China LED Market Share

The LED (Light Emitting Diode) market in China is one of the largest and fastest-growing markets in the world. As the country rapidly urbanizes and becomes more environmentally conscious, the demand for energy-efficient lighting solutions has soared. LEDs are considered the next generation of lighting technology, offering significant advantages over traditional lighting sources like incandescent and fluorescent bulbs, such as longer lifespans, lower energy consumption, and enhanced performance.

In 2023, the Chinese LED market is valued at approximately ¥400 billion (around $58 billion) and is expected to continue expanding with an annual growth rate of 10-12%. China’s leadership in the global LED market is driven by various factors, including favorable government policies, increased domestic demand for energy-efficient solutions, and a rapidly expanding infrastructure sector. Moreover, with the growing adoption of LED technology in commercial, industrial, and residential applications, China is both the largest producer and consumer of LEDs in the world.

The LED market in China is highly competitive, with numerous companies involved in the design, production, and sale of LED components, modules, and lighting products. These companies include both domestic giants and international players who operate across various segments of the market, such as LED displays, automotive lighting, architectural lighting, and general illumination. Companies like Samsung, LG Electronics, and OSRAM are important players in the Chinese LED market, along with domestic leaders such as Cree, Sanan Optoelectronics, and Huacan Optoelectronics. These firms compete on factors such as product innovation, price, performance, and distribution channels.

Key Drivers of the Market

Energy Efficiency and Environmental Benefits

Energy efficiency is one of the most significant driving forces behind the growth of the LED market in China. As China continues to grapple with environmental challenges, the demand for energy-efficient products has grown. The Chinese government has prioritized sustainability and energy conservation through a series of policies that encourage the adoption of energy-efficient technologies across industries. This has led to the widespread replacement of older lighting technologies with more efficient LED lighting solutions.

LEDs consume up to 80% less energy than traditional incandescent bulbs, which has made them an attractive option for both residential and commercial applications. Moreover, the long lifespan of LEDs, which can last up to 25,000 hours or more, reduces the need for frequent replacements, further contributing to energy savings and lower carbon footprints. This energy efficiency, combined with the growing concerns about climate change and pollution, has helped propel the LED market in China.

Government Policies and Subsidies

The Chinese government has been instrumental in driving the growth of the LED market through favorable policies and subsidies. In recent years, China has implemented several initiatives to promote energy-efficient technologies, including tax incentives for LED manufacturers, subsidies for consumers to adopt LED lighting products, and government-led programs to replace traditional lighting with LEDs in public spaces and infrastructure projects.

The government’s “Made in China 2025” strategy, which focuses on advancing technology and manufacturing innovation, has helped promote the development of the LED industry. Additionally, the government has set ambitious energy reduction targets, which include the widespread adoption of energy-efficient lighting systems like LEDs across both urban and rural areas. These policies, along with strong public and private sector investment, have created an environment where the LED market can continue to thrive.

Growing Infrastructure and Urbanization

China’s rapid urbanization and infrastructure development are key drivers of the LED market. As cities continue to expand and modernize, there is a growing need for more efficient lighting systems for street lighting, public transportation, commercial buildings, and residential complexes. The demand for high-quality, long-lasting, and energy-efficient lighting solutions has led to an increase in the adoption of LED technologies for urban and infrastructure projects.

The Chinese government has also launched various smart city initiatives, which include the implementation of LED-based street lighting systems that are connected to the Internet of Things (IoT) for better energy management. As smart cities become more prevalent, the demand for advanced LED lighting solutions will continue to grow, driving market expansion.

Major Segments in the LED Market

LED Display Panels

One of the fastest-growing segments of the LED market in China is the LED display panel market, driven by the rising demand for large-format digital signage and advertising displays. The use of LED panels in both indoor and outdoor advertising is widespread in urban centers, shopping malls, airports, and stadiums, where they are used for advertising, entertainment, and information dissemination.

The Chinese LED display panel market was valued at approximately ¥100 billion ($14.5 billion) in 2023 and is projected to continue growing at a rate of 15-18% annually. LED display panels are preferred for their high brightness, energy efficiency, and ability to deliver sharp, high-resolution images. As demand for digital signage and advertising continues to rise, China’s LED display market is expected to experience significant growth in the coming years.

Automotive Lighting

The automotive lighting segment is another major contributor to China’s LED market. LED technology is increasingly being used in vehicle lighting systems, including headlights, taillights, indicator lights, and interior lighting. The adoption of LEDs in the automotive sector is driven by their energy efficiency, compact size, long lifespan, and ability to produce brighter and more uniform light.

China is the world’s largest automobile market, and the increasing demand for electric vehicles (EVs) has further fueled the growth of LED lighting in the automotive industry. LED headlights, in particular, are preferred for their superior illumination, low power consumption, and ability to improve vehicle safety by providing better road visibility. The automotive LED lighting market in China is valued at around ¥80 billion ($11.5 billion) in 2023 and is projected to continue growing as automakers adopt LEDs for their new vehicle models.

