China Music Streaming Market Share

The music streaming market in China has grown rapidly in recent years, transforming the way millions of people consume music and opening up new opportunities for local and international companies in the digital entertainment space. With a population of over 1.4 billion and a young, tech-savvy demographic, China’s music streaming sector is a significant player in the global music industry. The rapid adoption of smartphones, high-speed internet, and mobile apps has helped fuel this growth, with streaming platforms now being the primary way most people in China listen to music.

In 2023, the music streaming market in China is valued at approximately ¥70 billion (around $10 billion), with a steady growth rate of around 15-20% annually. This growth is driven by factors such as increased smartphone penetration, the expansion of 4G and 5G networks, rising disposable incomes, and a growing middle class that is willing to pay for premium music services. Additionally, Chinese consumers have shown increasing interest in both domestic and international music, contributing to the diversification of available content and the evolution of music consumption habits.

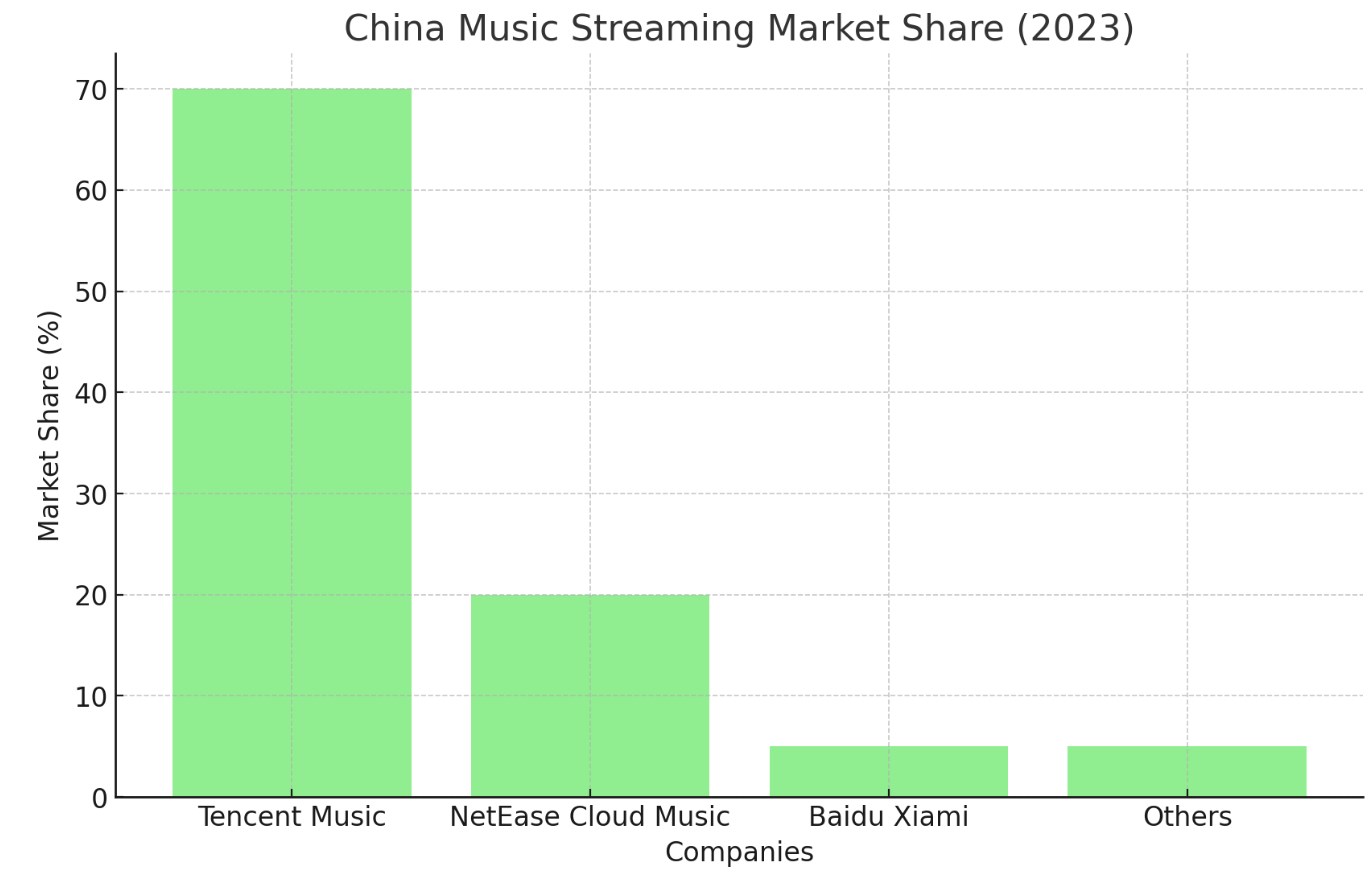

China’s music streaming market is highly competitive, with several local players dominating the landscape. Major platforms like Tencent Music (which operates QQ Music, Kugou, and Kuwo), NetEase Cloud Music, and others have emerged as the leading providers of music content and services. These companies are battling for market share by offering innovative features, personalized experiences, exclusive content, and competitive pricing models. The market is also witnessing increased consolidation, as large players look to secure their position in a rapidly growing and evolving space.

