China E-Commerce Market Share

China has become the world’s largest and most dynamic e-commerce market, with an estimated market size exceeding USD 2 trillion in 2024. The growth of online retail in China has been driven by a range of factors, including a massive population of internet users, the widespread adoption of mobile technology, and the government’s strong support for digital infrastructure development. E-commerce in China is not only limited to consumer goods but also includes online services such as food delivery, online education, and entertainment.

China’s e-commerce landscape is dominated by a few major players, including Alibaba, JD.com, Pinduoduo, and a host of smaller yet fast-growing platforms. These platforms have been able to tap into the diverse needs of Chinese consumers, from price-sensitive buyers in lower-tier cities to high-end consumers in major metropolitan areas. The dominance of e-commerce has also led to significant shifts in how retail is conducted, with online platforms increasingly blending online and offline experiences to enhance customer engagement and streamline logistics.

The structure of China’s e-commerce market is highly fragmented, with companies focusing on various niches, from luxury goods to groceries. Despite the dominance of the leading players, new and emerging companies are leveraging technology, innovative business models, and strong supply chains to challenge the market leaders. In this vibrant and competitive environment, the future of Chinese e-commerce looks promising, with continued growth anticipated in both traditional and newer categories.

Key Drivers of China’s E-Commerce Market Growth

Internet Penetration and Smartphone Usage

China is home to more than 1.4 billion people, and as of 2024, the country has over 1 billion internet users, with a vast majority accessing the internet via smartphones. The high penetration of mobile internet has been one of the primary drivers of e-commerce in China. Online shopping, mobile payments, and other digital services have become deeply integrated into the daily lives of consumers, who increasingly prefer to shop on their mobile devices due to the convenience, speed, and wide product selection.

The surge in smartphone ownership, especially in rural and less developed areas, has expanded the reach of e-commerce platforms to a broader demographic. Mobile payment systems like Alipay and WeChat Pay have further facilitated the growth of e-commerce by offering easy, secure, and widely accepted methods of payment, reducing friction in the purchasing process. These factors have led to significant growth in online retail sales across all categories, from fashion to groceries.

Government Policies and Infrastructure Support

The Chinese government has been a key enabler of the country’s e-commerce growth. In recent years, government initiatives have focused on improving digital infrastructure, supporting the development of e-commerce platforms, and encouraging consumer spending in the digital economy. The government’s “Made in China 2025” policy, which emphasizes technological innovation and self-reliance, has also paved the way for the rapid development of e-commerce logistics, delivery systems, and digital payment methods.

China’s focus on building smart cities and advancing technological infrastructure, including high-speed internet access and logistics networks, has provided a solid foundation for the expansion of online shopping. Furthermore, government policies encouraging e-commerce innovation and cross-border trade have allowed Chinese companies to dominate the global e-commerce scene, leveraging China’s manufacturing capabilities and tech-savvy workforce.

