China Grocery Market Share

The grocery market in China is one of the largest and most rapidly growing markets globally, fueled by increasing urbanization, rising incomes, and changing consumer preferences. With a market size that exceeds USD 1.1 trillion in 2024, China is not only a major player in the global grocery sector but also one of the most dynamic. The country’s grocery industry is characterized by its vast diversity, which spans from traditional wet markets to modern supermarkets, hypermarkets, and the increasingly popular e-commerce platforms.

In recent years, China has witnessed a shift in the grocery shopping behavior of its consumers. The rise of the middle class, combined with an aging population, has resulted in a growing demand for premium products, convenience, and healthier food options. The increasing penetration of digital technologies has also led to a boom in online grocery shopping, a trend accelerated by the COVID-19 pandemic. E-commerce platforms and delivery services have become integral to the grocery shopping experience in China, with online grocery sales estimated to account for more than 20% of the market share in 2024.

Additionally, the grocery market in China is increasingly influenced by both domestic and international players. Domestic retail giants have built extensive networks of supermarkets, hypermarkets, and convenience stores, while international chains have made significant inroads into the market, contributing to the intense competition. The regulatory landscape, government policies, and consumer preferences continue to shape the industry, making it crucial for both local and foreign companies to adapt and innovate to capture market share.

Major Players in the Chinese Grocery Market

Walmart

Market Share and Position

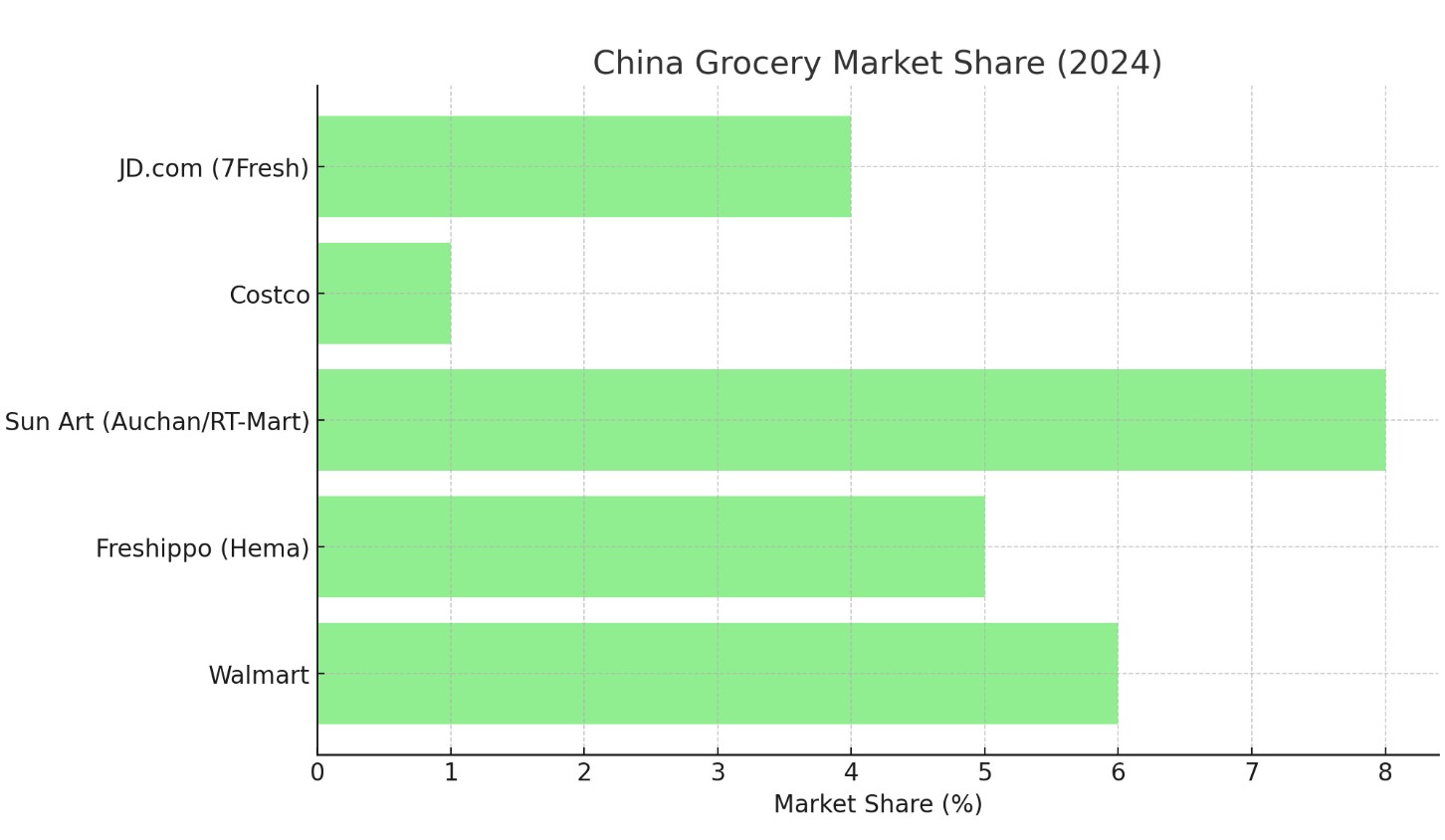

Walmart, the global retail giant, remains one of the leading players in China’s grocery market, with an estimated market share of around 6% in 2024. Despite facing intense competition from both local and international players, Walmart’s significant market share is a testament to its ability to adapt to the rapidly changing retail environment in China. Walmart operates a combination of hypermarkets and Sam’s Clubs across major cities, targeting both urban and suburban consumers. In 2024, Walmart’s annual revenue from its grocery operations in China is estimated to exceed USD 10 billion.

Walmart’s continued success in China is attributed to its well-established supply chain, its global reputation for low-cost products, and its ability to adapt to local tastes. In recent years, Walmart has placed significant emphasis on expanding its e-commerce operations, recognizing the growing importance of online grocery shopping. The company has partnered with local e-commerce platforms, such as JD.com, to integrate its offline and online operations and expand its customer base.

Walmart has also made efforts to cater to the growing demand for health-conscious food options in China. The company has increased its offerings of organic and fresh products, catering to the rising consumer preference for healthier food choices. Additionally, Walmart has focused on improving its in-store shopping experience, with enhanced customer service and modernized stores to meet the needs of tech-savvy Chinese consumers.

Key Strategies and Innovations

- Expansion into Tier-2 and Tier-3 Cities: Walmart has focused on expanding its footprint beyond first-tier cities like Beijing and Shanghai, targeting smaller cities where growing middle-class populations offer new opportunities.

