China Life Insurance Market Share

The life insurance market in China is one of the largest and most dynamic in the world, reflecting the country’s significant economic growth, rising disposable incomes, and increasingly sophisticated financial services. As China’s middle class expands, its appetite for financial products that offer protection and savings has surged. The country’s life insurance sector has experienced steady growth over the past few years, with a growing number of individuals recognizing the importance of financial security and long-term planning. With a population of over 1.4 billion people and a rapidly aging demographic, life insurance has become a vital component of the financial landscape.

In 2023, the Chinese life insurance market is valued at approximately ¥5 trillion (about $720 billion), and it continues to grow at an average annual rate of 8-10%. The life insurance sector in China is driven by factors such as the increasing awareness of financial protection, the expanding wealth management market, the rising focus on health and wellness, and government policies aimed at improving social welfare. As the market matures, life insurance providers are also focusing on innovations such as digital insurance, mobile platforms, and custom-tailored insurance solutions to meet the evolving demands of Chinese consumers.

The Chinese life insurance market is characterized by both domestic and international players, with the top companies occupying a substantial market share. The competition is intense, with major life insurance companies continuously innovating and enhancing their product offerings, distribution channels, and customer service in order to capture a larger portion of the rapidly growing market.

Key Drivers of the Market

Increasing Middle-Class Population

China’s growing middle class is one of the primary drivers of the life insurance market. As incomes rise and financial literacy improves, Chinese consumers are increasingly seeking products that provide both protection and investment opportunities. The middle class, which has expanded rapidly in recent years, is now more inclined to purchase life insurance policies to secure the financial well-being of their families and to plan for future expenses, including education and retirement.

Additionally, the government’s push to build a social safety net, including pension systems and healthcare, has created an environment in which individuals are looking to supplement state-backed benefits with private insurance options. This has led to a steady rise in the number of people purchasing life insurance products.

Aging Population and Demand for Health-Related Products

China’s aging population has also contributed to the growing demand for life insurance. The country’s elderly population is increasing rapidly due to improvements in healthcare and higher life expectancy, putting additional pressure on pension systems and social welfare programs. As a result, many people are seeking life insurance policies that include long-term care and health-related benefits.

Products like critical illness insurance, long-term care insurance, and health riders attached to life insurance policies are gaining popularity as individuals look to mitigate the financial burden of aging. These policies are designed to cover the costs associated with chronic conditions and long-term healthcare needs, offering peace of mind for the aging population and their families.

Digitalization and Technology Integration

The integration of technology in the life insurance sector has revolutionized the way products are sold and managed. With the rise of mobile apps, online platforms, and digital tools, life insurance companies are increasingly adopting digital solutions to enhance customer experience and streamline operations. Chinese consumers, especially younger generations, are more comfortable purchasing financial products online, and the ease of digital transactions is driving the growth of life insurance.

Insurtech companies in China are also leveraging artificial intelligence (AI), big data, and blockchain technology to develop innovative insurance products, personalize policies, and improve underwriting processes. These technologies enable insurers to provide more customized solutions that meet the unique needs of consumers, improving both accessibility and affordability.

Major Segments in the Life Insurance Market

Traditional Life Insurance

Traditional life insurance products, including term life insurance and whole life insurance, remain the backbone of China’s life insurance market. These policies provide financial protection for policyholders’ families in the event of death or disability. Term life insurance policies offer coverage for a specific period, while whole life insurance provides coverage for the policyholder’s entire life, as well as a cash value component that can accumulate over time.

In 2023, traditional life insurance accounts for approximately 60% of the total market share, valued at around ¥3 trillion ($430 billion). The popularity of traditional life insurance products continues to grow, driven by the increasing awareness of the need for financial protection and security among Chinese families.

Health and Critical Illness Insurance

Health and critical illness insurance products are becoming more prominent in China as consumers seek to safeguard themselves against the high costs of medical treatment. These policies typically cover expenses related to hospitalization, surgery, and medical care for critical illnesses such as cancer, heart disease, and stroke.

The critical illness insurance market in China has seen substantial growth in recent years, valued at approximately ¥700 billion ($100 billion) in 2023. The demand for health-related insurance products is expected to continue rising, particularly as China’s middle class becomes more health-conscious and seeks to address the financial risks associated with serious medical conditions.

Universal Life and Investment-Linked Insurance

Universal life insurance and investment-linked products are increasingly popular in China, particularly among high-net-worth individuals (HNWIs) and those looking to build wealth while securing insurance coverage. Universal life insurance offers flexible premium payments and death benefits, as well as the opportunity to accumulate cash value based on interest rates or market performance. Investment-linked insurance, on the other hand, ties the cash value of the policy to investment funds, allowing policyholders to grow their wealth in line with the performance of the financial markets.

