China Motorcycle Market Share

China is the world’s largest motorcycle market, both in terms of production and consumption. The market has seen significant growth over the past few decades, driven by factors such as urbanization, a growing middle class, and the increasing demand for affordable and efficient transportation options. With an estimated market size surpassing USD 25 billion in 2024, the Chinese motorcycle industry continues to be a key player in the global motorcycle market. The growing popularity of motorcycles is particularly evident in rural and suburban areas, where they serve as a crucial mode of transport due to their affordability and flexibility.

The market is diverse, with a wide range of motorcycles on offer, from entry-level models to high-performance motorcycles. In addition, electric motorcycles are becoming an increasingly important segment, driven by the country’s push towards environmental sustainability and its expanding infrastructure for electric vehicles (EVs). The dominance of domestic motorcycle manufacturers in China has created a highly competitive landscape, with key players vying for market share in both traditional combustion engine motorcycles and electric vehicles.

Major Players in the China Motorcycle Market

China National Heavy Duty Truck Group (SINOTRUK)

Market Share and Position

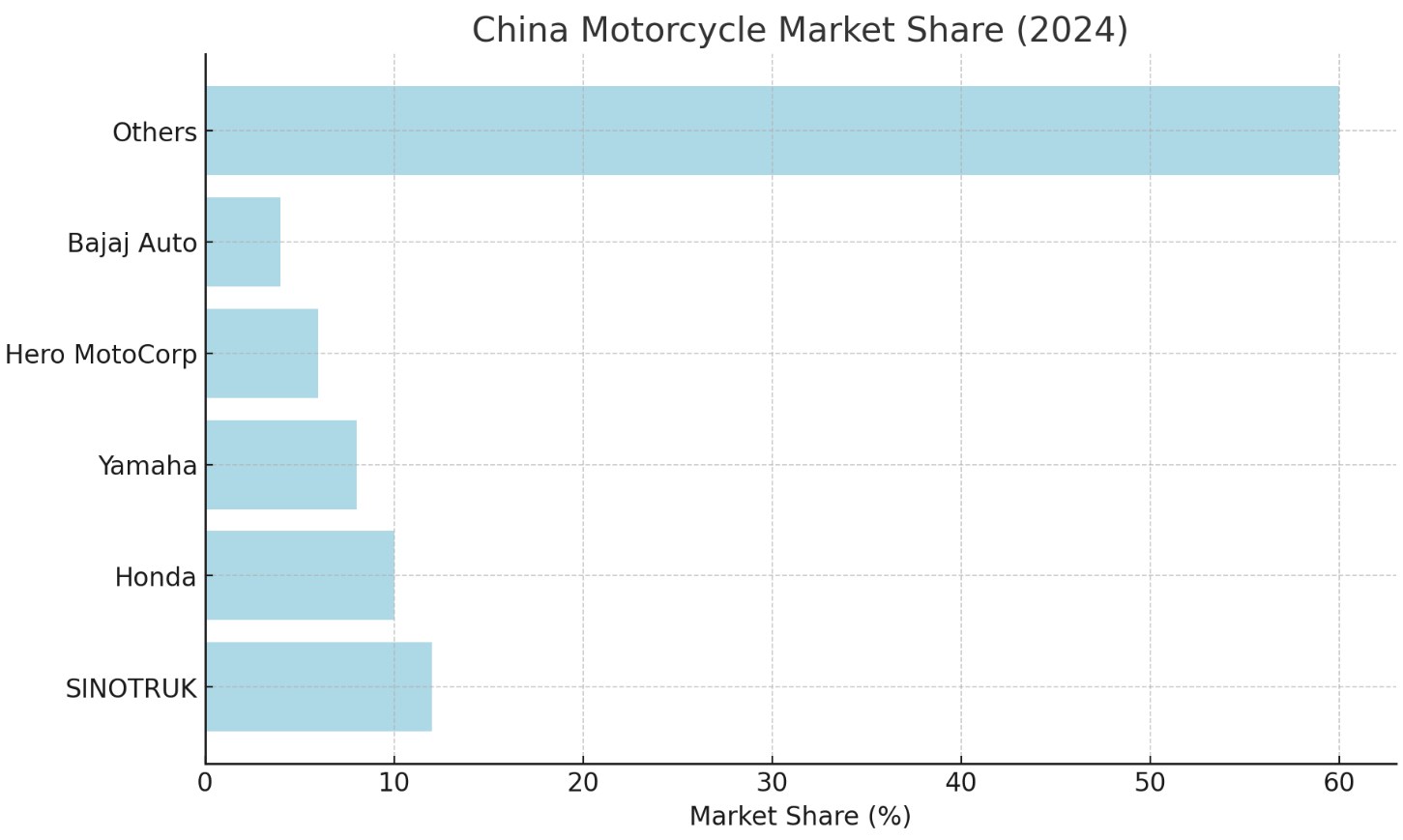

SINOTRUK is one of the largest manufacturers of motorcycles in China, with an estimated market share of approximately 12% in 2024. The company’s annual revenues from motorcycle sales are projected to exceed USD 2 billion in 2024. Although SINOTRUK is primarily known for its production of heavy-duty trucks and commercial vehicles, it also manufactures motorcycles, including both traditional combustion engine models and electric motorcycles.

SINOTRUK’s strong position in the motorcycle market is largely due to its vast production capabilities, extensive distribution network, and long-standing reputation for quality. The company has established a strong presence in both domestic and international markets, offering a wide range of motorcycles that cater to different consumer needs, from entry-level bikes to high-performance models. SINOTRUK’s focus on innovation, combined with its ability to leverage its global supply chain, has enabled it to maintain a competitive edge in the Chinese motorcycle market.

Key Strategies and Innovations

- Diversified Product Range: SINOTRUK offers a wide variety of motorcycles, including both combustion engine models and electric motorcycles. The company’s extensive portfolio allows it to target a broad spectrum of consumers, from budget-conscious buyers to high-end enthusiasts.

- Technological Advancements: The company is investing in the development of electric motorcycles, aiming to capitalize on the growing demand for environmentally friendly transportation solutions.

SINOTRUK’s strategy of diversification and innovation has allowed it to remain a dominant player in China’s motorcycle market, especially as the demand for electric motorcycles continues to grow.

