China Insurance Market Share

China’s insurance market is one of the largest and fastest-growing in the world. With a market size projected to reach over USD 700 billion in 2024, the country has become a key player in the global insurance industry. China’s insurance market has experienced rapid development over the past two decades, driven by economic growth, urbanization, rising disposable incomes, and increasing awareness of the need for financial protection. The market encompasses a wide variety of products, including life insurance, health insurance, property and casualty insurance, and annuities.

The Chinese government has also played a critical role in the development of the insurance industry by introducing regulatory reforms, supporting the creation of an insurance safety net, and promoting financial inclusion. At the same time, the market remains highly competitive, with both domestic and international players vying for market share. Domestic companies, with their deep understanding of local needs, have maintained a strong foothold in the market, while foreign insurers are leveraging partnerships, joint ventures, and innovations to expand their presence in this lucrative sector.

Major Players in the Chinese Insurance Market

China Life Insurance Company

Market Share and Position

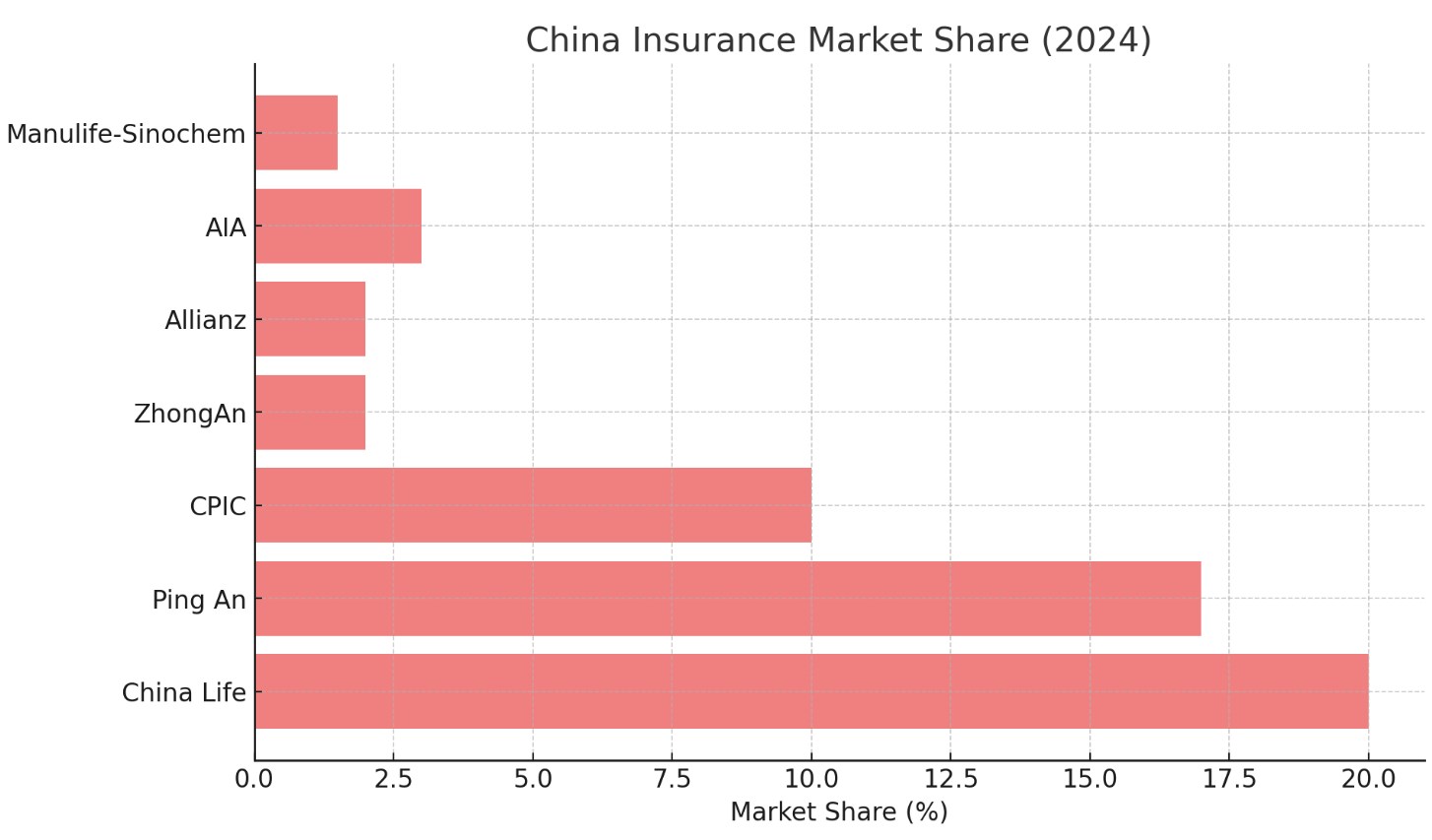

China Life Insurance Company is the largest player in China’s life insurance market and one of the largest life insurers globally. In 2024, the company holds an estimated market share of around 20%, with revenues exceeding USD 80 billion. As the dominant life insurer in China, China Life Insurance has maintained its leadership position due to its extensive network of distribution channels, strong brand recognition, and comprehensive product offerings. The company provides a wide range of life insurance products, including individual and group policies, pension plans, annuities, and health insurance.

China Life is heavily focused on providing long-term insurance solutions, which have been popular due to the country’s aging population and rising awareness of the need for retirement and health planning. Additionally, the company has made significant strides in leveraging technology to enhance its customer experience. It has integrated digital tools, such as mobile apps and online platforms, allowing customers to easily purchase and manage their insurance policies.

Key Strategies and Innovations

- Extensive Distribution Network: China Life has developed a vast distribution network that spans across China, with a mix of agency forces, brokers, and digital channels. The company’s extensive network allows it to reach customers in both urban and rural areas.

- Digital Transformation: China Life has embraced digital tools, including mobile applications and online insurance services, to improve customer engagement and streamline the policy purchase and management process.

China Life continues to leverage its established infrastructure and market expertise to maintain its dominant position in the Chinese life insurance sector.

Ping An Insurance

Market Share and Competitive Position

Ping An Insurance is one of the largest and most diversified insurance companies in China, with a strong presence in both the life and property and casualty insurance sectors. In 2024, Ping An holds an estimated 17% share of the total insurance market in China, with revenues reaching approximately USD 70 billion. The company’s diversification into banking, asset management, and fintech has enabled it to develop a more comprehensive financial services ecosystem, which in turn has bolstered its insurance business.

