China Industrial Robot Market Share

The industrial robot market in China has grown at an unprecedented rate, transforming the manufacturing landscape and becoming one of the leading sectors in the global robotics industry. By 2024, China’s industrial robot market is expected to reach a market size of USD 11.5 billion, making it the largest industrial robotics market in the world. This growth is driven by the rapid industrialization of the Chinese economy, technological advancements, and the country’s shift towards automation and smart manufacturing as part of its broader economic modernization strategy.

China’s industrial robotics sector has witnessed a steady increase in the adoption of robots in sectors such as automotive manufacturing, electronics, metalworking, logistics, and food processing. This expansion has been fueled by the increasing demand for automation to improve production efficiency, enhance product quality, and meet labor shortages. Additionally, government initiatives, such as the “Made in China 2025” plan, have provided significant incentives for businesses to adopt automation technologies, further driving the demand for industrial robots.

As China continues to embrace automation in its industries, the competition in the robotics market has become fierce, with both domestic and international players striving for market share. China’s industrial robot market is marked by the dominance of local companies, although international brands also hold a significant share, especially in high-end robots for complex tasks.

Major Players in the Chinese Industrial Robot Market

ABB

Market Share and Competitive Position

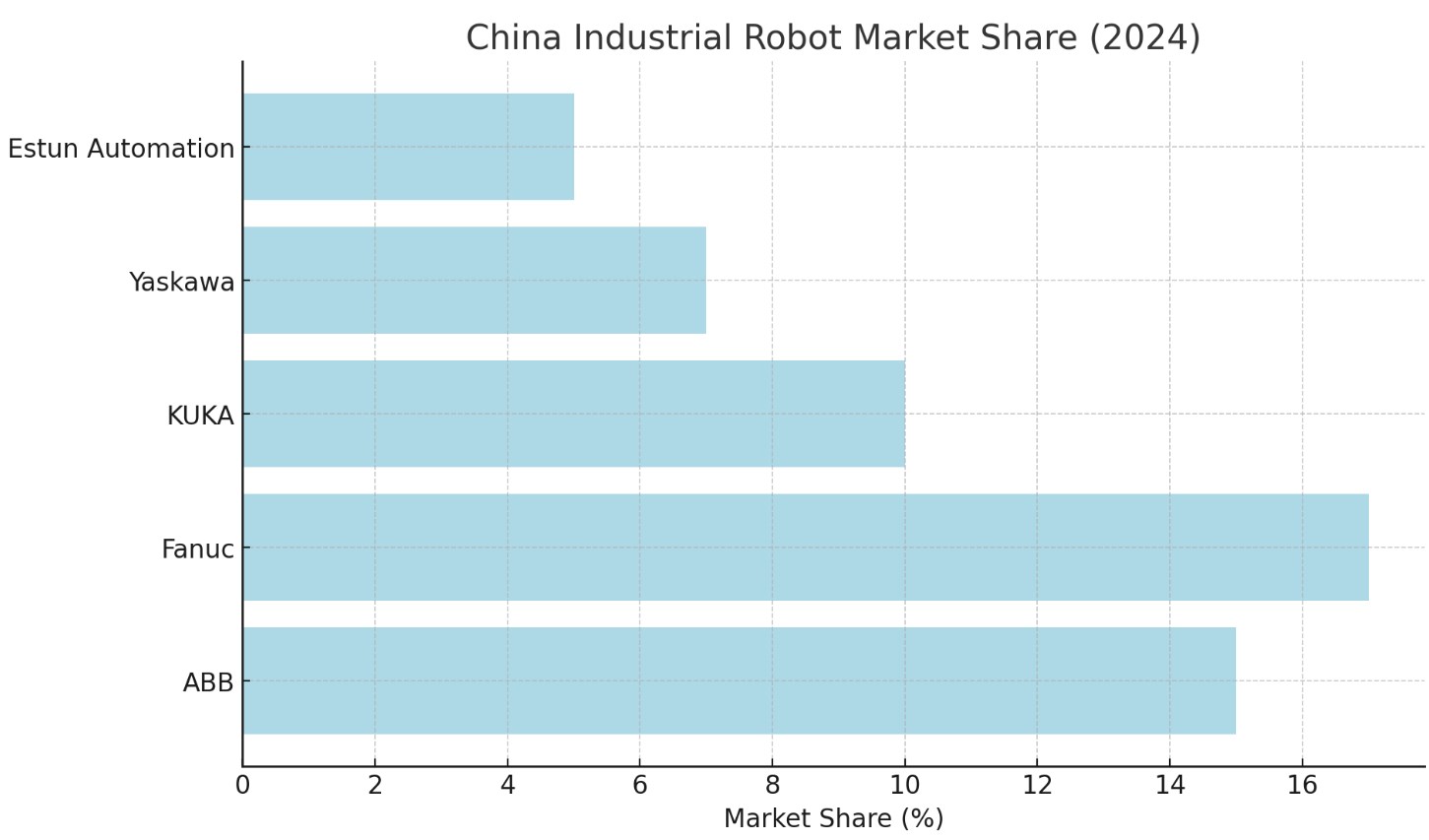

ABB, a Swiss multinational corporation, has established itself as one of the leading players in China’s industrial robot market. As of 2024, ABB holds an estimated market share of around 15%, with annual revenues exceeding USD 1.7 billion from its robotics division in China. The company’s success in China is attributed to its strong brand presence, cutting-edge robotic solutions, and deep understanding of the local manufacturing environment. ABB is particularly well-regarded for its high-performance industrial robots used in automotive manufacturing, electronics assembly, and metalworking industries.

ABB’s robots are known for their precision, flexibility, and reliability, and the company has been a pioneer in developing advanced collaborative robots (cobots) that work safely alongside human operators. These cobots are becoming increasingly popular in sectors that require a mix of human intelligence and robotic efficiency. ABB’s long-standing relationships with major Chinese manufacturers, particularly in the automotive sector, have helped the company maintain a strong foothold in the market.

Key Strategies and Innovations

- Collaborative Robots: ABB has placed a significant focus on the development of cobots, which have become a major part of its portfolio. These robots are designed to work closely with human operators, enhancing productivity while maintaining safety standards.

- Localized Manufacturing: To meet the growing demand for robots in China, ABB has invested in local production facilities, ensuring that its robots are tailored to the specific needs of Chinese industries. This also helps reduce costs and improve delivery times.

ABB’s success in China’s industrial robot market can be attributed to its focus on technological innovation, collaborative robotics, and its strong local partnerships that continue to drive growth in the country.

Fanuc

Market Share and Competitive Position

