China Gaming Market Share

The gaming market in China stands as one of the largest and most influential in the world. With an estimated market value of over USD 46 billion in 2024, the country is the largest gaming market globally, surpassing even the United States in terms of revenue. The massive size of the market is driven by the country’s population of over 1.4 billion people, the widespread adoption of smartphones, and the increasing popularity of online gaming across multiple platforms. As one of the most rapidly developing gaming markets, China presents both opportunities and challenges for local and international game developers.

China’s gaming industry is highly diverse, encompassing mobile games, PC games, and console gaming. Mobile gaming, in particular, has become the dominant sector, making up approximately 60% of the total gaming revenue. The rise of esports has also added a new dimension to the industry, with a growing number of tournaments, teams, and sponsors investing in the sector. The government plays a significant role in regulating the market, particularly in the areas of content censorship and approval of new games. Despite these regulatory hurdles, China remains a key player in the global gaming ecosystem, both as a producer and consumer of video games.

The gaming market in China is dominated by several key players, ranging from large state-owned enterprises to innovative startups. While some of the top companies are based in China, the market also attracts significant investments from global gaming giants, all vying for a piece of the lucrative Chinese market.

Major Players in the Chinese Gaming Market

Tencent

Dominance and Market Share

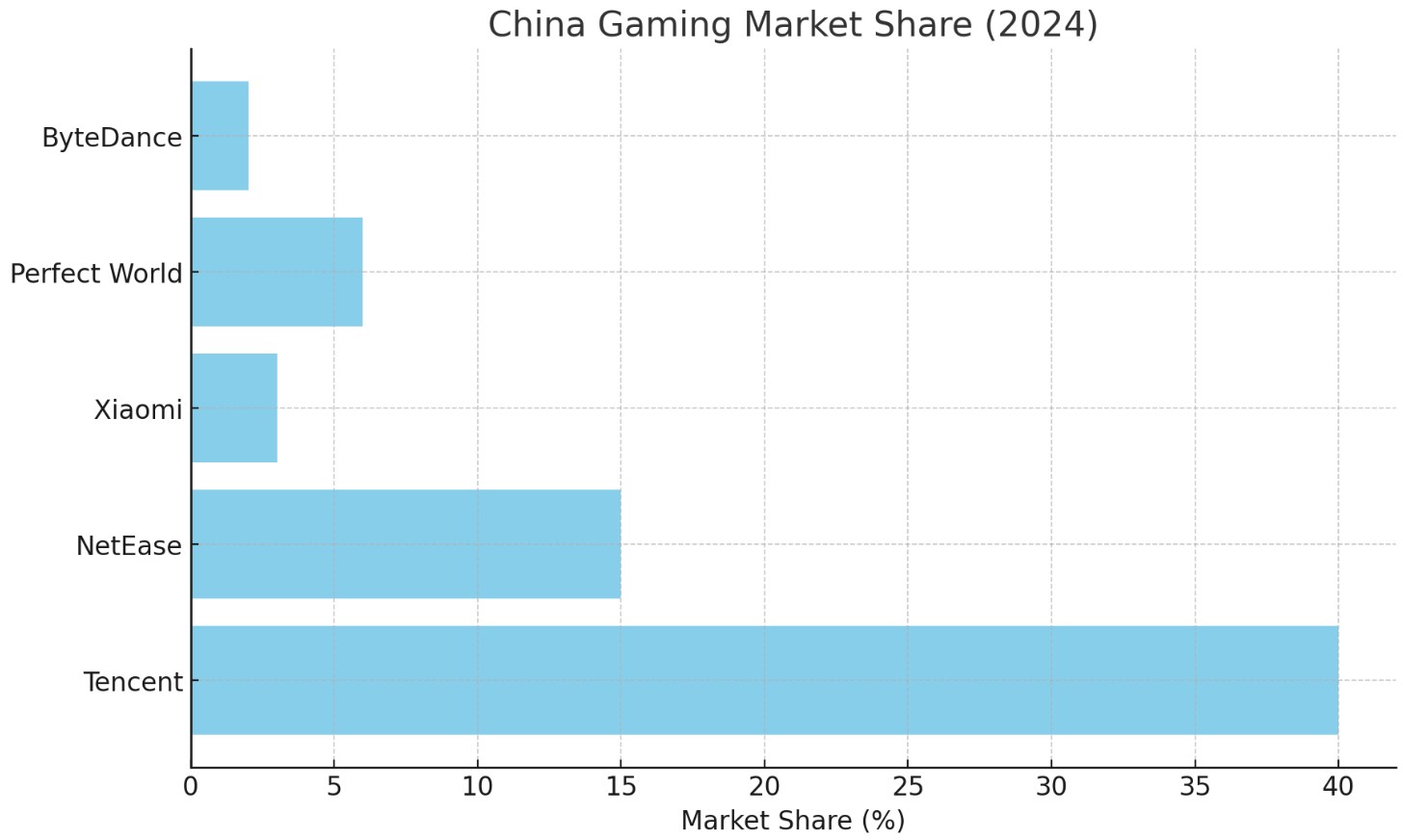

Tencent is undoubtedly the dominant player in China’s gaming market, holding an overwhelming market share of approximately 40%. This market position has allowed the company to generate annual gaming revenues exceeding USD 18 billion, making Tencent not only the largest player in China but also one of the largest gaming companies in the world. Tencent’s gaming division is incredibly diverse, covering mobile, PC, and console platforms, as well as publishing, distribution, and game development.

Tencent’s success in the gaming sector can be attributed to its robust portfolio of popular games and strategic acquisitions. The company owns Riot Games (creator of “League of Legends”), holds a significant stake in Epic Games (developer of “Fortnite”), and has partnerships with major global gaming studios such as Activision Blizzard and Ubisoft. Tencent also operates the highly popular “Honor of Kings” and “PUBG Mobile,” which are among the highest-grossing mobile games in the world.

Tencent’s gaming business is further strengthened by its dominance in the social media and mobile payment space, which gives the company an integrated platform for distributing games. Its WeChat platform and QQ services enable Tencent to reach millions of users across China, offering a seamless experience for players to engage with games, make in-app purchases, and connect with friends. Tencent’s diversified approach to gaming, through ownership, investment, and publishing, has helped it maintain a strong position in the market.

Key Titles and Innovations

Tencent has a broad portfolio of successful games across various genres. Some of its key titles include:

- Honor of Kings: This is one of the most popular mobile games in China, with millions of daily active users. It has revolutionized the mobile multiplayer online battle arena (MOBA) genre and continues to generate significant revenue through in-app purchases.