Ping An is known for its innovative approach to insurance, combining technology with traditional insurance services. It was one of the first companies in China to invest heavily in artificial intelligence, big data, and blockchain technology, making it a leader in the digital transformation of the insurance industry. The company’s robust online platforms allow consumers to access a wide variety of insurance products and manage their policies seamlessly.

Key Strategies and Innovations

- Technology Integration: Ping An’s commitment to technology has led to the creation of a vast ecosystem, integrating health, banking, insurance, and asset management services, all accessible through digital platforms. This has made insurance services more convenient and accessible to consumers.

- Focus on Customer-Centric Services: The company has placed a significant focus on improving customer experience by using data and technology to personalize insurance products and services. This customer-centric approach has helped Ping An differentiate itself from competitors.

Ping An’s continued success is tied to its ability to leverage its technological capabilities and expand its financial services footprint, positioning itself as one of China’s most innovative insurance companies.

China Pacific Insurance (Group) Co., Ltd. (CPIC)

Market Share and Position

China Pacific Insurance (CPIC) is another major player in China’s insurance market, ranking among the top five insurance companies in the country. In 2024, CPIC holds an estimated market share of 10%, with annual revenues of around USD 40 billion. The company is primarily focused on life insurance, but it also has a significant presence in the property and casualty insurance market. CPIC offers a variety of products, including health insurance, life insurance, auto insurance, and accident insurance.

CPIC has managed to maintain its competitive position through strong brand recognition and a focus on customer service. The company has expanded its footprint across China by tapping into both traditional and digital distribution channels. CPIC has also focused on improving its technological infrastructure to enhance efficiency and customer satisfaction, which has become increasingly important in China’s fast-paced insurance market.

Key Strategies and Innovations

- Diversified Product Offering: CPIC provides a wide range of insurance products, from life insurance to health and property insurance, allowing it to cater to a broad spectrum of customer needs.

- Investment in Technology: The company has increasingly focused on improving its digital capabilities, including enhancing its mobile app and launching online platforms for purchasing and managing policies.

CPIC’s strategic focus on technology and customer service has helped it maintain a strong presence in China’s highly competitive insurance market.

ZhongAn Online P&C Insurance

Market Share and Position

ZhongAn Online P&C Insurance is China’s leading online property and casualty insurer. In 2024, the company holds an estimated market share of approximately 2%, with revenues of over USD 2 billion. ZhongAn is unique in that it operates entirely online, without a traditional physical network of agents or brokers. The company was founded in 2013 as a joint venture between Alibaba, Tencent, and Ping An, leveraging the digital expertise of its parent companies.

