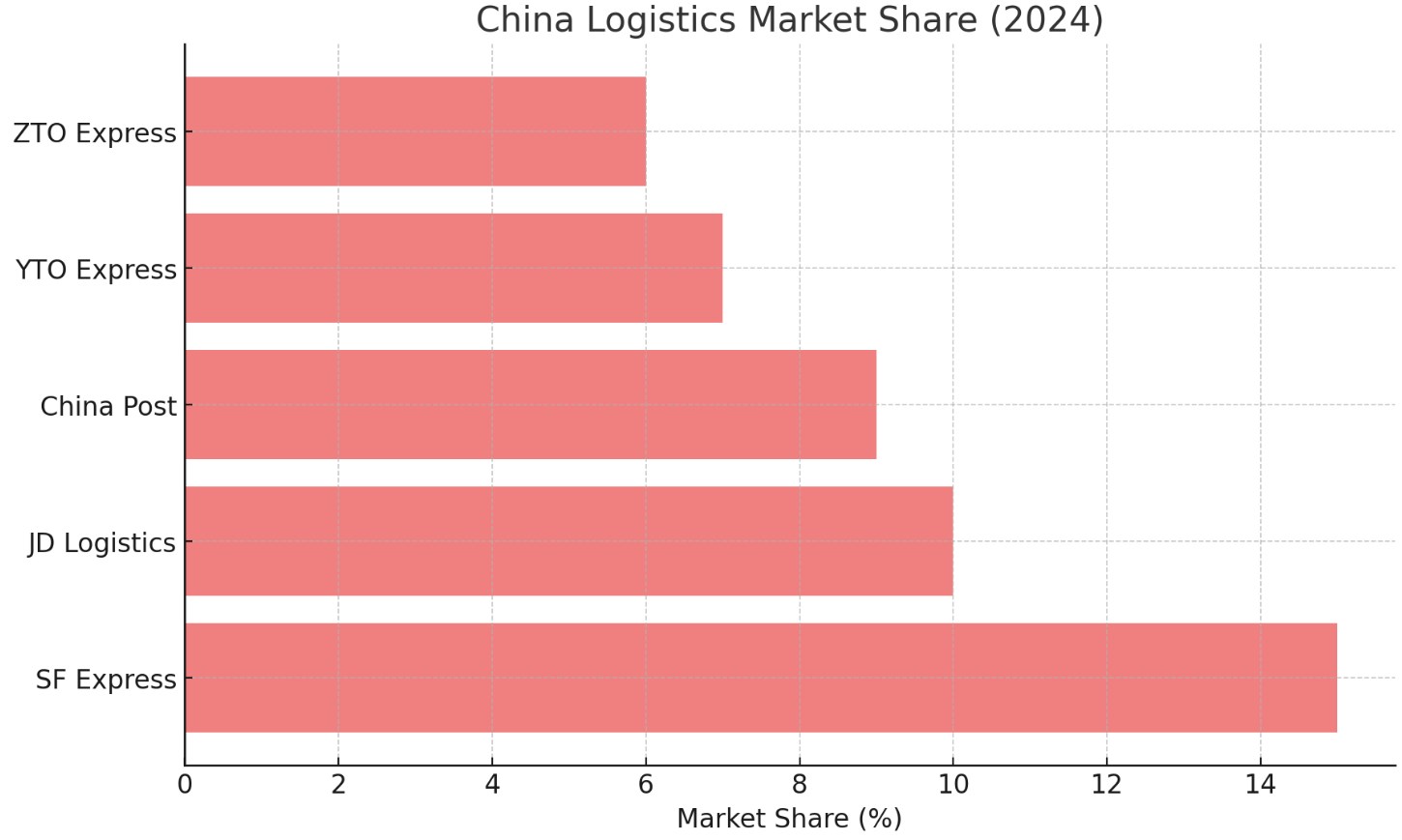

China Logistics Market Share

The logistics industry in China plays a crucial role in the country’s rapidly growing economy, providing the backbone for both domestic and international trade. With a market size projected to exceed USD 350 billion in 2024, China has become the largest logistics market in the world. The industry is expected to maintain robust growth, driven by the rise in e-commerce, the rapid expansion of infrastructure, and China’s position as the global hub for manufacturing, export, and import activities. The logistics sector in China encompasses a wide range of services, including transportation, warehousing, freight forwarding, and supply chain management, which are essential to the functioning of both domestic and global trade.