General Lighting

General lighting is the largest segment of the LED market in China, encompassing both residential and commercial lighting applications. The shift toward LED-based lighting solutions in homes, offices, shopping centers, and industrial facilities is driven by the energy-saving potential of LEDs, which are more efficient and longer-lasting than traditional lighting solutions.

The general lighting segment is expected to continue its growth trajectory, with LEDs replacing incandescent and fluorescent lighting in a wide range of applications. In 2023, the general lighting segment in China is valued at approximately ¥200 billion ($29 billion), and it is projected to account for a significant portion of the overall LED market. As consumer awareness of the environmental and financial benefits of LED lighting continues to grow, demand for LED-based general lighting solutions is expected to rise.

LED Components and Modules

The LED components and modules segment includes the individual components used to build LED lighting systems, such as chips, drivers, and controllers. This segment is crucial to the overall LED market, as the quality and performance of LED lighting systems depend on the components used to manufacture them.

The LED components and modules market in China is valued at approximately ¥70 billion ($10 billion) in 2023. This segment is experiencing strong growth due to the increasing demand for high-performance LED lighting systems, particularly in applications like automotive lighting, commercial lighting, and industrial lighting. As China continues to invest in technology development and the production of advanced LED components, this segment will remain a vital part of the country’s LED market.

Major Players in the Chinese LED Market

Sanan Optoelectronics

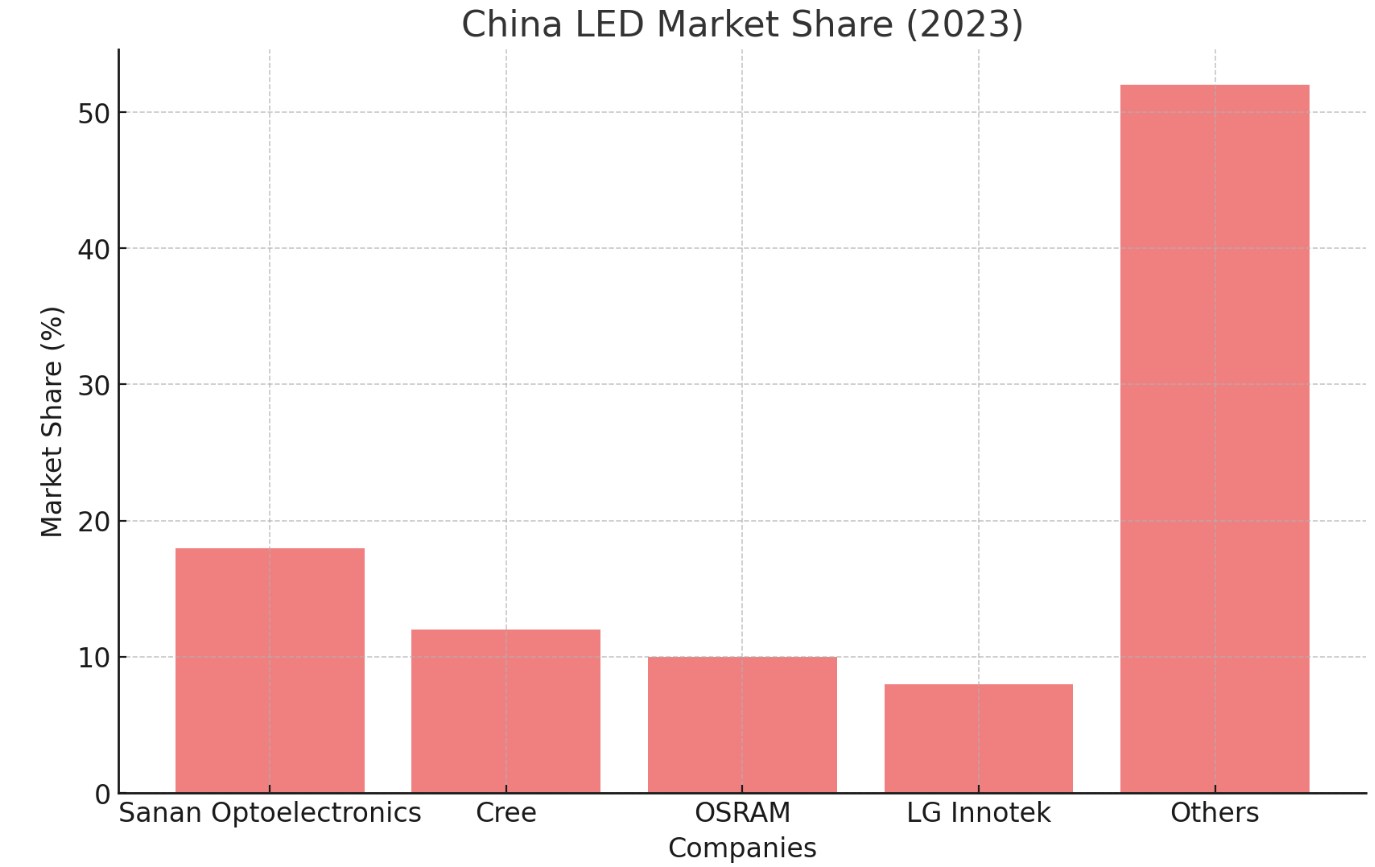

Sanan Optoelectronics is one of the largest domestic players in China’s LED market, with a market share of around 18% in 2023. The company is a leading manufacturer of LED chips, modules, and lighting products, and its products are widely used in general lighting, automotive lighting, and display panels. Sanan Optoelectronics has built a strong reputation for its innovative technology, high-quality products, and large-scale production capacity.