- PUBG Mobile: Tencent’s partnership with PUBG Corporation to create “PUBG Mobile” has proven to be a huge success. The mobile version of the popular battle royale game quickly became one of the highest-grossing mobile games globally, especially in China, where it has a massive player base.

- League of Legends: Riot Games, a subsidiary of Tencent, is behind the legendary multiplayer online battle arena (MOBA) game “League of Legends,” which has an enormous fan base in China. With frequent updates, new champions, and a vibrant esports scene, “League of Legends” remains one of the most popular PC games in China.

Tencent continues to lead the Chinese gaming market with its relentless focus on innovation, platform integration, and strategic acquisitions. The company’s massive revenue generation from mobile gaming, particularly from “Honor of Kings” and “PUBG Mobile,” has solidified its position as the leader in the Chinese gaming market.

NetEase

Market Share and Competitive Position

NetEase is the second-largest player in China’s gaming market, with an estimated market share of around 15%. The company generates annual gaming revenues of approximately USD 7 billion. NetEase is well-known for its online gaming and game development capabilities, especially in the mobile and PC gaming segments. The company is a major player in China’s gaming ecosystem, with a strong presence in both domestic and international markets.

NetEase’s success in the gaming industry can be attributed to its focus on developing and publishing games across a wide range of genres, from massively multiplayer online role-playing games (MMORPGs) to mobile puzzle games. The company also has strong partnerships with global gaming giants, such as Blizzard Entertainment, with which it co-publishes popular titles like “World of Warcraft” and “Overwatch” in China.

In 2024, NetEase’s revenue from gaming is projected to surpass USD 7 billion, driven by both its own game development efforts and publishing partnerships. NetEase is also investing heavily in expanding its esports presence and has been involved in organizing major tournaments and events across the country.

Key Games and Partnerships

NetEase has an extensive catalog of games, both domestically developed and published in collaboration with international studios. Some of its most notable titles include:

- Identity V: A popular mobile asymmetrical horror game, which has found a dedicated player base in China and abroad. The game’s unique blend of mystery and strategy has made it a hit among mobile gamers.

- Knives Out: A battle royale game that has gained widespread popularity in China, with millions of players participating in fast-paced, last-man-standing matches. It has helped NetEase establish a foothold in the competitive gaming market.

- World of Warcraft (China version): NetEase has maintained a close partnership with Blizzard Entertainment to publish and operate “World of Warcraft” in China, one of the largest MMORPGs globally. The game remains a staple of the Chinese PC gaming market.

NetEase’s strategy of balancing homegrown game development with high-profile international partnerships has enabled the company to diversify its portfolio and capture a significant share of the Chinese gaming market. Additionally, its commitment to investing in esports has set it on a path to further solidifying its place among the industry’s leaders.

