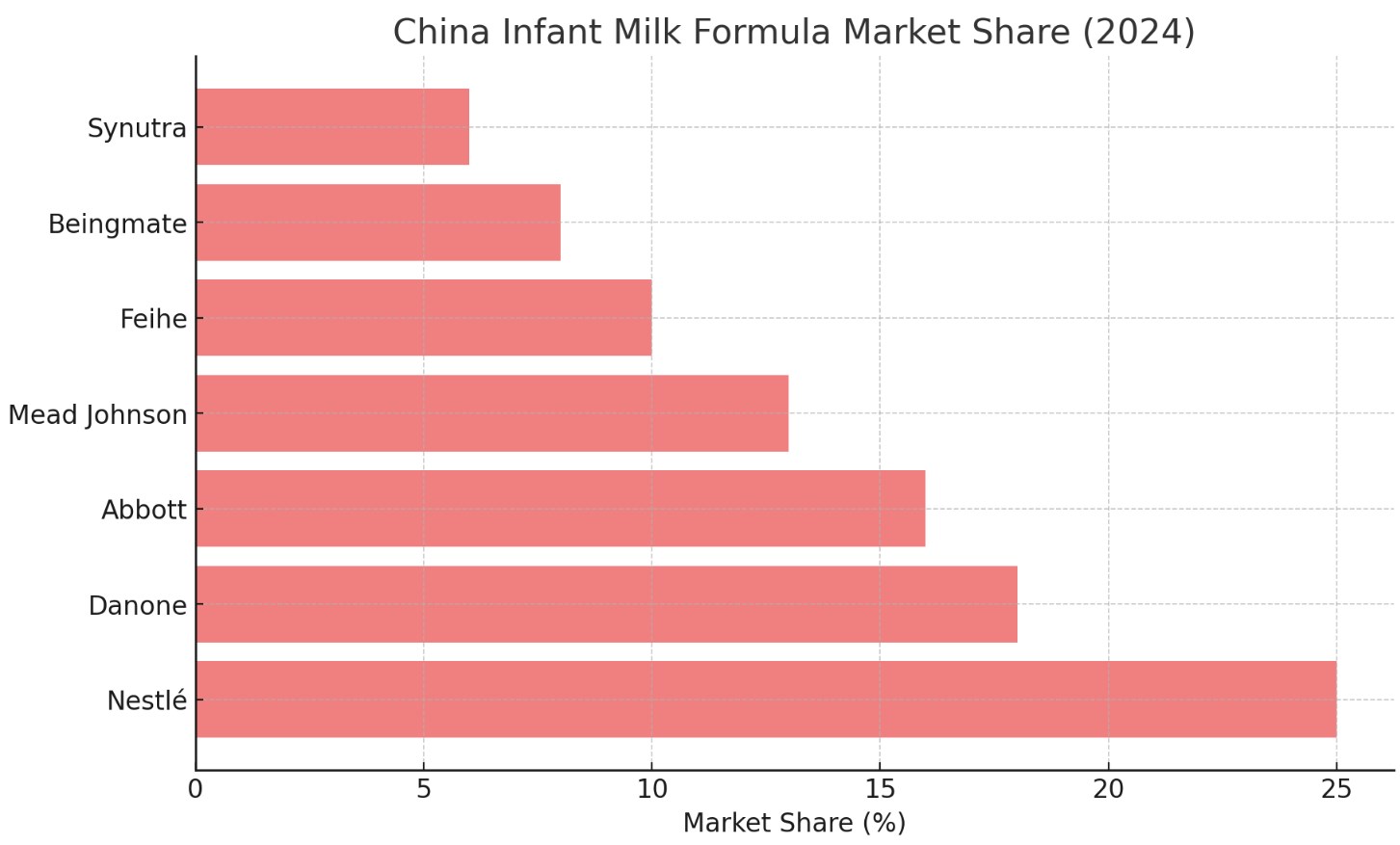

China Infant Milk Formula Market Share

The infant milk formula market in China has experienced significant growth over the past two decades, driven by the country’s expanding middle class, increasing awareness of the benefits of nutrition, and government policies supporting infant care. China represents one of the largest markets for infant milk formula globally, with a projected market size of over USD 16 billion in 2024, making it the largest in the Asia-Pacific region. This growth is fueled by increasing urbanization, a rising birth rate in certain demographics, and a shift in consumer preferences towards premium and imported brands.