These products offer more flexibility and investment options compared to traditional life insurance policies. In 2023, the universal life and investment-linked insurance segment in China is valued at approximately ¥1.5 trillion ($220 billion), making up around 30% of the overall life insurance market.

Major Players in the Chinese Life Insurance Market

China Life Insurance Company (CLIC)

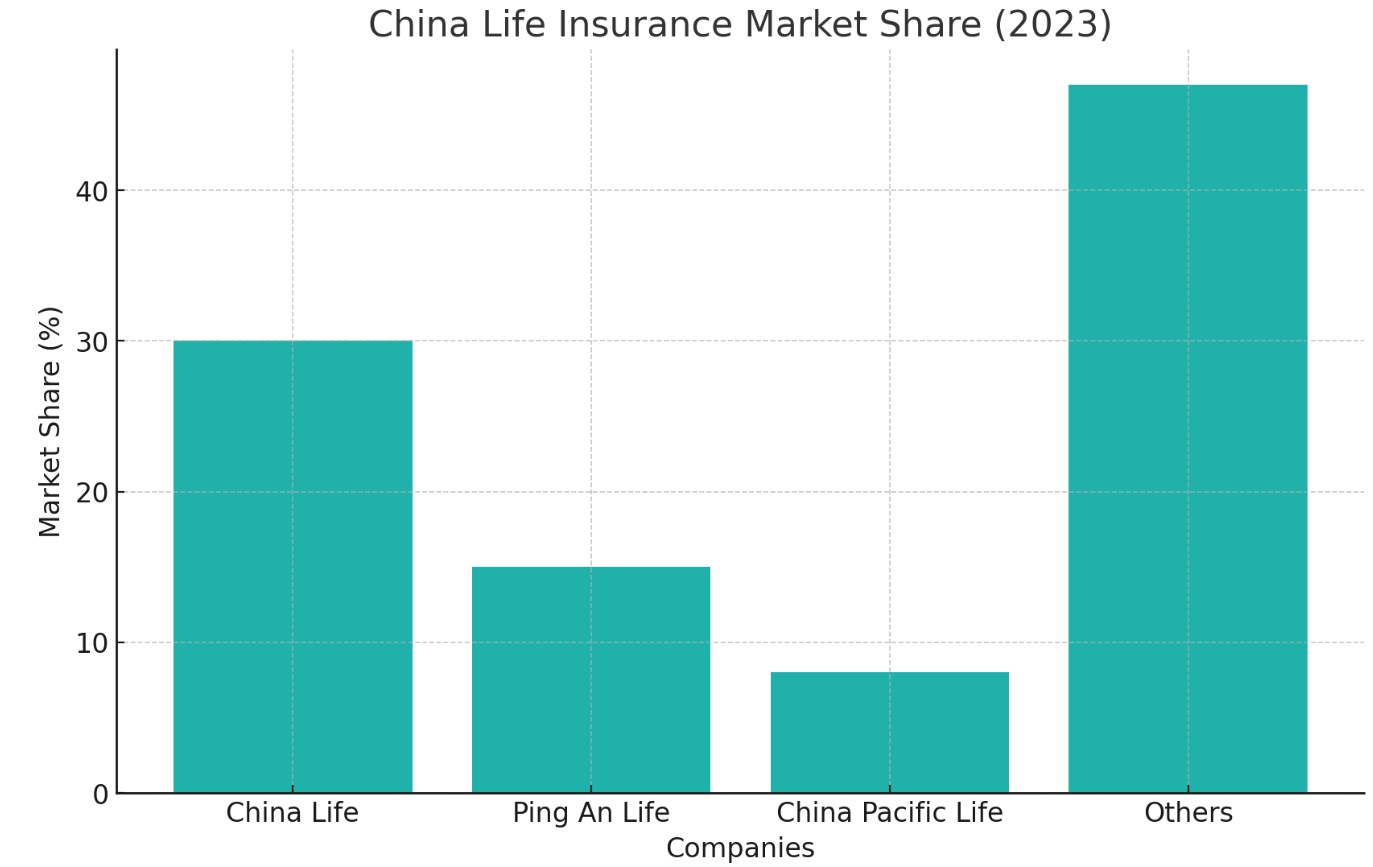

China Life Insurance Company (CLIC) is the largest player in China’s life insurance market, commanding a market share of around 30% in 2023. The company is a state-owned enterprise and is well-known for its broad portfolio of products, including traditional life insurance, health insurance, and investment-linked policies. China Life has the most extensive network of agents, branches, and distribution channels in the country, which has enabled it to maintain its dominant position in the market.

