China Footwear Market Share

The footwear market in China is one of the largest and most dynamic in the world, driven by a combination of factors such as growing urbanization, rising disposable incomes, increasing awareness of fashion trends, and the country’s large and diverse population. As one of the most important players in the global footwear industry, China has a huge domestic market for both domestic and international footwear brands, with a high demand across different footwear categories, including athletic shoes, casual wear, formal shoes, and sandals.

The Chinese footwear market was valued at approximately ¥400 billion ($58 billion) in 2023, and it is projected to continue growing at a compound annual growth rate (CAGR) of 6-7% over the next few years. This growth is driven by the increasing preference for fashion-forward footwear, the rise of online shopping, and the adoption of sustainable and technologically advanced shoe designs. Additionally, China’s strong manufacturing capabilities have positioned it as both the largest consumer and producer of footwear globally.

As China continues to modernize, more consumers are becoming aware of global footwear brands and their preferences are shifting toward higher quality, more fashionable, and technologically advanced footwear products. At the same time, domestic brands are making significant strides by improving their product offerings and distribution networks to capture larger shares of the market. This creates a competitive environment where both global brands and domestic players are vying for the attention of the Chinese consumer.

Key Drivers of the Market

Rising Disposable Income

One of the most important factors influencing the growth of the footwear market in China is the rising disposable income of the country’s population. Over the past few decades, China has experienced rapid economic growth, lifting millions of people into the middle class. With greater purchasing power, Chinese consumers are increasingly spending on non-essential products such as fashionable footwear. Footwear is no longer seen as a necessity but a way to express personal style, and this shift in perception has led to an increase in demand for both luxury and affordable footwear options.

Growing Urbanization

China’s rapid urbanization is another significant driver behind the footwear market. As millions of people move from rural areas to urban centers, there is a growing demand for footwear to match the lifestyle needs of urban dwellers. Cities like Beijing, Shanghai, Guangzhou, and Shenzhen have seen significant growth in the number of consumers who value fashion and brand recognition, leading to an uptick in demand for both international and domestic footwear brands. Urbanization also drives the need for comfortable and durable footwear for commuting, and this trend contributes to the growing popularity of sports and casual footwear.

E-commerce and Online Shopping

The rise of e-commerce and online shopping has further boosted the growth of the footwear market in China. Platforms such as Tmall, JD.com, and Taobao have become key channels for consumers to purchase shoes. Online shopping offers a wide selection of brands, sizes, and styles, allowing consumers to make more informed decisions from the comfort of their homes. Moreover, online shopping has made it easier for footwear brands to reach a wider audience, especially in smaller cities and rural areas. The rise of online reviews, influencer marketing, and social media campaigns also plays a role in driving footwear sales in China.

Footwear Market Segmentation

Athletic Footwear

Athletic footwear is one of the largest segments of the Chinese footwear market, reflecting the country’s growing interest in sports and fitness. The rise of health-consciousness, along with a growing number of fitness enthusiasts, has contributed to the increasing demand for performance-oriented footwear. Both global and domestic athletic brands are expanding their presence in China, capitalizing on the rising demand for high-performance shoes designed for running, walking, and other athletic activities.

The sportswear segment has seen steady growth due to increasing participation in activities such as jogging, basketball, and football. Popularity in fitness clubs, gyms, and outdoor sports like hiking has also contributed to the sales of athletic footwear. Moreover, with the rise of the “athleisure” trend, athletic shoes are not only worn for sports but also as part of casual fashion, further expanding the market.

Casual and Fashion Footwear

Casual and fashion footwear has become increasingly important in the Chinese footwear market. As the Chinese middle class continues to grow, consumers are becoming more interested in following global fashion trends, and this has influenced their footwear choices. The demand for stylish and comfortable casual shoes such as sneakers, flats, and slip-ons has surged in recent years.

With younger generations driving the demand for fashion-forward designs, brands that offer trendy and aesthetically pleasing footwear have found success in the Chinese market. Global brands like Nike, Adidas, and Converse, as well as domestic fashion-oriented brands, continue to cater to the growing appetite for stylish and versatile footwear.

Formal and Luxury Footwear

While athletic and casual footwear dominate the market, formal and luxury footwear have also seen steady demand in China. The growing number of wealthy individuals and the rise of disposable income in urban areas have fueled the demand for luxury footwear. International luxury brands such as Louis Vuitton, Gucci, and Prada have established strong market positions in China, where consumers are increasingly willing to pay premium prices for high-quality, designer shoes.

The formal footwear segment, which includes dress shoes, loafers, and high heels, remains strong in the professional sector. Business professionals in major cities continue to purchase formal shoes for office wear and business events. This category’s steady growth reflects the broader trend of increasing consumer sophistication and the desire for high-end products.

