China Mobile OS Market Share

The mobile operating system (OS) market in China is one of the largest and most competitive globally. As the world’s largest smartphone market, China plays a pivotal role in shaping the future of mobile operating systems. Mobile OS is a critical aspect of the smartphone ecosystem, and the competition among different platforms has led to rapid technological advancements and changes in consumer preferences. From global giants like Android and iOS to local players such as HarmonyOS, the mobile OS market in China is highly dynamic and continues to evolve.

In 2023, the Chinese mobile OS market is valued at approximately ¥100 billion ($14 billion), driven by an ever-growing number of mobile phone users, technological advancements, and a strong emphasis on the Internet of Things (IoT) and connectivity. With over a billion mobile phone users in China, the mobile OS market represents an immense opportunity for both domestic and international companies to expand their reach.

The two dominant mobile operating systems globally, Android and iOS, continue to maintain a large market share in China. However, the emergence of HarmonyOS, developed by Huawei, has intensified competition in the market. The development of homegrown operating systems like HarmonyOS is part of China’s broader strategy to reduce dependence on foreign technology and increase the competitiveness of domestic firms. Despite this, Android remains the dominant OS in China due to its extensive ecosystem, variety of devices, and widespread adoption across price segments.

Key Drivers of the Market

Growing Smartphone Market and Consumer Demand

The rapid expansion of the smartphone market in China has been a significant driver of the mobile OS market. With a population exceeding 1.4 billion people and a high level of mobile penetration, the demand for smartphones continues to grow at a rapid pace. China’s middle class is increasingly investing in mobile technology, driving the demand for smartphones and, by extension, mobile operating systems.

Smartphone users in China have diverse needs and preferences, from basic communication and social networking to gaming, shopping, and more advanced tasks like banking and financial services. As the variety of mobile applications and services grows, the demand for mobile OS platforms that offer seamless integration with apps, security features, and an intuitive user experience has surged. As a result, mobile OS providers are continuously innovating to meet the diverse demands of the Chinese consumer.

Technological Advancements and Ecosystem Integration

The development of advanced mobile technologies such as 5G, AI, and IoT has also played a crucial role in driving the growth of mobile OS platforms in China. 5G technology, in particular, has transformed the mobile experience, providing users with faster internet speeds and low latency, which in turn enables more advanced applications, such as augmented reality (AR), virtual reality (VR), and advanced mobile gaming.

The Chinese government’s push for smart cities and connected devices has further fueled the demand for mobile OS platforms that support a broad range of devices and services. As the Chinese smartphone market becomes increasingly integrated with other consumer electronics and home devices, OS developers are focusing on building ecosystems that offer seamless connectivity between mobile devices, wearables, home automation products, and more. This has led to the rise of operating systems like HarmonyOS, which are designed to power a variety of smart devices beyond just smartphones.