In recent years, China has invested heavily in its logistics infrastructure, building advanced transportation networks such as highways, railways, ports, and airports. This expansion, combined with the increasing demand for faster and more efficient logistics services, has led to the rise of new players and new service models, including the integration of technology and automation into logistics operations. The logistics market is becoming increasingly digitized, with companies focusing on improving efficiency, reducing costs, and enhancing customer service.

China’s logistics market is characterized by a combination of domestic giants and international companies, each vying for a share of the growing market. E-commerce companies, such as Alibaba and JD.com, have also entered the logistics space, further intensifying competition.

Major Players in the China Logistics Market

SF Express

Market Share and Position

SF Express is the largest and most dominant player in China’s logistics market, with an estimated market share of 15% in 2024. The company’s market value in the logistics sector is expected to exceed USD 50 billion in 2024, driven by its extensive network, strong brand recognition, and commitment to fast delivery services. SF Express primarily focuses on express delivery and freight forwarding, catering to both e-commerce and business customers. The company has built an impressive reputation for reliability and speed, which has helped it dominate the domestic market.

SF Express operates one of the largest logistics networks in China, with a combination of air, ground, and rail transportation. The company also has a significant presence in the international logistics market, offering global delivery services to customers in over 200 countries. SF Express has expanded its services beyond traditional logistics by integrating technology and automation into its operations, including robotics, artificial intelligence, and data analytics to improve efficiency and customer service.

Key Strategies and Innovations

- Integrated Logistics Solutions: SF Express offers a wide range of logistics services, including express delivery, freight forwarding, warehousing, and supply chain management, enabling the company to cater to various market segments.

- Technology and Automation: SF Express has invested heavily in automation and technology to improve operational efficiency. The company uses drones, robotics, and artificial intelligence in its sorting centers and delivery networks to accelerate the delivery process.

SF Express’s extensive service offerings, coupled with its focus on technology and customer experience, have allowed it to maintain its position as the leader in China’s logistics market.

JD Logistics

Market Share and Competitive Position

JD Logistics, a subsidiary of JD.com, holds a significant market share of around 10% in China’s logistics market in 2024. The company’s logistics division generates over USD 40 billion in revenue annually, driven by its highly efficient supply chain infrastructure and rapid growth in e-commerce logistics. JD Logistics primarily provides warehousing, transportation, and supply chain management services to JD.com’s e-commerce platform, but the company has also expanded its services to third-party businesses, making it a key player in China’s logistics sector.

JD Logistics is known for its advanced use of technology, particularly in automation and artificial intelligence, which has allowed it to streamline its operations and provide faster and more reliable services. The company operates an extensive network of fulfillment centers, sorting hubs, and warehouses across China, allowing it to deliver products quickly to customers. JD Logistics is also known for its strong last-mile delivery capabilities, leveraging its fleet of vehicles and drones to provide fast delivery services.

Key Strategies and Innovations

- Automation and Smart Warehousing: JD Logistics has invested in automated warehouses that use robots and drones to streamline operations, reduce costs, and improve delivery times.

- Third-Party Logistics: JD Logistics has expanded its services beyond its own platform by offering logistics solutions to third-party businesses, thereby increasing its revenue streams and market reach.

JD Logistics’ focus on technology, innovation, and supply chain optimization has helped the company become one of the largest players in the Chinese logistics market.

China Post

Market Share and Position

China Post is another dominant player in China’s logistics industry, particularly in the area of express delivery and postal services. As of 2024, China Post holds an estimated market share of approximately 9%, generating over USD 35 billion in revenue. The company operates under the direct supervision of the State Post Bureau of China and offers a broad range of logistics services, including parcel delivery, mail services, and international shipping.

China Post has the advantage of a vast delivery network that spans across the entire country, including remote and rural areas where other logistics companies may have limited reach. The company’s long-established infrastructure and government backing have allowed it to become a key player in China’s logistics market, particularly in the delivery of letters, small parcels, and packages for e-commerce businesses.

Key Strategies and Innovations

- Rural Delivery Network: China Post has leveraged its extensive rural network to provide last-mile delivery services in areas where other logistics companies may not be able to reach.

- International Expansion: China Post has invested in expanding its international logistics capabilities, offering cross-border shipping services to cater to China’s growing e-commerce export market.

China Post’s vast delivery network, along with its government backing, has helped it maintain a strong position in China’s logistics market, especially in underserved areas.