- E-Commerce Integration: By partnering with JD.com and focusing on its own online platforms, Walmart has effectively bridged the gap between traditional retail and e-commerce, making it easier for consumers to shop for groceries both online and offline.

Walmart’s strategy of combining its brick-and-mortar presence with e-commerce innovations has allowed it to capture a significant portion of the grocery market in China, especially as consumer preferences continue to evolve.

Alibaba’s Freshippo (Hema)

Market Share and Competitive Position

Alibaba’s Freshippo, also known as Hema, has emerged as a significant player in China’s grocery market, gaining traction with consumers through its combination of online and offline retailing. Freshippo holds an estimated market share of around 5% in 2024, with projected grocery revenue of approximately USD 7 billion. Hema’s innovative business model, which integrates e-commerce with physical retail stores, has disrupted the traditional grocery market in China, offering a unique shopping experience that blends the convenience of online shopping with the immediacy of in-store purchases.

The success of Hema can be attributed to its seamless integration of technology, which allows consumers to shop for groceries in-store or online using the Hema app. Hema stores also feature a unique layout, with fresh produce and food prepared on-site for consumers, creating an immersive shopping experience. The company has positioned itself as a premium grocery retailer, offering high-quality products, including organic produce, imported goods, and gourmet foods.

Hema’s business model, which emphasizes speed and convenience, has been well received by the urban, tech-savvy consumer base. In 2024, the company’s rapid expansion and focus on omnichannel retailing have made it one of the top players in China’s highly competitive grocery market.

Key Strategies and Innovations

- Omnichannel Retailing: Freshippo combines online shopping with physical stores, allowing consumers to order groceries through the app for home delivery or in-store pick-up, enhancing convenience.

- Fresh and Premium Offerings: Hema has focused on offering fresh, high-quality products and organic food, tapping into the increasing demand for premium and healthier groceries in China.

Hema’s ability to combine technology, fresh food offerings, and a superior shopping experience has enabled it to capture a growing share of the grocery market in China, especially among younger, more affluent consumers.

Sun Art Retail Group (Auchan and RT-Mart)

Market Share and Position

Sun Art Retail Group, a joint venture between the French retail giant Auchan and the Taiwanese conglomerate Ruentex, operates the Auchan and RT-Mart supermarket chains in China. As one of the largest grocery retailers in the country, Sun Art commands a market share of approximately 8% in 2024, with revenues from grocery operations expected to exceed USD 12 billion.

RT-Mart and Auchan cater to middle-income consumers across China’s first- and second-tier cities, offering a wide range of products, from fresh food to household goods. Sun Art’s large network of stores, which spans hundreds of locations across China, positions it as a formidable competitor in the grocery market. The company is also focusing on expanding its online grocery operations to cater to the growing trend of e-commerce in the country.

Sun Art’s grocery business is built on its ability to offer competitive prices, extensive product selection, and consistent quality. Additionally, the company has invested heavily in enhancing its in-store experience, offering promotions, loyalty programs, and improving customer service.