Major Domestic Players in China’s E-Commerce Market

Alibaba Group

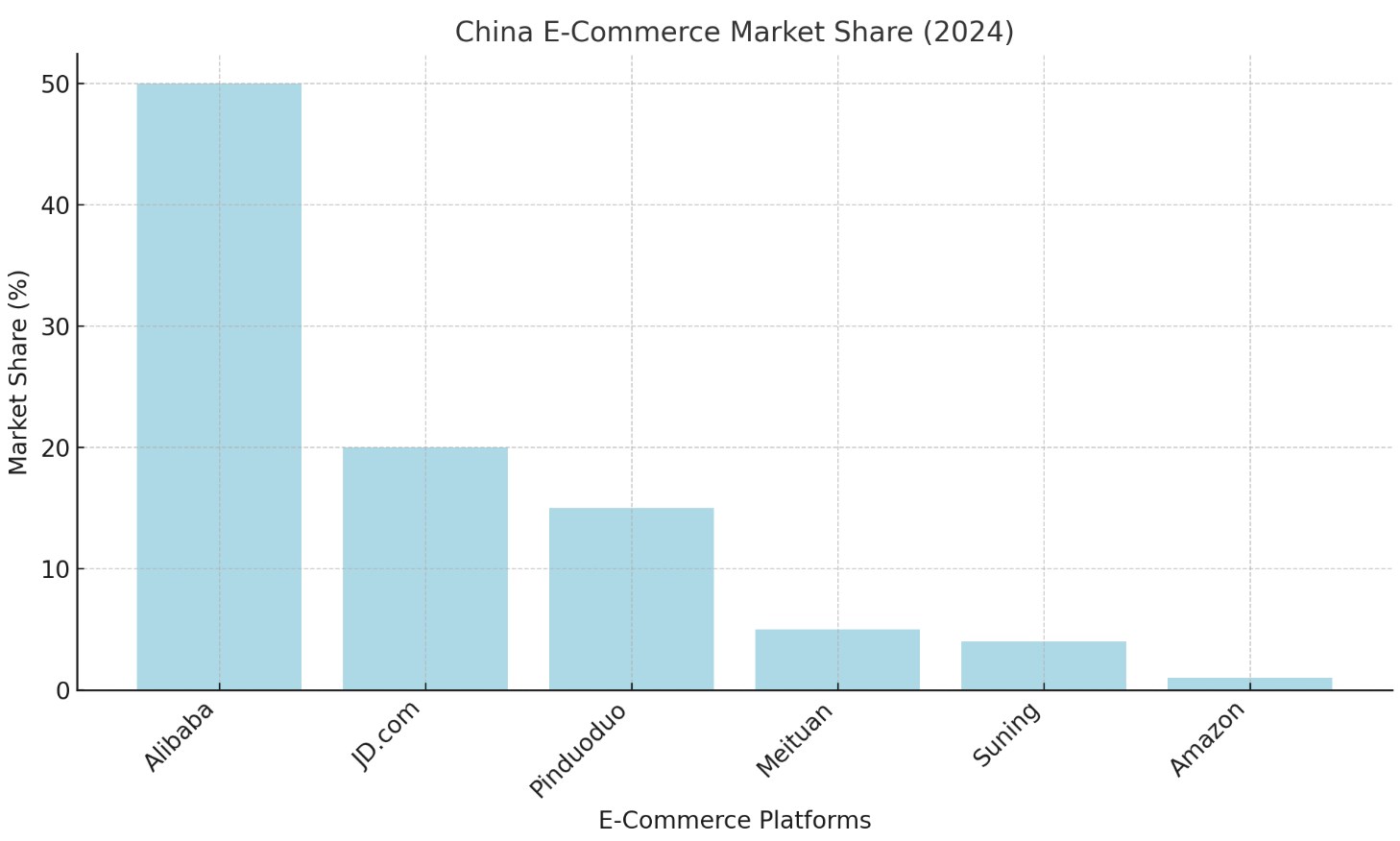

Market Share Overview

Alibaba Group, founded by Jack Ma in 1999, is the undisputed leader of China’s e-commerce market. With its multiple platforms, including Taobao, Tmall, and AliExpress, Alibaba has established a dominant presence in both the business-to-consumer (B2C) and consumer-to-consumer (C2C) e-commerce sectors. As of 2024, Alibaba holds a significant share of around 50% of China’s e-commerce market, making it the largest e-commerce player in the country.

Key Strengths and Factors Contributing to Market Share

- Diverse Platform Ecosystem: Alibaba’s portfolio of e-commerce platforms includes Taobao, which serves as the largest C2C platform in China, and Tmall, which targets higher-end consumers and businesses. By catering to different market segments, Alibaba has been able to capture a diverse range of consumers. Additionally, the company’s logistics arm, Cainiao, has played a key role in enabling efficient and fast delivery services across the country.

- Integrated Digital Payments and Services: Alibaba’s Alipay platform has transformed the way consumers make payments in China. Alipay is one of the most widely used payment methods in the country and is deeply integrated with Alibaba’s e-commerce platforms, making transactions seamless for consumers. Alibaba’s ecosystem also includes services such as cloud computing (Alibaba Cloud), digital entertainment (Youku), and logistics, which further enhance its market position.

JD.com

Market Share Overview

JD.com, also known as Jingdong, is the second-largest e-commerce player in China, with an estimated market share of 20%. JD.com differentiates itself from Alibaba by focusing on direct sales and offering an extensive range of products, including electronics, home appliances, and everyday consumer goods. JD’s commitment to logistics and customer service has made it a trusted name among consumers.

Key Strengths and Factors Contributing to Market Share

- Logistics and Supply Chain: JD.com has heavily invested in building its own logistics network, including warehouses, delivery hubs, and last-mile delivery infrastructure. This investment in logistics allows JD to offer faster and more reliable delivery than many competitors, particularly in the delivery of bulky and high-value items.

- Quality Control and Authenticity: JD.com has positioned itself as a platform offering authentic, high-quality products. This commitment to quality control has helped it build a reputation as a reliable platform for consumers looking for trusted brands, especially in categories like electronics and home appliances.