Honda Motor Co.

Market Share and Position

Honda, the Japanese multinational conglomerate, is one of the leading foreign players in China’s motorcycle market, with an estimated market share of around 10% in 2024. With revenues from motorcycle sales expected to exceed USD 2.5 billion in 2024, Honda has established itself as a key competitor in China’s motorcycle industry, particularly in the mid-range and premium segments.

Honda’s motorcycles are known for their reliability, advanced technology, and fuel efficiency, making them highly popular among Chinese consumers. The company has been successful in producing a range of motorcycles that cater to both urban commuters and off-road enthusiasts, positioning itself as a leader in the mid- to high-end market. Honda also offers a variety of electric motorcycles, which have gained traction among environmentally conscious consumers.

Key Strategies and Innovations

- Emphasis on Quality and Performance: Honda’s motorcycles are well-regarded for their high build quality, performance, and reliability. The company’s focus on producing durable and high-performing motorcycles has helped it maintain a strong position in the competitive Chinese market.

- Expansion into Electric Motorcycles: Honda has made significant strides in the electric motorcycle segment, offering eco-friendly alternatives that appeal to consumers looking for more sustainable transportation options.

Honda’s commitment to quality, performance, and innovation in electric motorcycles has made it a top competitor in China’s motorcycle market, particularly in the higher-end segments.

Yamaha Motor Co.

Market Share and Position

Yamaha, another leading Japanese motorcycle manufacturer, holds an estimated market share of around 8% in China’s motorcycle market as of 2024. The company’s annual revenues from motorcycle sales in China are projected to reach over USD 1.5 billion in 2024. Yamaha is well-established in the Chinese market, offering a wide range of motorcycles that cater to different segments, including entry-level models, mid-range bikes, and premium models.

Yamaha’s strong market position in China is due to its reputation for producing high-performance motorcycles with advanced technology. The company’s motorcycles are popular for their durability, fuel efficiency, and affordability, which has helped it capture a substantial share of the market. Yamaha has also made significant investments in electric motorcycles, anticipating the growing demand for environmentally friendly vehicles.

Key Strategies and Innovations

- Focus on High-Performance Models: Yamaha is known for its high-performance motorcycles, including sportbikes and off-road models, which have helped it maintain a loyal customer base in China.

- Electric Motorcycles and Sustainable Solutions: Yamaha has focused on the development of electric motorcycles as part of its strategy to expand its product range and meet the growing demand for green transportation solutions.

Yamaha’s strong focus on performance and sustainability has allowed it to compete effectively in China’s diverse motorcycle market.