Key Strategies and Innovations

- Focus on Price and Value: Sun Art’s supermarkets cater to price-sensitive consumers, with a heavy emphasis on promotions, discounts, and value-for-money offerings.

- E-Commerce Expansion: As part of its strategy to keep pace with shifting consumer preferences, Sun Art is heavily investing in online grocery shopping, expanding its digital platforms and home delivery services.

Sun Art’s extensive reach and ability to adapt to consumer preferences have helped it retain a significant share of China’s grocery market, especially in the competitive mid-tier segment.

Costco

Market Share and Position

Costco, the American warehouse club chain, entered the Chinese market in 2019 and has since become one of the most notable international players in the country’s grocery sector. While Costco’s market share in China remains relatively small, estimated at around 1%, the company has seen significant growth since its entry, with annual revenues projected to exceed USD 1 billion in 2024. Costco’s model, which focuses on bulk purchasing and membership-based discounts, appeals to price-conscious Chinese consumers, particularly in cities like Shanghai and Beijing.

Costco’s success in China can be attributed to its strong value proposition, offering high-quality imported products at lower prices, and its ability to meet the needs of the growing middle class. The company’s focus on bulk purchasing and membership-based shopping also sets it apart from traditional supermarket chains, attracting consumers looking for value for money.

Costco’s continued growth in China is also supported by its ability to tap into the increasing demand for imported products, as many Chinese consumers perceive foreign brands as offering superior quality. The company’s ability to leverage its global supply chain and competitive pricing strategy has made it a notable player in the evolving grocery market.

Key Strategies and Innovations

- Bulk Purchasing and Membership: Costco’s business model is based on offering bulk goods at discounted prices, which is especially appealing to families and cost-conscious shoppers.

- Imported Products: The company has capitalized on the growing demand for foreign products in China, offering a variety of imported goods, including food and household items.

Costco’s focus on value, bulk purchasing, and premium imported products has enabled it to carve out a niche in China’s competitive grocery market, and it is expected to grow its presence in the coming years.

JD.com and 7Fresh

Market Share and Position

JD.com, one of China’s largest e-commerce platforms, has also entered the grocery market through its 7Fresh brand. 7Fresh operates a chain of high-end supermarkets in major cities, offering a wide range of fresh food, organic produce, and imported goods. As of 2024, JD.com’s grocery segment is estimated to have a market share of around 4%, with revenues exceeding USD 5 billion.

JD.com’s success in the grocery market can be attributed to its robust e-commerce platform, which enables consumers to order groceries online for home delivery or in-store pickup. JD.com has been quick to integrate new technologies such as AI and robotics into its operations, enabling it to optimize its supply chain and improve the customer shopping experience.

In addition to its online grocery offerings, 7Fresh stores are known for their high-quality products, premium offerings, and advanced in-store technology, which further enhances the shopping experience.

Key Strategies and Innovations

- E-Commerce and Delivery Integration: JD.com has seamlessly integrated online shopping and home delivery services, capitalizing on the growth of e-commerce in China.

- Focus on Fresh and Premium Offerings: 7Fresh stores focus on providing high-quality, fresh, and organic products to appeal to health-conscious Chinese consumers.

JD.com’s ability to leverage its existing e-commerce infrastructure to tap into the grocery market has enabled it to gain significant traction in China, making it one of the top players in the industry.

Key Trends Shaping the Market

E-Commerce Growth

The rapid rise of e-commerce has fundamentally transformed the grocery market in China. Online grocery shopping has become increasingly popular, especially among younger, urban consumers who value convenience and speed. Companies like Alibaba’s Freshippo, JD.com, and Walmart have embraced this trend by expanding their online platforms and offering home delivery services. As a result, e-commerce is expected to account for over 20% of China’s total grocery market by 2024.

Health and Premium Products

As disposable incomes rise, Chinese consumers are placing greater emphasis on health and wellness. There is a growing demand for organic food, fresh produce, and premium grocery items. This trend is particularly evident in urban centers, where consumers are willing to pay more for high-quality, nutritious food options. Retailers are responding by increasing their range of organic products and health-conscious options, catering to the evolving preferences of Chinese shoppers.

Convenience and Technology Integration

Consumers in China are increasingly looking for convenience in their grocery shopping experience. Supermarkets and e-commerce platforms are responding by offering tech-driven solutions, such as mobile apps for ordering, automated checkouts, and AI-powered recommendations. In-store technologies, including digital price tags and automated fulfillment centers, are becoming more common, making it easier for consumers to shop and receive their groceries quickly.

The grocery market in China is evolving rapidly, with both traditional and online retail players adapting to changing consumer preferences and leveraging technology to enhance the shopping experience. With increasing competition, retailers must continue to innovate and meet the diverse needs of China’s vast and dynamic consumer base to capture market share.