Xiaomi

Emerging Player in the Gaming Market

Xiaomi, the Chinese electronics giant known for its smartphones, has emerged as a growing player in the Chinese gaming market. Although Xiaomi’s market share in gaming is relatively small compared to Tencent and NetEase, the company is making significant strides with its focus on mobile gaming. Xiaomi’s market share in China’s gaming sector is estimated at around 3%, with projected gaming revenue reaching approximately USD 1.5 billion in 2024.

Xiaomi’s strength in the gaming industry lies in its vast consumer base, which is attracted to the company’s budget-friendly smartphones that are optimized for mobile gaming. Xiaomi’s devices, such as the Black Shark series of smartphones and gaming accessories, are designed to provide a high-quality gaming experience for users on a budget. The Black Shark gaming phone series, in particular, has gained popularity among gamers for its performance, design, and gaming-focused features, making it one of the top choices in the mobile gaming space.

Key Innovations in Gaming Devices

- Black Shark Gaming Phone: Xiaomi’s Black Shark gaming phone is one of the most popular gaming phones in China. With a focus on providing powerful performance, long battery life, and optimized hardware for gaming, the Black Shark phone series is highly regarded by mobile gamers.

- Gamepad Controllers and Accessories: In addition to smartphones, Xiaomi also produces a range of gaming accessories, such as Bluetooth controllers, gamepads, and external cooling devices, which enhance the mobile gaming experience.

Xiaomi’s strong position in the smartphone market, combined with its commitment to the mobile gaming sector, has allowed the company to gain traction among gamers in China. As mobile gaming continues to dominate the market, Xiaomi’s strategic focus on gaming devices and accessories will continue to contribute to its growth in this segment.

Other Key Players

Perfect World

Perfect World, a Chinese video game developer and publisher, holds a significant position in the Chinese gaming market with an estimated market share of around 6%. Known for its focus on MMORPGs, the company has developed and published popular games such as “Perfect World” and “Neverwinter,” which have garnered large player bases in China and abroad. In 2024, Perfect World’s gaming revenues are expected to reach over USD 2 billion, driven by its popular game titles and international expansion.

Perfect World’s ability to develop and operate MMORPGs has made it a prominent player in the PC gaming segment, where it continues to thrive. The company is also exploring new opportunities in the mobile and esports sectors, aiming to diversify its revenue streams and capture a broader audience.

ByteDance (TikTok’s Parent Company)

ByteDance, the parent company of TikTok, has ventured into gaming through strategic acquisitions and investments in gaming studios. The company has launched mobile games such as “Game for Peace,” a China-exclusive version of “PUBG Mobile,” and is looking to expand its presence in the mobile gaming space. While ByteDance’s market share in the gaming sector is currently smaller than that of Tencent or NetEase, the company’s rapidly growing influence in the entertainment and social media sectors gives it the potential to become a major player in the gaming market in the near future.

ByteDance’s strategy of leveraging its massive social media platforms to promote games provides a unique opportunity for the company to integrate gaming experiences with social networking, creating a seamless connection between entertainment, gaming, and content consumption.

Key Trends Shaping the Market

Mobile Gaming Domination

The rise of mobile gaming in China has been one of the most defining trends in the gaming market. With more than 1 billion mobile phone users in the country, mobile gaming accounts for approximately 60% of the total gaming revenue. Games like “Honor of Kings” and “PUBG Mobile” have become household names, driving the demand for smartphones optimized for gaming. The convenience of gaming on smartphones, coupled with the low cost of entry compared to consoles and PCs, has made mobile gaming the dominant platform for Chinese gamers.

Esports Boom

Esports has become a major cultural phenomenon in China, with millions of fans following competitive gaming events. The Chinese government has recognized esports as an official sport, further legitimizing its place in the country’s entertainment industry. Tencent and NetEase are heavily invested in esports, with the former hosting major tournaments for games like “League of Legends” and “Honor of Kings,” while the latter runs “Identity V” tournaments. Esports organizations, sponsors, and broadcasters are also investing heavily in China, making it one of the leading esports markets globally.

Increasing Regulation and Censorship

The Chinese government has been actively involved in regulating the gaming industry, particularly in the areas of game approval, content censorship, and gaming addiction prevention. The government has imposed strict regulations on the release of new games, requiring approval before they can be published in the country. This has slowed the pace at which new games enter the market, making it more challenging for developers to navigate the approval process. Additionally, the government has introduced restrictions on the amount of time minors can spend playing video games, further impacting the industry.

Investment from Global Gaming Giants

As China remains one of the most lucrative markets for gaming, global gaming giants such as Activision Blizzard, Electronic Arts, and Ubisoft are increasingly focusing their efforts on the Chinese market. These companies have formed partnerships with Chinese firms like Tencent and NetEase to publish and distribute their games in the country, which has helped them navigate the complexities of the local market. As China’s gaming market continues to grow, international companies will continue to invest heavily to secure their share of the market.