ZhongAn offers a variety of insurance products, including auto insurance, health insurance, travel insurance, and small-ticket personal property insurance. The company’s online-only model allows it to provide competitive pricing and simplified insurance products that are easy for consumers to purchase and manage. ZhongAn has also developed several innovative offerings, such as micro-insurance products and usage-based insurance, which appeal to the younger, tech-savvy population in China.

Key Strategies and Innovations

- Digital-First Model: ZhongAn’s focus on an online-only platform allows it to streamline operations and reduce overhead costs, enabling the company to offer competitive pricing on a wide variety of insurance products.

- Innovative Insurance Products: The company has developed micro-insurance products that cater to specific customer needs, such as insurance for online shopping or short-term travel.

ZhongAn’s online-first model and focus on innovation make it a standout player in the Chinese property and casualty insurance market, appealing to consumers seeking convenience and affordability.

Allianz China Life Insurance Co., Ltd.

Market Share and Position

Allianz is a global insurance company that has made significant inroads into the Chinese market in recent years. With a market share of approximately 2% in 2024, Allianz China Life Insurance has established a strong presence in the life insurance sector. The company offers a broad range of life insurance products, including term life insurance, health insurance, and annuities, catering primarily to the middle and high-income segments of the market.

Allianz’s success in China can be attributed to its global reputation, local partnerships, and its focus on offering comprehensive, high-quality insurance products that meet the needs of Chinese consumers. The company has focused on expanding its distribution channels through partnerships with local companies and by increasingly using digital platforms to make insurance products more accessible to a larger audience.

Key Strategies and Innovations

- Partnerships with Local Insurers: Allianz has partnered with domestic insurers to leverage their local market knowledge and distribution networks, helping the company expand its presence in China.

- Focus on High-Quality Products: Allianz has focused on offering premium, tailored insurance products designed to meet the specific needs of China’s affluent middle class.

Allianz’s reputation for providing high-quality insurance products and its partnerships with local players have allowed it to effectively grow its footprint in China’s competitive insurance market.

Other Key Players

AIA Group

AIA Group is one of Asia’s largest life insurance companies, with a growing presence in the Chinese insurance market. AIA holds a market share of around 3% in China, with annual revenues surpassing USD 5 billion. The company primarily focuses on life and health insurance and has made significant strides in expanding its operations in China through joint ventures and partnerships with local firms. AIA’s focus on providing long-term insurance solutions has allowed it to cater to China’s growing middle class, particularly in major urban centers.

Manulife-Sinochem

Manulife-Sinochem is a joint venture between the Canadian insurance giant Manulife and the Chinese Sinochem Group. The company offers a wide range of life and health insurance products and has a market share of around 1.5% in 2024. The company has made significant progress in China’s insurance sector, focusing on wealth management and pension solutions, two areas that are experiencing increased demand due to China’s aging population.

Key Trends Shaping the Market

Digital Transformation and Online Insurance

The digital transformation of China’s insurance market has been one of the most significant trends in recent years. Consumers increasingly expect the convenience of online shopping for insurance, with many insurers investing heavily in digital platforms to streamline the customer experience. Companies like ZhongAn Online, Ping An, and Allianz have been at the forefront of this trend, offering easy-to-use mobile apps and online insurance purchasing tools. These digital platforms have made it easier for consumers to purchase insurance, file claims, and manage policies, contributing to the rapid growth of online insurance sales.

Growing Demand for Health and Life Insurance

As China’s population ages and the middle class continues to expand, there has been a marked increase in demand for health and life insurance products. The government has supported this shift by expanding social insurance programs and introducing regulations that encourage the purchase of private health insurance. This trend has driven growth in both life and health insurance segments, with companies such as China Life, Ping An, and Allianz capitalizing on this opportunity by offering comprehensive health insurance policies and long-term savings products.

Regulatory Changes and Market Consolidation

The Chinese government has introduced several regulatory reforms to enhance the stability and efficiency of the insurance market. These reforms include tighter capital requirements for insurers, increased transparency, and improved consumer protection. At the same time, there has been a trend toward market consolidation, with larger companies acquiring smaller players to increase market share and diversify their product offerings.

These regulatory changes are expected to shape the future of China’s insurance market, ensuring greater stability and consumer confidence. The impact of these regulations will be felt across the entire industry, influencing the strategies of both domestic and international players in the market.