Key Drivers of the Market

Increasing Smartphone Penetration

Smartphone penetration in China has been a major factor in the growth of the music streaming market. With the proliferation of affordable smartphones and access to high-speed mobile internet, more consumers in China have the ability to stream music at their convenience. The rapid adoption of smartphones has not only provided consumers with access to music on the go but has also made it easier for music streaming platforms to reach a broader audience. In 2023, smartphone penetration in China is expected to surpass 90%, further driving the demand for mobile music services.

The use of mobile apps for music streaming has become an integral part of daily life in China, with millions of users accessing music platforms through their smartphones, whether at home, on the commute, or at work. As mobile internet speeds continue to improve with the roll-out of 5G networks, the overall music streaming experience will continue to enhance, boosting consumer engagement with these services.

Rise of Paid Subscription Models

The shift from free ad-supported music streaming services to paid subscription models has been another important factor in the growth of the music streaming market in China. While free services dominate in terms of user base, many consumers are choosing to pay for premium subscriptions in exchange for ad-free experiences, higher sound quality, and access to exclusive content.

In 2023, the paid music streaming market in China is valued at approximately ¥25 billion ($3.6 billion), with subscription services like Tencent Music’s VIP membership and NetEase Cloud Music’s “Super VIP” providing platforms with a significant portion of their revenue. The increasing willingness of consumers to pay for premium content reflects the growing recognition of the value and quality of music streaming services, further accelerating the market’s expansion.

Government Policies and Industry Regulations

The Chinese government has played a significant role in the development of the music streaming market. Policies promoting the digital economy and the expansion of internet infrastructure have facilitated the growth of online services across various sectors, including entertainment. Furthermore, the government has introduced regulations to protect intellectual property rights, which has had a positive impact on the music streaming market by ensuring that content creators and rights holders are compensated fairly.

However, the government also regulates online music platforms in terms of licensing, content restrictions, and censorship, which can sometimes impact the availability of international music and affect how companies operate within the market. Despite these regulatory challenges, China’s music streaming sector has flourished, benefiting from government support aimed at driving digital transformation and expanding access to entertainment.

Major Segments in the Music Streaming Market

Free Streaming Services

Free streaming services represent the largest segment of the music streaming market in China, attracting millions of users who enjoy music without having to pay a subscription fee. These services are ad-supported and offer users access to a broad catalog of music, but with limitations such as lower sound quality, the presence of ads, and fewer features compared to premium subscriptions.

Tencent Music’s QQ Music, Kuwo, and Kugou platforms offer free streaming options that allow users to listen to music with occasional interruptions by advertisements. These platforms generate revenue from ads, while also providing users with the option to upgrade to paid subscriptions for enhanced features, including ad-free listening and higher-quality sound.

In 2023, the free streaming services segment in China is valued at around ¥45 billion ($6.5 billion), with a market share of approximately 70%. Free music streaming platforms continue to serve as an entry point for consumers who are new to the digital music landscape or who are unwilling to pay for a subscription.

Paid Subscription Services

Paid subscription services in China are experiencing rapid growth as more consumers choose to pay for enhanced music experiences. The main selling points of paid subscriptions include higher-quality sound, ad-free listening, offline music downloads, and exclusive content such as early releases and artist collaborations.

Tencent Music’s QQ Music VIP, NetEase Cloud Music’s VIP membership, and Alibaba’s Xiami Music all offer premium subscription models that cater to users looking for a more refined and uninterrupted music experience. With an increasing number of consumers willing to pay for the added benefits of a subscription, the paid subscription segment in China is expanding.

The paid music streaming services market in China is valued at approximately ¥25 billion ($3.6 billion) in 2023, accounting for about 35% of the total market share. As more consumers discover the value of paid subscriptions and the benefits of exclusive content, this segment is expected to continue its upward trajectory in the coming years.

Music Distribution and Licensing

Music distribution and licensing have become increasingly important as the demand for diverse music content grows in China. The licensing of music from domestic and international record labels has enabled music streaming platforms to expand their catalogs and offer a wider variety of content to consumers. This segment also includes the licensing of music for use in films, TV shows, video games, and advertisements.