Sanan Optoelectronics has a robust global presence, exporting its LED products to various regions, including North America, Europe, and Southeast Asia. The company’s market value is estimated at ¥50 billion ($7.2 billion) in 2023, and it continues to invest in research and development to maintain its leadership in the LED industry.

Sanan Optoelectronics’ Key Strengths

- Technological innovation: Sanan invests heavily in R&D, focusing on improving the efficiency and performance of its LED products.

- Global presence: The company’s international expansion and strong distribution network have helped it capture a significant share of the global LED market.

Cree

Cree is a major player in the global LED market, with a significant presence in China’s LED sector. The company focuses on the development and production of high-performance LED chips, components, and lighting solutions. Cree has been a pioneer in the LED industry, known for its innovative products that deliver exceptional brightness, efficiency, and reliability.

Cree holds an estimated market share of 12% in China’s LED market in 2023. The company’s commitment to sustainable lighting solutions, along with its reputation for technological leadership, has allowed it to remain a key competitor in China’s highly competitive LED market. Cree’s market value in China is estimated to be ¥25 billion ($3.6 billion) in 2023.

Cree’s Key Strengths

- Focus on high-performance LEDs: Cree is known for its cutting-edge LED products that offer superior performance and energy efficiency.

- Sustainability focus: The company is committed to providing environmentally friendly lighting solutions, which align with China’s green energy goals.

OSRAM

OSRAM, a global leader in lighting solutions, has a strong presence in China’s LED market, where it competes in the general lighting, automotive lighting, and industrial lighting segments. The company is known for its high-quality LED chips, modules, and systems that are used in various applications, from street lighting to automotive headlights.

OSRAM holds a market share of approximately 10% in China’s LED market in 2023. The company’s market value is estimated at ¥18 billion ($2.6 billion) in 2023. OSRAM has been focusing on expanding its product portfolio to include smart lighting solutions and connected devices, which align with the growing demand for smart homes and cities.

OSRAM’s Key Strengths

- Comprehensive product portfolio: OSRAM offers a wide range of LED solutions, from chips to complete lighting systems, making it a versatile player in the market.

- Focus on smart lighting: The company is investing in smart and connected lighting technologies to meet the growing demand for IoT-based lighting systems.

LG Innotek

LG Innotek, a subsidiary of LG Electronics, is a significant player in China’s LED market, known for its high-quality LED components used in general lighting, automotive lighting, and display technologies. The company has been expanding its LED product offerings and is focused on developing innovative solutions that deliver improved efficiency and performance.

LG Innotek holds a market share of around 8% in China’s LED market in 2023. The company is valued at ¥15 billion ($2.2 billion) in 2023 and continues to innovate by introducing new technologies such as micro-LEDs and organic LEDs (OLEDs) for various applications.

LG Innotek’s Key Strengths

- Strong backing from LG Electronics: LG Innotek benefits from the global reach and technological expertise of its parent company.

- Innovation in advanced lighting technologies: The company is focusing on developing next-generation lighting technologies, including micro-LED and OLED.

Market Trends and Future Outlook

Rise of Smart Lighting

Smart lighting systems, which use LED technology combined with wireless connectivity and sensors, are gaining popularity in China. As the demand for smart homes and cities increases, the need for intelligent, energy-efficient lighting solutions is expected to rise. Smart lighting systems allow users to control lighting remotely, adjust brightness, and automate lighting schedules, offering both convenience and energy savings.

Adoption of 5G and IoT in Lighting

The integration of 5G and IoT technologies with LED lighting systems is an emerging trend in China. 5G technology promises to enable faster communication between lighting systems and other smart devices, making it easier to create interconnected smart cities. This technology is expected to further drive the demand for energy-efficient, connected LED lighting solutions.

Continued Focus on Sustainability

As China continues to prioritize environmental sustainability, the demand for energy-efficient and eco-friendly lighting solutions will continue to grow. LED lighting, with its lower energy consumption and longer lifespan, aligns with China’s green energy goals and will remain a central component of the country’s energy strategy.

The LED market in China is experiencing significant growth, driven by the increasing demand for energy-efficient lighting, government policies promoting sustainability, and the rise of smart technologies. With major players like Sanan Optoelectronics, Cree, and OSRAM leading the way, China is poised to remain a dominant force in the global LED industry.