In recent years, the Chinese market has witnessed rapid changes, driven by consumer demand for high-quality, safe, and nutritious products for their infants. With a rising focus on product quality, safety, and ingredient transparency, brands are increasingly innovating to cater to the discerning Chinese consumer. Additionally, China’s increasingly affluent and educated population places a significant emphasis on child health and nutrition, further increasing demand for infant milk formulas that promise high standards.

The market is composed of both local and international players, with foreign brands gaining a substantial share due to consumer preferences for imported products. While domestic companies have maintained a strong presence, the trust factor in foreign brands has been reinforced by incidents of safety concerns in the past. This has opened the door for significant market share opportunities for companies offering premium products.

Major Players in the Chinese Infant Milk Formula Market

International Brands

Nestlé

Nestlé is the undisputed leader in China’s infant milk formula market, commanding a market share of approximately 25%. The Swiss multinational’s dominance in China is driven by its strong portfolio of well-known brands, including Nan and Lactogen, which are trusted by Chinese parents for their quality and nutritional value. With its established manufacturing facilities in China and its long-standing history in the country, Nestlé has been able to penetrate deeply into both urban and rural areas. Its market value in the Chinese infant formula segment is estimated to exceed USD 4 billion in 2024.

Nestlé has continued to innovate its product offerings in China, introducing specialized formulas for different stages of infant development. For example, it offers follow-up formulas, prebiotics, and DHA-enriched products. The company’s success is also attributed to its efforts to improve product safety and transparency, which resonate strongly with Chinese parents seeking to provide the best nutrition for their children. Furthermore, Nestlé’s established distribution channels and strong brand recognition have contributed to its success in the highly competitive market.

Danone

Danone, a French multinational food products company, holds the second-largest market share in China’s infant milk formula sector, accounting for around 18% of the market. Danone’s success in China can be attributed to its robust portfolio of premium brands, such as Aptamil and Dumex, which are well-regarded for their quality and nutritional benefits. Danone’s infant formula products are particularly popular in first-tier cities like Beijing and Shanghai, where the demand for imported, premium products is highest. In 2024, Danone’s market value in China’s infant milk formula segment is estimated at approximately USD 3 billion.

Danone has made significant strides in localizing its products to better suit Chinese preferences, introducing specific formulas designed to cater to the nutritional needs of Chinese infants. The company has also focused on improving its supply chain and enhancing product safety, a critical factor in the wake of several safety scandals in the industry. Danone’s continued investment in research and development has enabled it to introduce new innovations, such as organic milk powder and formula enriched with probiotics, which help to support digestive health and immunity.

Abbott Laboratories

Abbott Laboratories, an American healthcare company, is another major player in the Chinese infant milk formula market. Abbott’s infant formula brands, including Similac and Gain, hold a combined market share of approximately 16%. Abbott’s annual revenue in China’s infant formula market is estimated to be around USD 2.5 billion in 2024. The company has established a strong reputation for offering high-quality, safe, and scientifically developed formulas. Abbott has been especially successful with its premium formulas, which are tailored to the needs of both babies and toddlers.

Abbott’s success in China is largely driven by its focus on product quality, safety, and innovation. The company has invested heavily in research to develop formulas that include ingredients such as DHA, ARA, and prebiotics, which support brain development and digestive health. Additionally, Abbott has strengthened its distribution channels, working closely with e-commerce platforms and retail partners to reach consumers in both urban and rural areas. The company’s continued focus on quality assurance and safety has helped Abbott maintain consumer trust in its products.

Mead Johnson Nutrition

Mead Johnson, which is now part of Reckitt Benckiser, is another key player in the Chinese market, holding an approximate market share of 13%. The company’s flagship infant milk formula brand, Enfamil, is one of the most recognized and trusted products in China. Mead Johnson’s focus on scientific research, product quality, and its strong brand recognition have made it a popular choice among Chinese parents. Its market value in China’s infant milk formula sector is estimated to be over USD 2 billion in 2024.

Mead Johnson’s success in China is attributed to its ability to offer specialized formulations that cater to specific nutritional needs, including formulas for premature infants, sensitive stomachs, and lactose intolerance. The company has also focused on strengthening its presence in both urban and rural areas, ensuring widespread availability of its products. Mead Johnson’s continued investment in consumer education, particularly around infant nutrition, has played a key role in the company’s ability to maintain and expand its market share in China.

Domestic Brands

Feihe International

Feihe International is one of the leading domestic infant milk formula brands in China, with an estimated market share of around 10%. The company’s revenue in the Chinese market is expected to surpass USD 1.5 billion in 2024. Feihe’s success can be attributed to its focus on producing high-quality formulas that meet the nutritional needs of Chinese infants, as well as its ability to tap into the growing demand for premium domestic brands. Feihe is particularly strong in second- and third-tier cities, where its products are highly regarded for their quality and affordability.