Hero MotoCorp

Market Share and Position

Hero MotoCorp, an Indian multinational motorcycle manufacturer, holds a significant portion of China’s motorcycle market, with an estimated market share of around 6% in 2024. Hero MotoCorp’s success in China is driven by its ability to offer affordable motorcycles that cater to budget-conscious consumers. The company’s focus on producing entry-level motorcycles with good fuel efficiency has allowed it to appeal to both urban and rural consumers in China.

Hero MotoCorp has made significant strides in establishing its presence in the Chinese market by offering affordable and reliable motorcycles at competitive prices. Although Hero is not yet as dominant as some of the local Chinese manufacturers, it continues to grow its market share by focusing on affordability and value for money.

Key Strategies and Innovations

- Affordable and Fuel-Efficient Models: Hero MotoCorp has focused on producing motorcycles that offer good fuel efficiency and low maintenance costs, making them an attractive option for price-sensitive consumers in China.

- Expansion into Rural Areas: Hero MotoCorp has focused on expanding its presence in China’s rural areas, where motorcycles serve as an essential mode of transportation for local communities.

Hero MotoCorp’s focus on affordability and fuel efficiency has enabled it to become a significant player in the lower-end segment of China’s motorcycle market.

Bajaj Auto

Market Share and Position

Bajaj Auto, another Indian motorcycle manufacturer, holds an estimated market share of around 4% in China’s motorcycle market in 2024. The company has focused on producing motorcycles for both the entry-level and mid-range segments, offering reliable models at affordable prices. Bajaj’s motorcycle sales in China are expected to exceed USD 1 billion in 2024.

Bajaj Auto’s success in China can be attributed to its competitive pricing and its ability to offer motorcycles that cater to the needs of both urban and rural consumers. The company has made efforts to expand its presence in China by offering a range of affordable and fuel-efficient motorcycles, as well as venturing into electric motorcycles.

Key Strategies and Innovations

- Affordable and Durable Motorcycles: Bajaj Auto’s motorcycles are designed to be durable and affordable, making them appealing to a wide range of consumers.

- Expansion into Electric Motorcycles: Bajaj Auto has also invested in the electric motorcycle segment, aiming to provide affordable electric vehicles to meet the growing demand for green transportation in China.

Bajaj Auto’s combination of affordability and durability has helped it establish a foothold in China’s competitive motorcycle market.

Other Key Players

Harley-Davidson

Harley-Davidson, the iconic American motorcycle manufacturer, has a niche but loyal customer base in China. While its market share is relatively small, estimated at around 2%, the company has found success in the premium segment, targeting affluent consumers who seek luxury motorcycles. Harley-Davidson’s annual revenue from China is expected to exceed USD 500 million in 2024.

KTM

KTM, an Austrian motorcycle manufacturer known for its high-performance off-road bikes, has a growing presence in China’s motorcycle market. KTM’s focus on performance and off-road capabilities has made it popular among Chinese motorcycle enthusiasts, particularly in the sportbike and adventure touring segments. The company’s market share is estimated at around 1.5% in 2024.

Key Trends Shaping the Market

Rise of Electric Motorcycles

The demand for electric motorcycles in China has been growing steadily, driven by the country’s environmental policies, government incentives, and increasing consumer demand for sustainable transportation options. Leading manufacturers like Honda, Yamaha, and Bajaj are investing in electric motorcycles to capture the growing market share in the electric vehicle space. Electric motorcycles offer consumers the benefits of lower operational costs, zero emissions, and government subsidies, making them an increasingly attractive option for urban commuters.

Urbanization and Changing Consumer Preferences

As China’s cities continue to expand, there is a growing demand for affordable and efficient transportation options. Motorcycles offer an alternative to congested public transportation and high-cost automobiles, making them a popular choice for urban commuters. Additionally, younger Chinese consumers are increasingly attracted to motorcycles for leisure and lifestyle purposes, such as touring and off-road activities, driving demand for sportbikes and high-performance models.

Government Regulations and Incentives

The Chinese government has introduced several policies to promote green transportation, including subsidies for electric vehicles and the development of EV charging infrastructure. These incentives are expected to drive the adoption of electric motorcycles in the coming years. The government is also working to reduce pollution levels in urban areas by encouraging the adoption of electric and low-emission vehicles, which will benefit manufacturers focused on eco-friendly motorcycle options.

China’s motorcycle market continues to evolve, with both domestic and international players vying for market share in a highly competitive environment. The growing demand for electric motorcycles, coupled with changing consumer preferences, government policies, and rapid urbanization, will shape the future of China’s motorcycle industry in the years to come.