Major Players in the Chinese Footwear Market

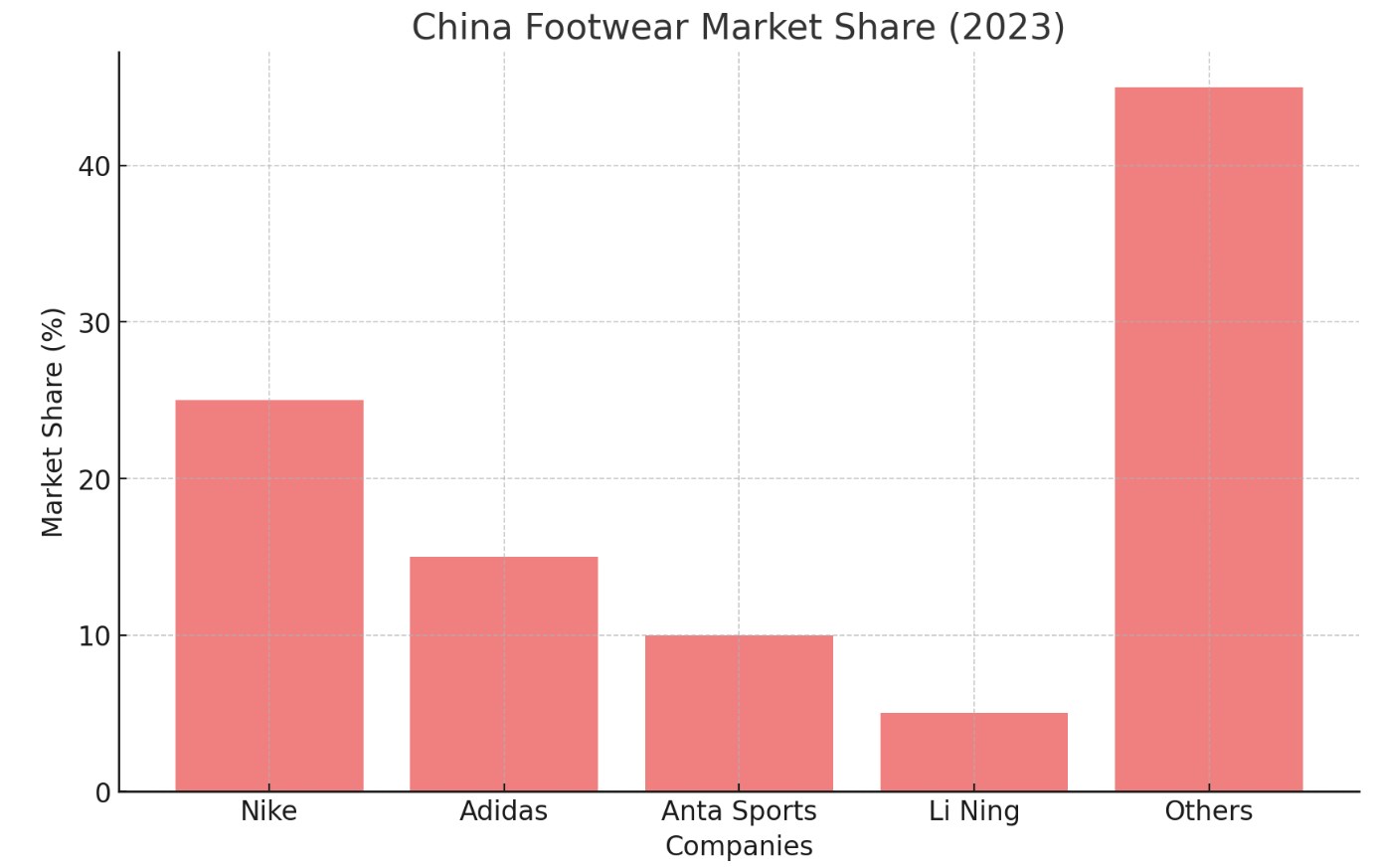

Nike

Nike remains the leading global player in China’s footwear market, holding a significant share of the athletic footwear segment. As of 2023, Nike commands an estimated 25% share of the total footwear market in China, making it the top player in the sector. The brand’s success in China can be attributed to its strong brand recognition, its commitment to innovation, and its ability to connect with Chinese consumers through localized marketing campaigns.

Nike has leveraged China’s growing fitness culture and increasing interest in sports to expand its presence. The brand’s wide range of performance-oriented shoes for various sports, as well as its athleisure products, appeal to both professional athletes and casual consumers. Additionally, Nike’s collaborations with Chinese celebrities, influencers, and sports figures have helped to maintain its position as a top footwear brand in the country.

Nike’s Key Strengths

- Brand recognition: Nike is one of the most recognized and trusted athletic footwear brands in China, appealing to a wide demographic of consumers.

- Innovation: Nike continues to invest heavily in product development, offering high-performance shoes that meet the needs of both professional athletes and casual consumers.