Feihe has leveraged its deep understanding of the Chinese consumer to offer a range of products that are specifically tailored to local preferences. For example, the company offers milk powder formulas that are enriched with nutrients known to support cognitive development, immunity, and digestive health. Feihe’s emphasis on product safety and traceability, particularly in the wake of the 2008 melamine scandal, has helped build consumer trust. Moreover, the company’s focus on e-commerce and online sales channels has allowed it to expand its reach and attract a younger, tech-savvy customer base.

Beingmate

Beingmate is another significant domestic player in China’s infant milk formula market, holding a market share of around 8%. In 2024, Beingmate’s revenue from the Chinese market is estimated to be approximately USD 1.2 billion. The company has a long history in the Chinese dairy industry, and its infant formula products are widely available across the country, from major urban centers to rural areas.

Beingmate’s market position is bolstered by its strong portfolio of products, which includes both standard and premium formulas. The company has made significant strides in improving the quality of its products, focusing on nutritional ingredients that support healthy growth and development. Beingmate has also invested in developing international partnerships to expand its product offerings and enhance brand recognition. Like other domestic brands, Beingmate has increasingly focused on e-commerce and digital marketing to engage with younger consumers who are more likely to shop online for baby products.

Synutra International

Synutra International is a Chinese company that focuses on the production of infant milk formula, holding an estimated market share of 6%. The company’s revenue in 2024 is projected to reach USD 1 billion. Synutra is particularly strong in the premium segment, where it offers high-quality, scientifically formulated products aimed at promoting brain development, immune health, and digestive wellness. Synutra’s focus on quality, safety, and affordability has helped it gain popularity among Chinese parents.

The company has made significant investments in research and development, focusing on improving the nutritional profiles of its products to align with the latest scientific findings. Synutra has also focused on strengthening its distribution network, ensuring that its products are available both in traditional retail stores and online platforms. This multi-channel approach has allowed Synutra to expand its customer base and increase its market share in China’s competitive infant formula market.

Key Trends Shaping the Market

Premiumization of Infant Milk Formula

One of the most significant trends in China’s infant milk formula market is the ongoing premiumization of products. Chinese parents are increasingly seeking higher-quality, imported formulas that they believe will provide superior nutrition for their children. Premium formulas, which often feature specialized ingredients like probiotics, DHA, and organic milk, are in high demand, particularly in first- and second-tier cities.

Foreign brands have capitalized on this trend, offering high-end products that are perceived as safer and more reliable. Domestic brands are also starting to target the premium segment, developing products that cater to the growing demand for top-tier infant nutrition. The increasing willingness of Chinese parents to invest in premium formulas has led to a surge in the market share of high-end products.

E-Commerce and Online Shopping

With the rapid growth of e-commerce in China, many infant milk formula brands are focusing heavily on online sales channels. Platforms such as Alibaba’s Tmall and JD.com have become critical distribution channels for infant formula products, particularly among younger, tech-savvy parents. Online shopping offers the convenience of home delivery, competitive pricing, and access to a wide range of brands, which makes it an appealing option for busy parents.

Many brands are using targeted digital marketing campaigns and influencer endorsements to drive sales and brand awareness. The rise of online shopping has also allowed domestic brands to expand their reach beyond traditional retail outlets and engage with consumers in smaller cities and rural areas.

Increased Focus on Safety and Transparency

In light of past safety scandals, safety and transparency have become critical concerns for Chinese parents when choosing infant milk formula. Brands that can offer transparency in their production processes, ingredient sourcing, and quality assurance are likely to gain the trust of consumers. Companies are increasingly investing in traceability systems and certifications to ensure that their products meet the highest safety standards.

This focus on safety has also led to a growing preference for imported formulas, as many Chinese parents associate foreign brands with higher safety standards. Domestic brands are responding by increasing their focus on quality control and safety practices, with some even collaborating with international partners to improve product safety and quality.

Government Regulations and Policy Support

The Chinese government plays a significant role in shaping the infant milk formula market. Over the past decade, the government has implemented stricter regulations to ensure the safety and quality of infant formula products. These regulations include guidelines on product labeling, ingredient sourcing, and manufacturing processes. Companies operating in the Chinese market must comply with these regulations, which have helped to increase consumer confidence in the products available.

At the same time, the government has provided support for domestic brands through subsidies, research grants, and other initiatives aimed at improving the quality of Chinese-made products. This support has helped domestic companies improve their manufacturing capabilities and compete with international brands in the premium segment.