CLIC’s strong performance is attributed to its reputation for reliability, its large customer base, and its wide range of insurance products designed to meet the needs of different demographic groups. With a market value of ¥1.5 trillion ($220 billion), China Life is expected to continue leading the market as it expands its offerings and leverages digital technologies to improve customer engagement.

China Life’s Key Strengths

- Extensive distribution network: China Life’s nationwide network of agents, branches, and online platforms allows it to reach a broad customer base.

- Comprehensive product portfolio: The company offers a wide variety of life insurance products, from basic coverage to more sophisticated investment-linked policies.

Ping An Life Insurance

Ping An Life Insurance, a subsidiary of Ping An Insurance Group, is another leading player in China’s life insurance market, with an estimated market share of around 15% in 2023. The company offers a diverse range of life insurance products, including traditional life, health, and wealth management policies. Ping An Life has been successful in attracting consumers through its innovative products, digital platforms, and use of big data analytics to personalize offerings.

Ping An Life’s strong presence in the health insurance and critical illness segments has helped it capture a significant share of the market. The company has also invested heavily in technology, using artificial intelligence and machine learning to improve underwriting, claims processing, and customer service. In 2023, Ping An Life’s market value is estimated at ¥750 billion ($105 billion).

Ping An Life’s Key Strengths

- Technology-driven innovation: Ping An Life’s investment in digital platforms and AI allows it to offer customized solutions and enhance customer experience.

- Strong health insurance focus: The company’s expertise in health and critical illness insurance has allowed it to capture a significant share of the growing health insurance market.

China Pacific Life Insurance

China Pacific Life Insurance is another key player in China’s life insurance market, with a market share of around 8% in 2023. The company has built a solid reputation for its strong product offerings, including traditional life insurance, health insurance, and investment-linked products. China Pacific Life is particularly known for its ability to innovate in the insurance sector, with a focus on high-quality customer service and tailored insurance solutions.

The company’s market value is estimated to be ¥400 billion ($58 billion) in 2023. China Pacific Life is expanding its customer base through digital platforms and leveraging big data analytics to offer more personalized products and improve operational efficiency.

China Pacific Life’s Key Strengths

- Strong customer service: China Pacific Life is known for its high-quality customer service, which helps build trust and loyalty among policyholders.

- Focus on innovation: The company’s commitment to product innovation has allowed it to remain competitive in the evolving insurance market.

Other Competitors

In addition to the major players, China’s life insurance market is also home to several smaller companies that are carving out niche segments and growing their market share. These include regional players such as Taikang Life, which focuses on wealth management and life insurance, as well as new entrants from the insurtech sector that leverage digital platforms to offer affordable and flexible insurance products.

- Taikang Life focuses on providing wealth management solutions and has become a prominent player in the higher-end insurance market.

- Insurtech companies such as ZhongAn Online are leveraging technology to provide innovative, on-demand life insurance products, appealing to younger, tech-savvy consumers.

Future Trends and Market Outlook

Increased Demand for Health and Critical Illness Insurance

As China’s population ages, the demand for health and critical illness insurance is expected to rise. Many consumers are becoming more aware of the risks associated with medical expenses, and insurance products that cover healthcare needs are becoming more popular. Companies are developing new products with more comprehensive coverage and flexible terms to meet the evolving needs of the population.

Digital Transformation and the Role of Insurtech

The role of insurtech in China’s life insurance market is expected to grow significantly, driven by the increasing adoption of digital technologies. Consumers are more comfortable purchasing insurance products online, and digital platforms enable insurance companies to offer personalized, on-demand policies. With the rise of mobile technology and the increasing use of big data analytics, the life insurance industry is becoming more consumer-centric, and this trend will likely continue in the coming years.

Focus on Sustainability and Green Finance

As China strives to meet its sustainability and carbon reduction goals, there is increasing pressure on the life insurance industry to integrate environmental, social, and governance (ESG) factors into their business models. Insurance companies are beginning to offer products that align with green finance principles, providing consumers with the option to invest in environmentally friendly and sustainable initiatives through their life insurance policies.

The life insurance market in China continues to grow rapidly, driven by the expanding middle class, the aging population, and the increasing demand for health, wealth, and protection products. Major players like China Life, Ping An, and China Pacific Life are at the forefront of this growth, constantly innovating and adapting to meet the changing needs of consumers. As the market matures, the integration of digital technologies, increased health-related insurance offerings, and the push for sustainability are expected to shape the future of China’s life insurance industry.