Major Segments in the Mobile OS Market

Android OS

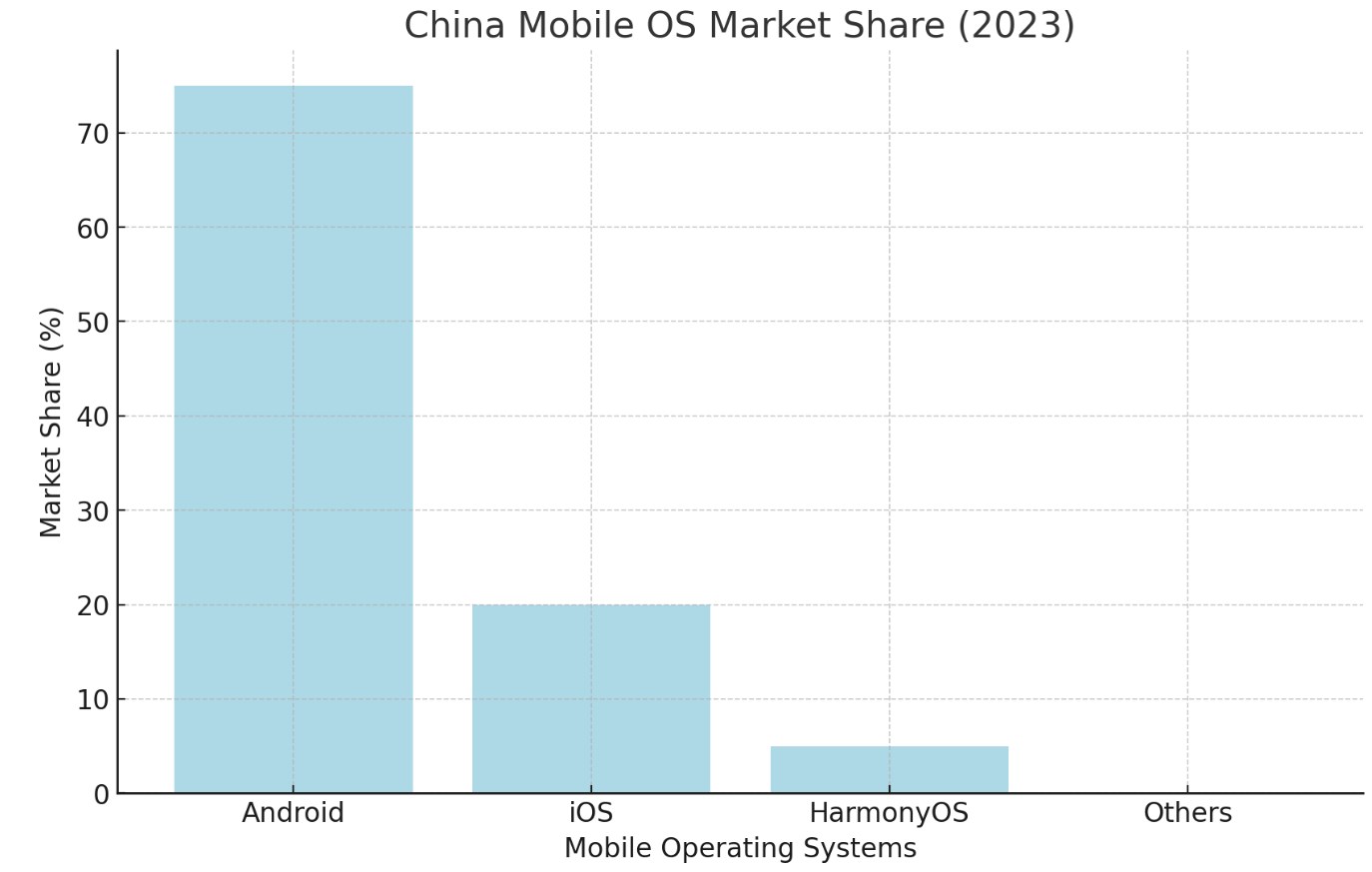

Android remains the dominant mobile operating system in China, with a market share of approximately 75% in 2023. Developed by Google, Android’s open-source nature and its widespread adoption across a variety of devices have made it the most popular OS in China and globally. The Android ecosystem is vast, supporting a wide range of smartphones, tablets, and other connected devices from various manufacturers.

In China, Android OS has been favored due to its flexibility, customizability, and the vast number of apps available on the Google Play Store, as well as alternative app stores. The OS also supports a broad range of hardware, from low-cost devices to premium flagship smartphones, which has helped Android maintain its dominance in the Chinese market.

The Android OS market in China is valued at approximately ¥80 billion ($11.5 billion) in 2023, and it continues to experience steady growth as more consumers adopt smartphones and other mobile devices powered by Android. Despite some regulatory challenges and competition from local players, Android’s open ecosystem remains highly attractive to both consumers and manufacturers in China.

iOS

iOS, developed by Apple, is the second-largest mobile operating system in China, with a market share of around 20% in 2023. Although Apple’s market share in China is smaller than Android’s, iOS enjoys a loyal customer base, particularly among affluent consumers. The Apple ecosystem, which includes iPhones, iPads, MacBooks, Apple Watches, and other products, provides a seamless experience for users, making it highly appealing to tech-savvy consumers who value security, privacy, and smooth integration across their devices.

iOS users are generally willing to pay a premium for Apple’s high-quality hardware and software, making iOS one of the most profitable platforms in the world. In China, Apple’s iPhones are considered luxury items, and the demand for iOS-powered devices remains strong, particularly in higher-tier market segments. The iOS market in China is valued at approximately ¥18 billion ($2.6 billion) in 2023, with a steady but smaller growth rate compared to Android.

Despite competition from Android, iOS continues to hold its ground in China’s mobile OS market, thanks to Apple’s brand loyalty, premium pricing, and ecosystem integration. The company has also made efforts to comply with local regulations and strengthen its presence in China’s mobile market, which has helped it retain its market share.

HarmonyOS

HarmonyOS, developed by Huawei, is the emerging third player in China’s mobile OS market. With Huawei’s growing influence in the smartphone market and its strong push to develop homegrown technology in response to geopolitical pressures, HarmonyOS represents a strategic shift in China’s approach to mobile OS development. In 2023, HarmonyOS holds a market share of approximately 5-7% in China, but its adoption is growing rapidly as Huawei integrates it across more devices.

HarmonyOS is designed to work across a wide range of connected devices, including smartphones, smart TVs, wearables, and IoT devices, positioning it as a key player in the future of smart homes and interconnected ecosystems. The OS is based on microkernel architecture, making it modular and scalable, which allows it to be adapted to different devices and use cases. HarmonyOS is also fully localized to meet the needs of Chinese consumers, with features and services tailored to the local market.

The rapid development of HarmonyOS and its integration with Huawei’s broader hardware ecosystem have helped it gain traction in China. The government’s support for local innovation and the desire for technological self-reliance have provided a boost for HarmonyOS, and its market share is expected to continue growing as more consumers embrace Huawei’s ecosystem.