Fanuc, a Japanese company, is one of the dominant players in China’s industrial robot market. In 2024, Fanuc holds an estimated market share of approximately 17%, making it one of the largest providers of industrial robots in China. Fanuc has made significant strides in the country, benefiting from its extensive product range, strong brand reputation, and decades of experience in the automation industry. With a focus on high-quality, reliable, and energy-efficient robots, Fanuc is a key player in sectors like automotive manufacturing, electronics, and packaging.

Fanuc’s robots are widely used in China’s manufacturing sector for tasks such as assembly, welding, painting, and packaging. The company is particularly strong in the automotive industry, where its robots are used for precision tasks in production lines. Fanuc has also been a leader in promoting the use of collaborative robots in manufacturing, enabling businesses to introduce automation without completely replacing human workers.

Key Strategies and Innovations

- Product Diversification: Fanuc offers a wide range of robotic solutions, including articulated robots, delta robots, and collaborative robots, catering to different applications across industries.

- Service and Maintenance: Fanuc provides comprehensive after-sales services, including training, maintenance, and troubleshooting, ensuring that its customers have access to full lifecycle support for their robotic systems.

Fanuc’s continued success in China’s industrial robot market is driven by its commitment to delivering high-performance, customizable robotic solutions and its ability to serve a wide variety of industries.

KUKA Robotics

Market Share and Competitive Position

KUKA Robotics, based in Germany, is one of the key players in China’s industrial robot market, with an estimated market share of 10% in 2024. KUKA is known for its innovative robotic solutions, which are used in various sectors such as automotive manufacturing, electronics, and logistics. The company’s robots are recognized for their precision, flexibility, and ability to perform complex tasks, which has made them highly popular among China’s leading manufacturers.

KUKA has been successful in China due to its advanced technologies, particularly in the areas of robotics for automation in the automotive and electronics sectors. The company has built a strong reputation by providing robotic solutions for precision welding, material handling, and assembly. Additionally, KUKA has focused on integrating robotics with artificial intelligence (AI) to provide smart automation solutions for Chinese industries.

Key Strategies and Innovations

- AI Integration: KUKA has developed robotic systems that are integrated with AI to enhance the robots’ ability to learn and adapt to complex tasks. This integration allows businesses to implement more flexible and scalable automation systems.

- Collaborative Robots: Like other leading players in the market, KUKA has embraced the growing demand for collaborative robots, enabling human workers to collaborate with robots in a safe and efficient manner.

KUKA’s strong focus on technology innovation and its ability to adapt its products to meet the needs of various industries has helped the company secure a significant market share in China.

Yaskawa Electric Corporation

Market Share and Competitive Position

Yaskawa Electric Corporation, another leading Japanese company, has a notable presence in China’s industrial robot market. In 2024, Yaskawa holds a market share of approximately 7%. The company’s robots are widely used in industries such as automotive manufacturing, electronics, food and beverage, and logistics. Yaskawa is well-regarded for its high-performance robots that excel in tasks such as assembly, welding, and painting.

