voice search technology, which has become increasingly popular in China due to the rise of smart devices and the growing interest in AI-powered search solutions.

Sogou’s strategy of integrating with Tencent’s ecosystem, combined with its investment in voice search and AI, has allowed it to maintain a strong presence in China’s competitive search engine market.

360 Search (by Qihoo 360)

Market Share and Competitive Position

360 Search, a subsidiary of Qihoo 360, has emerged as one of China’s leading search engines. The platform has gained traction, especially in the realm of online security, and is increasingly offering personalized results based on AI and machine learning. Qihoo 360’s market share is growing, reaching around 15% in 2024, with significant revenue from digital ads integrated with its search services.

Key Strategies and Innovations

- Data Security and Integration: Leveraging its strength in internet security, 360 Search focuses on offering a secure browsing and search experience.

- Customizable and Personalized Content: 360 Search offers tailored recommendations and more personalized content through advanced AI algorithms.

360 Search is steadily becoming one of the most trusted search engines for users who prioritize security.

Baidu’s Competitive Advantages

Baidu holds a significant edge in China’s search engine market. The company’s leadership is driven by its advanced technologies and its ability to provide a comprehensive ecosystem for consumers. Key advantages of Baidu include:

- Market Reach: Baidu serves millions of Chinese users across multiple platforms and services, making it the dominant search engine in the country.

- Innovation in AI: Baidu has heavily invested in AI and natural language processing (NLP), giving it an edge in delivering high-quality, relevant search results and enabling innovations like conversational search and AI-driven ads.

Trends in China’s Search Engine Market

Rise of Mobile Search

As China’s smartphone penetration continues to grow, mobile search has become the dominant form of online search. In 2024, over 70% of all search engine queries in China are expected to come from mobile devices. This trend has led search engines to optimize their platforms for mobile users, focusing on speed, efficiency, and mobile-friendly advertising formats.

Artificial Intelligence and Voice Search

Artificial intelligence (AI) and voice search are key trends that are shaping the future of China’s search engine market. As voice assistants such as Baidu’s DuerOS and Tencent’s WeChat voice search become more prevalent, the search experience is evolving. Search engines are increasingly utilizing AI and machine learning to provide more personalized, context-aware search results and deliver a better overall user experience.

Integration with E-commerce

Search engines in China are also integrating more closely with e-commerce platforms, allowing users to search for products and make purchases directly through search results. This shift is being driven by the growing demand for seamless online shopping experiences. Baidu and Sogou, for instance, are expanding their e-commerce offerings, enabling users to shop directly through search queries.

Government Influence and Regulatory Landscape

China’s government plays a significant role in the search engine market through its regulatory framework. The country’s strict censorship laws, including the Great Firewall, ensure that search engines are heavily monitored and regulated. Search engines in China must adhere to these regulations, which can influence search results, block certain content, and promote government-friendly information. This creates a unique dynamic in the market, where the ability to operate a search engine in China depends heavily on compliance with government policies.

Privacy Concerns and Data Security

With growing concerns over user privacy and data security, search engines in China are increasingly under scrutiny. While search engines like Baidu and Sogou collect vast amounts of data on user behavior to refine their search results, the issue of user privacy remains a hot topic. The Chinese government is also implementing stricter data privacy regulations, which will likely impact how search engines manage user data in the coming years.

Integration with Social Media

China’s social media platforms, including WeChat and QQ, have significantly impacted the search engine market. These platforms have introduced integrated search functionalities within their apps, allowing users to search for information, products, and services directly within their social media apps. This trend presents a challenge to traditional search engines, as social media platforms increasingly offer search functionality as part of their user experience.

China’s search engine market continues to evolve rapidly, with domestic companies like Baidu, Qihoo 360, and Sogou driving growth and competition. The market is influenced by technological advancements in AI, voice search, mobile optimization, and e-commerce integration. Furthermore, government regulations and privacy concerns will continue to shape the direction of search engine development, ensuring that the industry remains highly dynamic in the coming years.