Other Mobile Operating Systems

While Android, iOS, and HarmonyOS dominate the Chinese mobile OS market, there are several other operating systems that contribute to the market, albeit with a smaller share. These include operating systems developed by smaller manufacturers or those targeted at niche markets.

-

KaiOS: Based on a fork of the Linux kernel, KaiOS is an operating system that targets feature phones and IoT devices. It is used in some budget and entry-level smartphones, particularly in rural areas where basic mobile phones are more common. While it has a much smaller market share in China compared to Android and iOS, it still serves a niche segment of the population that seeks low-cost, functional devices.

-

Samsung Tizen: Although Tizen was originally developed by Samsung for its smartphones, it is now primarily used in smartwatches, TVs, and other smart devices. Tizen’s presence in the smartphone market is minimal, but it is growing in the smart device market, particularly in the realm of wearables and smart TVs.

Major Players in the Chinese Mobile OS Market

Huawei (HarmonyOS)

Huawei’s HarmonyOS is emerging as a strong contender in China’s mobile OS market. With its rapid growth and increasing adoption, HarmonyOS is supported by Huawei’s dominance in the smartphone, IoT, and consumer electronics markets. The company’s strategy of developing an ecosystem around HarmonyOS, which includes smartphones, smart devices, and connected technologies, has contributed to the OS’s rising market share.

Huawei’s market value in the Chinese mobile OS market is estimated to be ¥25 billion ($3.6 billion) in 2023. While HarmonyOS is still in its early stages compared to Android and iOS, the OS’s integration across various devices and its appeal to domestic consumers have positioned it as a key player in China’s mobile landscape.

Huawei’s Key Strengths

- Ecosystem integration: HarmonyOS is designed to work seamlessly across a wide range of devices, from smartphones to wearables, smart TVs, and IoT devices.

- Government support: As part of China’s broader strategy to reduce dependence on foreign technology, HarmonyOS is likely to receive continued support from the government.

Google (Android)

Android continues to dominate the mobile OS market in China, with a market share of approximately 75% in 2023. Google’s Android OS is the go-to platform for most smartphone manufacturers in China, from budget devices to high-end flagship smartphones. Android’s flexibility, open-source nature, and vast ecosystem of apps make it a popular choice for Chinese consumers and manufacturers.

Google’s market value in China’s mobile OS market is estimated at ¥60 billion ($8.7 billion) in 2023. The OS remains the dominant platform, supported by its widespread adoption across multiple device manufacturers and its ability to meet the needs of consumers at various price points.

Android’s Key Strengths

- Open-source nature: Android’s open-source model allows manufacturers to customize the OS to meet the specific needs of their devices.

- Large app ecosystem: Android’s app store offers millions of applications, providing a wide range of options for consumers.

Apple (iOS)

Apple’s iOS holds the second-largest share of the Chinese mobile OS market, with a market share of approximately 20% in 2023. Although iOS is more expensive than Android, it continues to enjoy a strong brand following, especially among affluent consumers. Apple’s focus on premium smartphones, seamless ecosystem integration, and emphasis on privacy and security have contributed to its sustained success in China.

Apple’s market value in China’s mobile OS market is estimated at ¥18 billion ($2.6 billion) in 2023. While its market share is smaller than Android’s, Apple continues to hold a prominent position in the premium segment, with a loyal customer base that values quality and user experience.

iOS’s Key Strengths

- Brand loyalty: iOS users are highly loyal to the Apple ecosystem, making it a strong competitor despite its smaller market share.

- Seamless ecosystem: iOS is known for its smooth integration with other Apple products, such as iPads, Macs, and Apple Watches, providing a cohesive user experience.

Future Trends and Market Outlook

5G Adoption and Mobile OS Integration

As 5G technology continues to roll out in China, mobile OS developers are focusing on integrating 5G capabilities into their platforms. The faster speeds, lower latency, and increased capacity offered by 5G will drive demand for advanced mobile applications, gaming, and high-definition content. Mobile OS platforms will need to adapt to harness the full potential of 5G, enabling smoother, faster, and more responsive experiences for users.

Smart Cities and IoT Integration

The rise of smart cities and the Internet of Things (IoT) is another major trend in China, driving the development of mobile OS platforms that can work seamlessly across a range of connected devices. As the country focuses on building interconnected urban environments, mobile OS providers will need to enhance their systems to support smart devices, from smartphones and wearables to home automation systems and connected cars.

Localized Operating Systems

With the growth of domestic players like Huawei and the increasing focus on reducing dependence on foreign technologies, there is a trend toward developing localized operating systems that cater specifically to Chinese consumers. HarmonyOS is a key example of this trend, as it is designed to work across a wide range of devices and is fully tailored to the Chinese market.

The Chinese mobile OS market is characterized by fierce competition between global giants like Android and iOS and emerging players like HarmonyOS. As consumer preferences evolve and technological advancements such as 5G and IoT drive demand for more integrated platforms, the mobile OS market in China will continue to experience rapid growth and innovation. The next few years will be critical in determining how the market shapes up, with new developments in mobile OS technology playing a pivotal role in this dynamic sector.