Yaskawa has differentiated itself by offering cost-effective robotic solutions that are reliable and easy to integrate into existing manufacturing systems. The company has also developed robots that are compatible with various industrial automation systems, allowing for greater flexibility in their applications. Yaskawa’s strong distribution network and focus on local manufacturing have helped it increase its market share in China.

Key Strategies and Innovations

- Cost-Effective Solutions: Yaskawa has focused on developing affordable robotic solutions that cater to small and medium-sized enterprises (SMEs) in China. This strategy has enabled the company to tap into the growing demand for automation in non-traditional sectors.

- Strong Distribution Network: Yaskawa has established a robust distribution and service network across China, ensuring that its customers have easy access to support and maintenance services.

Yaskawa’s focus on delivering cost-effective and high-quality robotic solutions, along with its strong local presence, has helped the company maintain a competitive position in China’s industrial robot market.

Estun Automation

Market Share and Position

Estun Automation, a domestic Chinese company, has emerged as a significant player in the industrial robot market, holding an estimated market share of approximately 5% in 2024. Estun is known for its focus on developing high-quality robots for industries such as automotive manufacturing, electronics, and packaging. The company has capitalized on China’s growing demand for automation by offering robots that are tailored to the specific needs of local industries.

Estun’s success can be attributed to its ability to combine technological innovation with cost efficiency. As a domestic player, Estun benefits from a deep understanding of local manufacturing processes and customer requirements. Additionally, the company’s ability to offer competitive pricing on its robotic systems has made it a popular choice for Chinese manufacturers looking to implement automation without significantly increasing costs.

Key Strategies and Innovations

- Customization for Local Needs: Estun offers customizable robotic solutions designed specifically for Chinese manufacturers, allowing them to achieve greater efficiency and cost-effectiveness in their production processes.

- Robotic Systems Integration: The company focuses on providing complete robotic systems that include robotic arms, vision systems, and controllers, making it easier for manufacturers to implement automated solutions in their production lines.

Estun’s ability to offer tailored solutions at competitive prices, combined with its focus on innovation, has helped it gain a significant share of China’s industrial robot market.

Key Trends Shaping the Market

Increased Adoption of Collaborative Robots

Collaborative robots (cobots) have become a significant trend in China’s industrial robot market. These robots are designed to work alongside human operators, enhancing productivity and safety. The demand for cobots has been driven by the increasing need for flexibility in production lines, where robots can perform repetitive tasks while humans focus on complex or value-added work. Companies like ABB, KUKA, and Fanuc have been at the forefront of this trend, developing robots that are safe, easy to program, and adaptable to various tasks.

Integration of Artificial Intelligence (AI) and Automation

The integration of AI with industrial robots has been another key trend shaping the market. AI allows robots to learn from data and improve their performance over time, enabling more advanced and flexible automation systems. AI-powered robots can be used in a variety of applications, from predictive maintenance and quality control to more sophisticated tasks like assembly and inspection. As industries in China continue to modernize, the demand for AI-integrated robots is expected to grow significantly, with companies like KUKA and ABB leading the way in this field.

Government Initiatives and Industry Policies

The Chinese government has played a critical role in driving the adoption of industrial robots through initiatives like the “Made in China 2025” plan, which aims to increase the adoption of advanced technologies, including automation, in the manufacturing sector. The government’s support for automation, along with subsidies and incentives for companies that invest in robotics, has fueled the rapid growth of the industrial robot market. As a result, both domestic and international companies are expanding their presence in China to take advantage of these opportunities.

Industry-Specific Applications

The industrial robot market in China is becoming increasingly segmented, with robots being tailored to meet the needs of specific industries. For example, robots used in the automotive sector are designed to handle heavy-duty tasks such as welding, painting, and assembly, while robots in the electronics industry focus on precision assembly and testing. As the demand for robots in niche sectors like food processing, logistics, and pharmaceuticals grows, robot manufacturers are developing specialized solutions that cater to the unique requirements of these industries.

Cost Reduction and Increased Efficiency

As labor costs in China continue to rise, manufacturing companies are turning to automation to reduce costs and increase efficiency. Industrial robots help to minimize the need for manual labor in repetitive or dangerous tasks, allowing human workers to focus on more complex activities. This shift towards automation is expected to accelerate in the coming years, with robots becoming an integral part of China’s manufacturing landscape.

The combination of technological advancements, government support, and the rising demand for automation has driven the rapid growth of China’s industrial robot market. With both domestic and international companies investing heavily in the sector, China is expected to remain the world leader in industrial robotics for years to come.