Pinduoduo

Market Share Overview

Pinduoduo, founded in 2015, has rapidly emerged as one of the most popular e-commerce platforms in China. Pinduoduo’s market share has surged to around 15% as of 2024, thanks to its unique approach to social commerce. The platform allows users to participate in group buying, where they can receive discounts by teaming up with friends or strangers to purchase products in bulk.

Key Strengths and Factors Contributing to Market Share

- Social Shopping and Group Buying: Pinduoduo’s innovative social shopping model has resonated strongly with China’s price-sensitive consumers, particularly in lower-tier cities and rural areas. By incorporating social media elements and gamification into its shopping experience, Pinduoduo has successfully tapped into the growing trend of social commerce.

- Focus on Lower-Tier Cities and Rural Markets: Pinduoduo has made a concerted effort to cater to the underserved markets in China’s lower-tier cities and rural areas, where price sensitivity is high. By offering deeply discounted products and emphasizing a mobile-first, easy-to-use interface, Pinduoduo has attracted a massive user base in these regions.

Meituan

Market Share Overview

Meituan is primarily known for its food delivery services, but it has gradually expanded into e-commerce, particularly in the fields of local services and lifestyle products. As of 2024, Meituan holds a 5% share in China’s e-commerce market. The company’s expansion into e-commerce is driven by its existing dominance in food delivery, restaurant reviews, and group-buying services.

Key Strengths and Factors Contributing to Market Share

- Strong Local Services Platform: Meituan’s platform is highly popular for local services, including food delivery, hotel bookings, and ticket reservations. The company’s ability to leverage its existing user base for cross-selling e-commerce products and services has helped it establish a presence in the broader e-commerce market.

- Integration with Daily Life: Meituan has become an essential part of daily life for many Chinese consumers, especially in urban areas. Its platform is frequently used by consumers for a variety of everyday tasks, from ordering food to booking local services, which makes it a convenient platform for e-commerce expansion.

Suning.com

Market Share Overview

Suning.com is one of China’s largest retailers, with a strong presence in the electronics and appliance sectors. As of 2024, Suning holds around 4% of the e-commerce market. The company is known for offering a wide range of consumer electronics, appliances, and other goods through its online platform, as well as its offline brick-and-mortar stores.

Key Strengths and Factors Contributing to Market Share

- Integrated Online and Offline Retail: Suning has developed an integrated approach to retail by combining its extensive network of physical stores with its online platform. This omnichannel strategy has allowed the company to cater to consumers who prefer in-store experiences as well as those who prefer online shopping.

- Strong Product Selection: Suning offers a broad range of consumer electronics, home appliances, and lifestyle products, attracting a wide range of consumers. The company’s strong relationships with suppliers in these sectors help it maintain competitive pricing and a steady supply of in-demand products.

Foreign Players in China’s E-Commerce Market

Amazon

Market Share Overview

Amazon, the global e-commerce giant, has made significant investments in China, but its market share remains relatively small compared to domestic competitors like Alibaba and JD.com. As of 2024, Amazon’s share of the Chinese e-commerce market is approximately 1-2%.

Key Strengths and Factors Contributing to Market Share

- Global Reach and Brand Recognition: Amazon’s brand is recognized globally, and its reputation for customer service and reliable delivery systems has helped it attract a loyal base of international shoppers. Amazon’s ability to offer international products and services has helped it carve out a niche in China’s highly competitive e-commerce market.

- Amazon Global Store: One of Amazon’s key strategies in China is its focus on cross-border e-commerce, allowing consumers to buy products from international sellers. This has allowed Amazon to tap into the growing demand for foreign goods, especially premium and luxury products.

Walmart

Market Share Overview

Walmart operates its e-commerce platform in China under the name Walmart China. While Walmart has not achieved the same dominance as Alibaba or JD.com, it still holds a notable share of around 3% of the Chinese e-commerce market as of 2024. Walmart has focused on integrating its online and offline retail presence.

Key Strengths and Factors Contributing to Market Share

- Omnichannel Strategy: Walmart has invested heavily in an omnichannel approach, allowing customers to shop online and pick up products in-store. This hybrid shopping experience is popular with Chinese consumers who enjoy the flexibility of both online and offline options.

- Local Partnerships and Logistics: Walmart has partnered with local players to enhance its delivery infrastructure and improve its reach. These partnerships have allowed Walmart to expand its offerings and improve its services to better meet the needs of Chinese consumers.