Music streaming platforms in China have established partnerships with both domestic and international labels to ensure that they have access to the most popular tracks. In 2023, the music distribution and licensing segment in China is valued at around ¥10 billion ($1.4 billion), and it plays a key role in the ability of streaming platforms to stay competitive by offering up-to-date and diverse content.

Major Players in the Chinese Music Streaming Market

Tencent Music Entertainment (TME)

Tencent Music Entertainment (TME) is the largest and most dominant player in China’s music streaming market. The company operates a portfolio of leading music streaming services, including QQ Music, Kugou, and Kuwo, which cater to different user segments. QQ Music is the flagship service of TME, targeting the mainstream audience, while Kugou and Kuwo focus on more regional and niche markets.

TME controls a significant portion of the market, with a market share of approximately 70% in 2023. The company has benefited from its extensive catalog, vast user base, and strong integration with Tencent’s ecosystem, including WeChat and WeCom. In addition to music streaming, TME also generates revenue through live streaming, concerts, and other music-related content.

In 2023, Tencent Music’s market value in China’s music streaming industry is estimated to be ¥50 billion ($7.2 billion). The company is focusing on expanding its paid subscription model and improving user engagement through personalized recommendations, exclusive content, and live music events.

TME’s Key Strengths

- Strong catalog and partnerships: Tencent Music has exclusive licensing agreements with major international and domestic record labels, which helps ensure a broad music catalog.

- Integration with Tencent’s ecosystem: The integration with WeChat and other Tencent services allows Tencent Music to tap into a massive user base.

NetEase Cloud Music

NetEase Cloud Music is the second-largest player in China’s music streaming market, with an estimated market share of 20% in 2023. The platform is known for its user-friendly interface, social features, and focus on music discovery. NetEase Cloud Music differentiates itself by catering to younger audiences and offering a more social music experience, allowing users to share playlists, comment on tracks, and follow their favorite artists.

NetEase Cloud Music has a strong focus on exclusive content, with a range of indie and up-and-coming artists releasing tracks on the platform. The service also features a premium membership offering additional benefits, including higher sound quality and ad-free listening.

NetEase Cloud Music’s market value in the music streaming industry is estimated at ¥10 billion ($1.4 billion) in 2023, with an increasing number of paid subscribers. As the company continues to expand its music catalog and innovate in terms of social features and content offerings, its share of the market is expected to grow.

NetEase Cloud Music’s Key Strengths

- Social music experience: The platform’s focus on social features and music discovery has helped it cultivate a loyal user base.

- Exclusive content and artist partnerships: NetEase Cloud Music’s exclusive content and partnerships with emerging artists help differentiate it from competitors.

Baidu Xiami Music

Xiami Music, operated by Baidu, was once one of the dominant platforms in China’s music streaming market. However, in recent years, its market share has dwindled as Tencent Music and NetEase Cloud Music have gained ground. Nevertheless, Xiami Music still holds a significant presence, particularly among users looking for a more niche music experience.

Xiami Music has focused on offering a wide range of independent and alternative music, with a particular emphasis on user-generated content. The platform also offers both free and premium subscription models, with paid users benefiting from enhanced features such as higher audio quality and offline listening.

In 2023, Xiami Music’s market share in China is estimated at around 5%, with a market value of ¥3 billion ($430 million). Although the platform faces stiff competition, it continues to appeal to users who value diversity in music genres and a more personalized listening experience.

Xiami Music’s Key Strengths

- Focus on indie music and emerging artists: Xiami’s catalog of indie and alternative music allows it to cater to a niche audience that values diverse music offerings.

- User-centric features: The platform’s personalized recommendations and user-generated content make it attractive to more engaged listeners.

Market Trends and Future Outlook

Growth of Paid Subscriptions

As more consumers in China become willing to pay for premium music services, the growth of paid subscriptions is expected to continue. Music streaming platforms are offering tiered subscription models to cater to different needs, from casual listeners to dedicated audiophiles. Paid subscriptions will remain a key revenue driver for music streaming platforms in China as consumers seek higher-quality audio, ad-free experiences, and access to exclusive content.

Mobile and Social Integration

The integration of music streaming services with mobile apps and social media platforms is becoming increasingly important in China’s music market. With the rise of short-form video apps like Douyin (TikTok) and WeChat, music streaming services are increasingly focusing on integrating with these platforms to attract new users and enhance engagement. Platforms like Tencent Music and NetEase Cloud Music are already leveraging social features and collaborations with influencers to attract a younger, more tech-savvy demographic.

Licensing and Exclusive Content

The demand for exclusive content will continue to shape the Chinese music streaming market. Platforms that can secure exclusive licensing deals with artists and record labels will have a competitive edge, as consumers are more likely to subscribe to services that offer access to rare or early-release tracks. The ongoing competition for exclusive content and collaborations will drive the growth of the industry, with platforms striving to outbid each other for the rights to popular music.