YTO Express

Market Share and Position

YTO Express is one of the leading players in China’s logistics and express delivery market, holding an estimated market share of around 7% in 2024. The company’s total revenue from logistics services in China is expected to surpass USD 15 billion in 2024. YTO Express offers a range of services, including express delivery, freight forwarding, and supply chain management, serving both businesses and consumers across China.

YTO Express has gained significant market share through its commitment to speed, reliability, and cost-effective services. The company operates an extensive network of transportation routes, distribution hubs, and warehouses across China, allowing it to provide fast and efficient delivery services. YTO Express is particularly popular among e-commerce businesses due to its ability to handle high-volume deliveries with flexibility and efficiency.

Key Strategies and Innovations

- Integrated Logistics Services: YTO Express provides a comprehensive range of logistics services, including express delivery, warehousing, and freight forwarding, enabling the company to meet the diverse needs of Chinese businesses.

- E-commerce Focus: YTO Express has focused on serving the growing e-commerce sector in China, offering flexible delivery options and fast service for online retailers.

YTO Express’s strong customer base, focus on cost-effectiveness, and ability to cater to e-commerce businesses have allowed it to remain one of the top players in China’s logistics market.

ZTO Express

Market Share and Position

ZTO Express is one of the largest express delivery companies in China, holding an estimated market share of around 6% in 2024. With annual revenue exceeding USD 10 billion, ZTO Express is a key player in China’s logistics sector, offering services such as express delivery, freight forwarding, and last-mile delivery. The company has established a strong market presence through its large fleet of vehicles, extensive distribution network, and commitment to fast delivery times.

ZTO Express is known for its high efficiency and technology-driven operations, including its use of artificial intelligence and automated sorting systems to optimize delivery routes and improve performance. The company’s ability to provide reliable and cost-effective services has made it a popular choice for e-commerce businesses and consumers alike.

Key Strategies and Innovations

- AI and Automation: ZTO Express has invested in artificial intelligence and automated systems to optimize its operations, reduce costs, and improve delivery speeds.

- Focus on E-commerce: Like other major players in China’s logistics market, ZTO Express has focused heavily on serving the e-commerce sector, providing tailored logistics solutions for online retailers.

ZTO Express’s strong service offerings, technological innovation, and focus on the e-commerce sector have helped it maintain a prominent position in the Chinese logistics market.

Key Trends Shaping the Market

E-Commerce Growth and Demand for Last-Mile Delivery

The rapid growth of e-commerce in China has been a driving force behind the expansion of the logistics market. As online shopping continues to thrive, the demand for efficient, fast, and reliable delivery services has increased, particularly for last-mile delivery solutions. Companies like JD Logistics, SF Express, and ZTO Express have capitalized on this trend by investing in technology, expanding their fleets, and enhancing their last-mile delivery capabilities to meet the growing demand.

Integration of Technology in Logistics

The logistics industry in China has embraced technological advancements, such as automation, artificial intelligence, and big data, to improve efficiency and reduce costs. Companies like JD Logistics and SF Express are leveraging technology to automate warehousing operations, optimize delivery routes, and provide real-time tracking for customers. The use of robotics, drones, and AI-powered sorting systems has also become increasingly common in China’s logistics sector, improving speed and accuracy.

Sustainability and Green Logistics

With the increasing focus on sustainability, there has been a growing demand for green logistics solutions in China. Companies are focusing on reducing their carbon footprints by investing in electric vehicles, optimizing delivery routes to reduce fuel consumption, and exploring sustainable packaging solutions. This trend is particularly prominent among logistics providers that serve e-commerce companies, which are under increasing pressure to meet consumer demand for environmentally friendly practices.

Government Support and Policy Initiatives

The Chinese government has played a significant role in the development of the logistics market, with various policies aimed at improving infrastructure, reducing transportation costs, and promoting the adoption of new technologies. The government has invested heavily in the construction of transportation networks, including highways, railways, and ports, and has provided incentives for logistics companies to adopt automation and digital solutions. Additionally, government regulations related to environmental sustainability are encouraging logistics providers to adopt greener practices.

The logistics market in China continues to experience strong growth, with major players expanding their offerings, investing in technology, and adapting to changing consumer demands. The increasing reliance on e-commerce, technological innovations, and government support are all expected to drive further expansion in the sector, making it a key area for both domestic and international players in the years to come.