Adidas

Adidas is another major player in China’s footwear market, competing directly with Nike in the athletic footwear segment. As of 2023, Adidas holds a market share of approximately 15%, with a strong presence in both the athletic and casual footwear categories. The German brand has successfully captured the attention of Chinese consumers by emphasizing its combination of performance and style. Adidas’s focus on sustainability, with initiatives such as the production of shoes made from recycled materials, resonates with Chinese consumers who are increasingly concerned about environmental issues.

Adidas has strengthened its position in China by localizing its product offerings and marketing campaigns, ensuring that its shoes meet the preferences and tastes of the Chinese market. Like Nike, Adidas also benefits from its partnerships with Chinese athletes, sports teams, and celebrities, which has helped to increase brand loyalty.

Adidas’s Key Strengths

- Sustainability initiatives: Adidas has positioned itself as a leader in sustainability within the footwear industry, which is appealing to environmentally conscious consumers in China.

- Product diversification: The brand offers a wide range of products that cater to both sports performance and fashion trends, giving it broad appeal.

Anta Sports

Anta Sports is one of the leading domestic footwear brands in China, with a market share of around 10%. Known for its affordable yet high-quality footwear, Anta has successfully capitalized on the growing middle class in China. The company offers a wide range of athletic footwear that appeals to both budget-conscious consumers and those looking for performance-oriented shoes.

Anta’s success in China is largely attributed to its ability to cater to the mass market while maintaining strong relationships with Chinese consumers. The brand has also made strategic acquisitions, including the purchase of the international brand Fila, which has allowed Anta to diversify its product offerings and expand its presence in the higher-end footwear segment.

Anta Sports’ Key Strengths

- Strong local presence: Anta’s understanding of the Chinese market has enabled it to create products that resonate with local consumers at competitive prices.

- Strategic acquisitions: The acquisition of Fila and other brands has helped Anta expand into the premium market and broaden its consumer base.

Li Ning

Li Ning is another prominent domestic brand in China, known for its strong presence in the sports and athletic footwear market. The brand has experienced significant growth in recent years, driven by its successful branding and marketing strategies, as well as its emphasis on product innovation. Li Ning’s focus on combining traditional Chinese culture with modern design has resonated well with younger consumers, especially in major cities.

Li Ning’s market share in the Chinese footwear market is estimated to be around 5%. The company has successfully carved out a niche for itself by offering performance-focused footwear at competitive prices, and its partnerships with athletes and sports teams have helped to boost its reputation as a serious player in the sportswear market.

Li Ning’s Key Strengths

- Cultural appeal: Li Ning’s branding and design philosophy, which incorporates elements of traditional Chinese culture, has helped the brand connect with local consumers.

- Competitive pricing: Li Ning offers quality athletic footwear at more affordable price points, making it an attractive option for budget-conscious consumers.

Other Competitors

In addition to the major global and domestic players, there are several other brands competing for market share in China’s footwear market. These include brands such as Skechers, New Balance, Puma, and Converse, each of which has managed to carve out its niche in the market. Skechers, for instance, is popular for its comfortable footwear and appeals to a broad demographic, while New Balance focuses on performance shoes and a loyal customer base.

Additionally, local brands such as Xtep and Peak Sports have made significant strides in recent years, gaining market share through their focus on both athletic and lifestyle footwear. Xtep, in particular, has found success by positioning itself as a trendy, affordable alternative to international brands.

Future Outlook and Trends

Sustainability and Eco-Friendly Footwear

Sustainability is a growing concern in the Chinese footwear market, with more consumers seeking products made from eco-friendly materials. This trend is reflected in the increasing popularity of sustainable footwear brands, as well as in the efforts of established companies like Adidas and Nike to develop more environmentally friendly products. The rise of eco-conscious consumers is expected to drive further innovation in the production of sustainable footwear options.

Growth of Online Footwear Sales

E-commerce continues to play a crucial role in the Chinese footwear market, with online sales growing at a rapid pace. Consumers are increasingly opting for online shopping due to its convenience, as well as the ability to access a wider range of brands and styles. The rise of mobile commerce and social media marketing is also contributing to the growth of online footwear sales, especially in smaller cities and rural areas where traditional brick-and-mortar stores may not have a strong presence.

Technological Advancements in Footwear

Advances in footwear technology, such as 3D printing, smart shoes, and the integration of performance-enhancing materials, are expected to shape the future of the Chinese footwear market. Consumers are becoming more interested in footwear that offers added benefits, such as improved comfort, durability, and customization. As a result, companies are investing heavily in research and development to create innovative footwear solutions that cater to the evolving needs of Chinese consumers.

The footwear market in China is poised for continued growth, with domestic and international players competing for a slice of the expanding market. As consumer preferences evolve, companies will need to innovate and adapt to stay competitive in this dynamic and fast-changing market.